Franklin Ohio Exhibit D to Operating Agreement Insurance — Form 2 is a legal document that is commonly used in business agreements to outline the insurance requirements and obligations of the parties involved. This document specifically pertains to businesses operating in Franklin, Ohio. The Franklin Ohio Exhibit D to Operating Agreement Insurance — Form 2 typically includes detailed information regarding the types and amounts of insurance coverage that each party must maintain throughout the duration of the agreement. It serves as a crucial component of the operating agreement, ensuring that all parties are adequately protected from potential risks and liabilities. Some relevant keywords related to Franklin Ohio Exhibit D to Operating Agreement Insurance — Form 2 could include: 1. Franklin, Ohio: This keyword emphasizes the geographic location of the agreement and indicates that it specifically applies to businesses operating in Franklin, Ohio. 2. Exhibit D: This keyword refers to the specific section or exhibit within the operating agreement that deals with insurance requirements. 3. Operating Agreement: This keyword highlights that the document is a part of the larger legal agreement governing the business operations. 4. Insurance: This keyword signifies that the document focuses on insurance coverage and related requirements. 5. Form 2: This keyword specifies the particular version or format of the document. Different forms may exist, indicating variations in content or structuring. Different types of Franklin Ohio Exhibit D to Operating Agreement Insurance — Form 2 may exist based on the specific nature of the business or industry. Some possible variations could include: 1. General Liability Insurance: This type of insurance provides coverage for bodily injury, property damage, and advertising injury claims. 2. Workers' Compensation Insurance: This insurance covers medical expenses and lost wages for employees who experience work-related injuries or illnesses. 3. Professional Liability Insurance: This insurance, also known as errors and omissions insurance, protects professionals from claims of negligence or inadequate work. 4. Property Insurance: This coverage protects against losses or damages to the business's physical assets, such as buildings, equipment, or inventory. 5. Commercial Auto Insurance: This type of insurance covers vehicles used for business purposes, protecting against accidents, theft, and property damage. It's essential to note that the specific types of insurance and their requirements may vary based on the nature of the business, legal requirements, and any industry-specific regulations. Therefore, it is crucial to consult with legal professionals and insurance providers to ensure compliance and adequate coverage.

Franklin Ohio Exhibit D to Operating Agreement Insurance - Form 2

Description

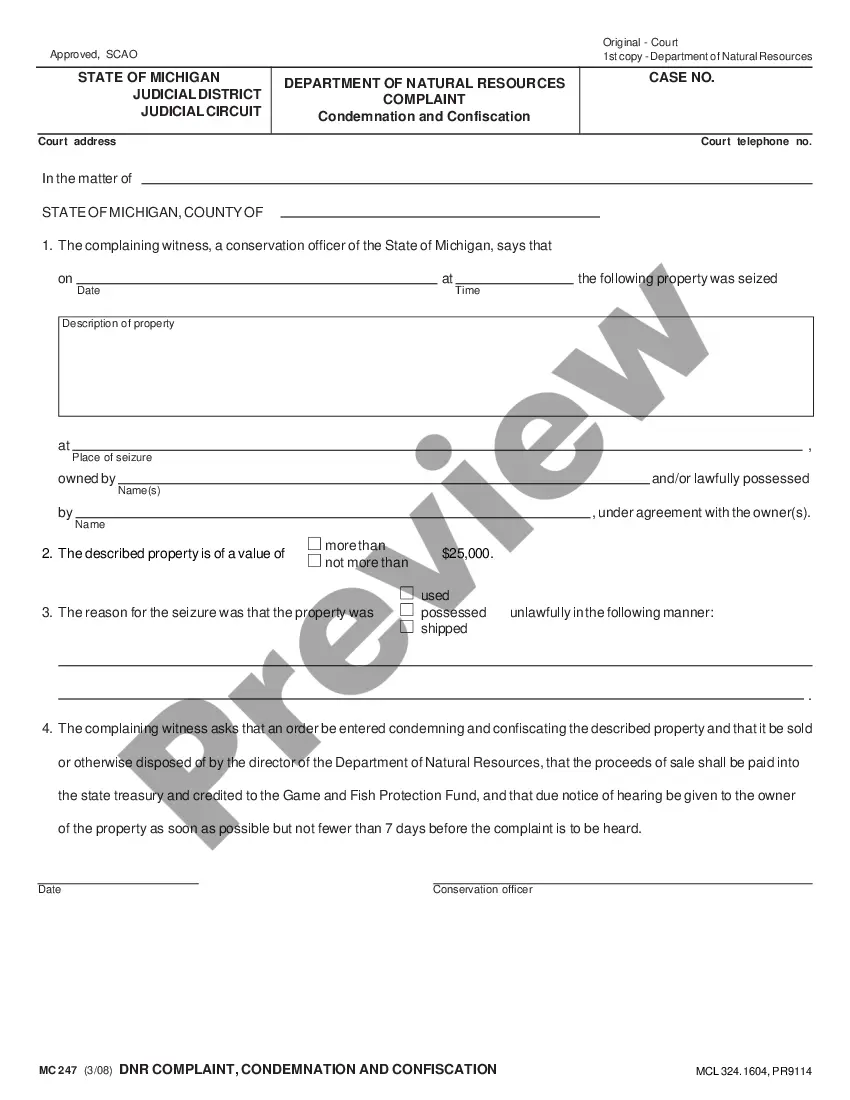

How to fill out Franklin Ohio Exhibit D To Operating Agreement Insurance - Form 2?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Franklin Exhibit D to Operating Agreement Insurance - Form 2, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Franklin Exhibit D to Operating Agreement Insurance - Form 2 from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Franklin Exhibit D to Operating Agreement Insurance - Form 2:

- Analyze the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

LLC Operating Agreement (template + instructions) - YouTube YouTube Start of suggested clip End of suggested clip The name and address of the registered office and registered agent the general business purpose ofMoreThe name and address of the registered office and registered agent the general business purpose of the LLC. The members percentages of ownership. And the names of the members. And their addresses.

An operating agreement is a legally binding document that limited liability companies (LLCs) use to outline how the company is managed, who has ownership, and how it is structured. If a company is a multi-member LLC , the operating agreement becomes a binding contract between the different members.

Other changes to the operating agreement can be done as amendments. An amendment is a simple document that clearly states the modifications to the original operating agreement and is signed by all members. This amendment becomes part of your operating agreement.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

Tip: It is unwise to operate without an operating agreement even though most states do not require a written document. Regardless of your state's law, think twice before opting out of this provision. Where should operating agreements be kept? Operating agreements should be kept with the core records of your business.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

What should an LLC operating agreement include? Basic company information. Member and manager information. Additional provisions. Protect your LLC status. Customize the division of business profits. Prevent conflicts among owners. Customize your governing rules. Clarify the business's future.