Dallas Texas Exhibit D to Operating Agreement Insurance — Form 2 refers to a specific document that is part of an operating agreement for businesses based in Dallas, Texas. This exhibit, commonly known as "Insurance — Form 2," outlines the insurance provisions and requirements for the business entity described in the operating agreement. It is an essential component that addresses the insurance needs, obligations, and coverage details related to the company's operations. The primary purpose of Dallas Texas Exhibit D to Operating Agreement Insurance — Form 2 is to ensure that the business has adequate insurance coverage to mitigate risks and protect its assets, employees, and stakeholders. This exhibit typically specifies the types of insurance required by the business, such as general liability, workers' compensation, property insurance, professional liability (errors and omissions), and other types that are deemed necessary based on the nature of the business. In addition to identifying the required insurance types, the exhibit also includes details about the minimum coverage limits, deductible amounts, and any specific provisions or endorsements that must be included in the policies. This document helps establish clear guidelines for the business partners and stakeholders to follow regarding insurance procurement and maintenance. Dallas Texas Exhibit D to Operating Agreement Insurance — Form 2 may differ based on the specific needs and industry of the business entity. Depending on the nature of the business, additional insurance types or specific provisions might be included to address unique risks. For example, a technology company might require cyber liability insurance to protect against data breaches or internet-based risks, while a construction company might need specific coverage for construction-related accidents or property damage. It is crucial for businesses operating in Dallas, Texas, to carefully review and customize the Exhibit D to align with their specific insurance requirements and comply with state and local regulations. This exhibit plays a vital role in outlining the insurance obligations, policies, and limits that all business partners must adhere to, ensuring the company is adequately protected against potential liabilities and risks.

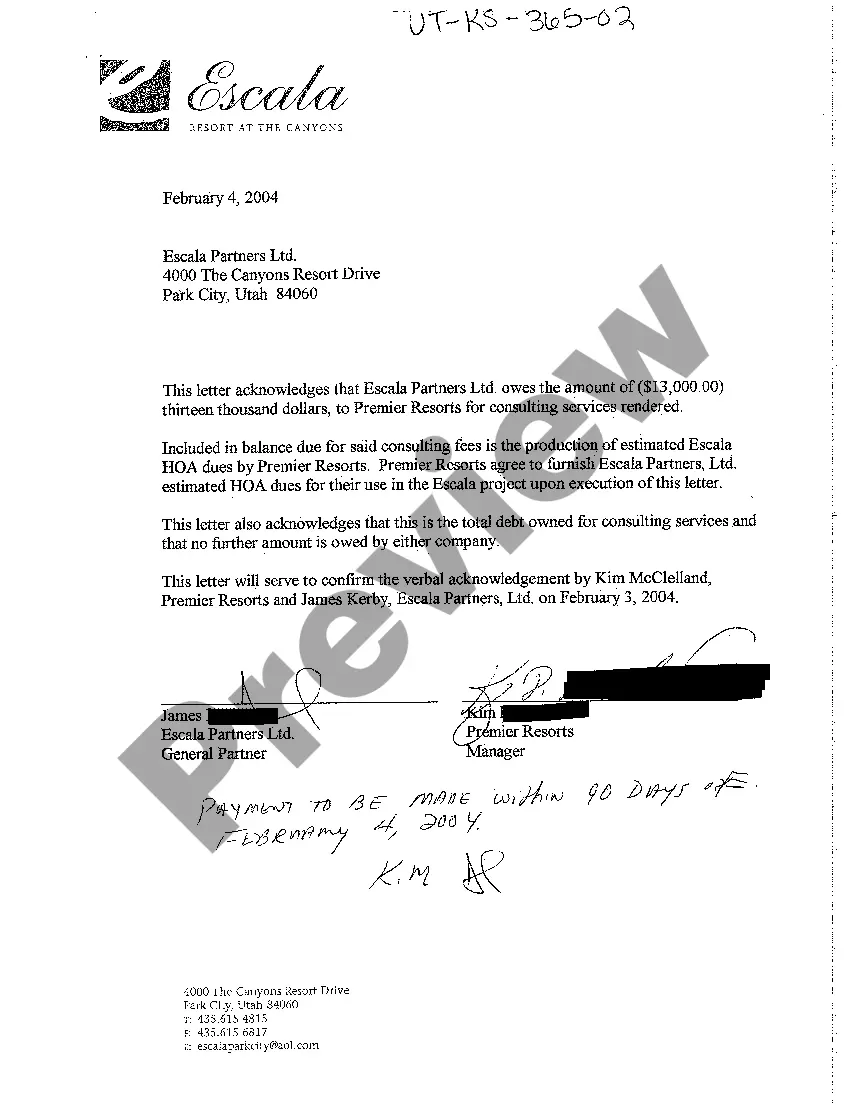

Dallas Texas Exhibit D to Operating Agreement Insurance - Form 2

Description

How to fill out Dallas Texas Exhibit D To Operating Agreement Insurance - Form 2?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Dallas Exhibit D to Operating Agreement Insurance - Form 2, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Dallas Exhibit D to Operating Agreement Insurance - Form 2 from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Dallas Exhibit D to Operating Agreement Insurance - Form 2:

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!