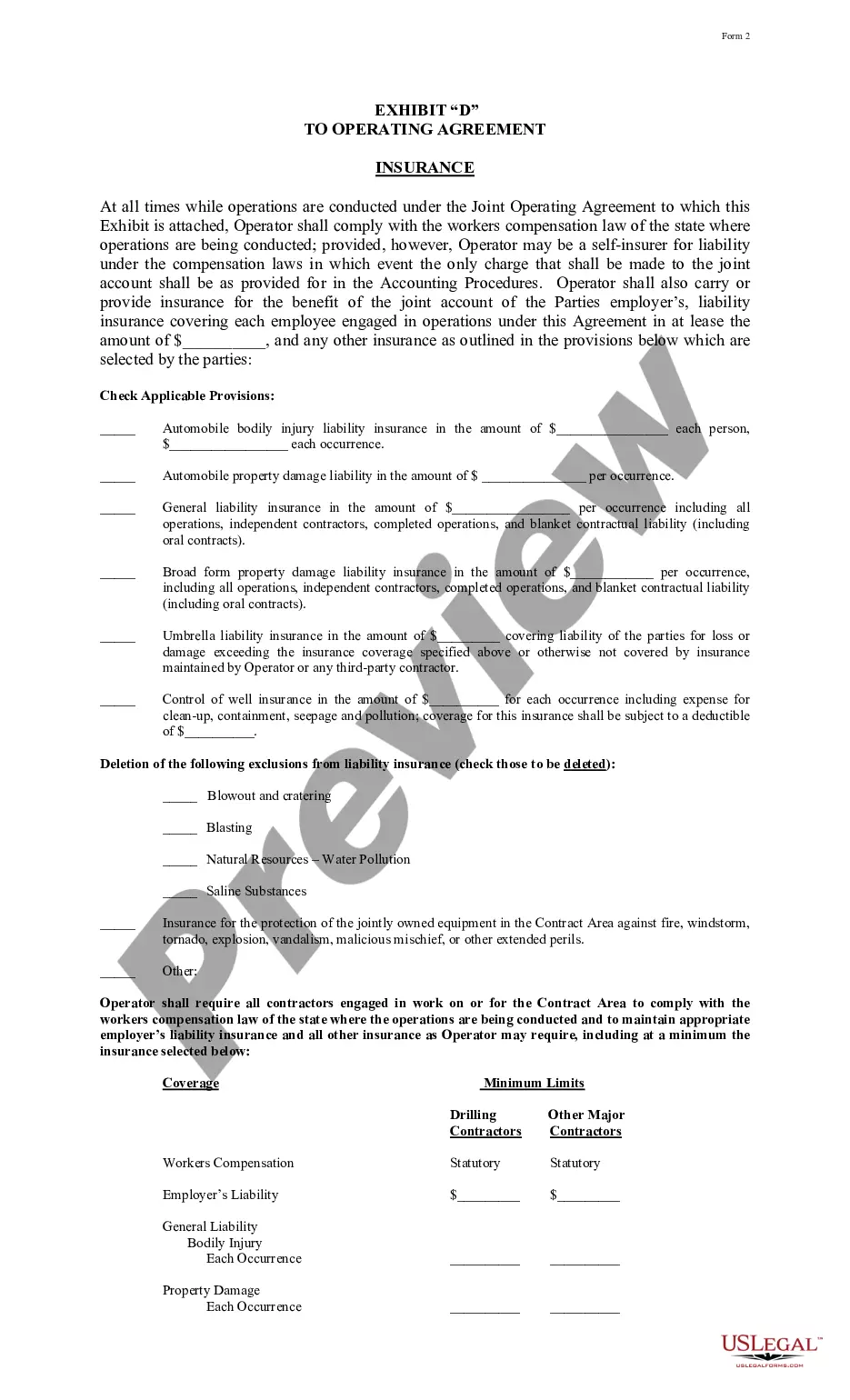

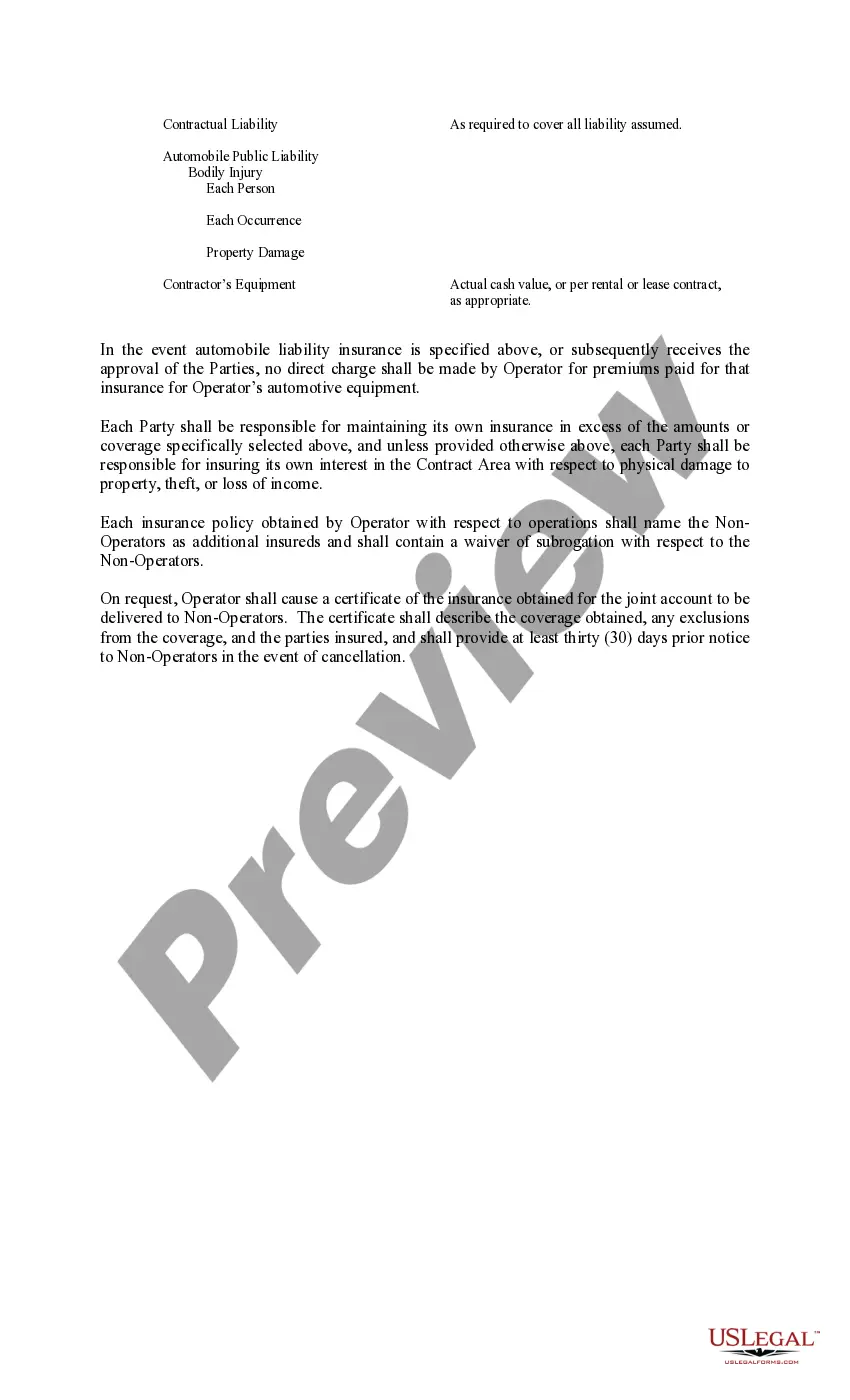

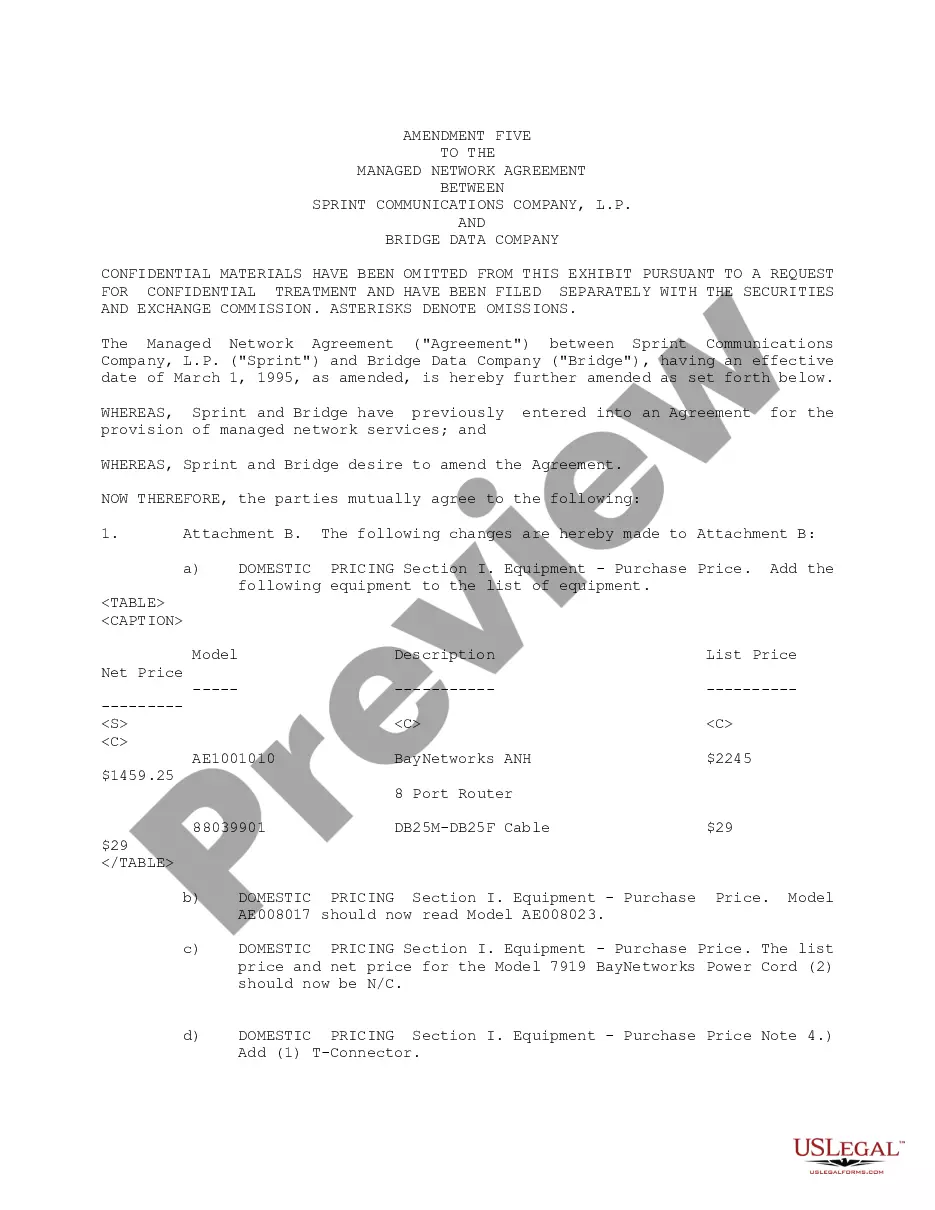

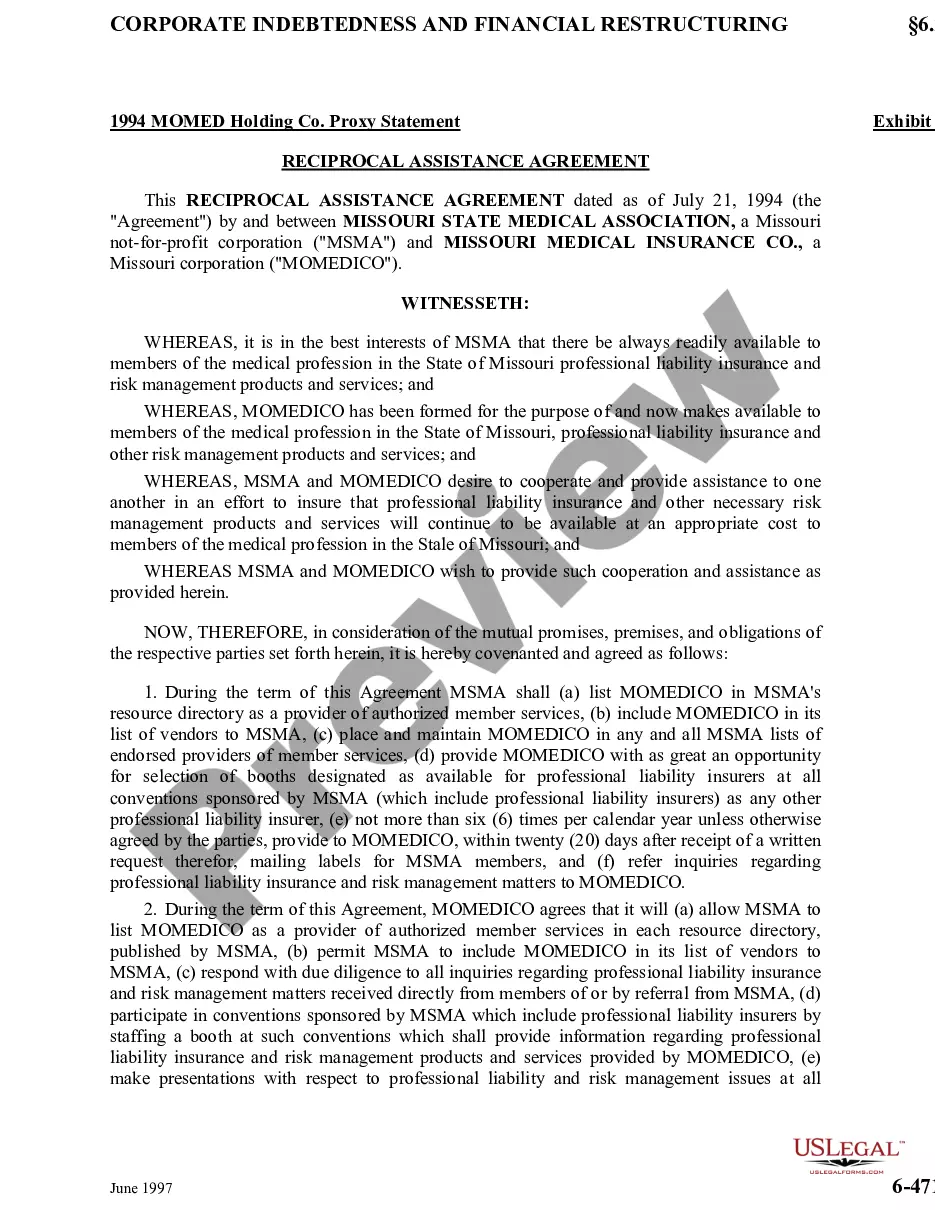

Los Angeles California Exhibit D to Operating Agreement Insurance — Form 2 is a specific legal documentation that pertains to the operating agreements of businesses or companies operating in Los Angeles, California. This comprehensive document is essential for outlining the insurance requirements and coverage details for the company. It provides detailed information about the insurance policies and provisions required to protect the company's assets and mitigate potential risks. Here are the different types of Los Angeles California Exhibit D to Operating Agreement Insurance — Form 2 that may exist: 1. General Liability Insurance: This type of insurance coverage protects the company from third-party claims related to bodily injury, property damage, personal injury, or advertising injury occurring on the company's premises or as a result of its operations. 2. Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, professional liability coverage is crucial for companies providing professional services, including legal, medical, consulting, or advisory services. It protects against claims arising from errors, negligence, or failure to deliver professional services. 3. Workers' Compensation Insurance: This insurance is typically mandatory for businesses with employees. It covers medical treatment, disability benefits, and lost wages for employees who suffer work-related injuries or illnesses. 4. Property Insurance: Property insurance provides coverage for damage or loss of the company's physical assets, including buildings, equipment, inventory, and furniture, caused by perils such as fire, theft, vandalism, or natural disasters. 5. Cyber Liability Insurance: In today's digital age, having cyber liability coverage is crucial. It protects the company against liability claims and expenses associated with a data breach, including legal fees, notification costs, credit monitoring, and reputation management. 6. Directors and Officers (D&O) Insurance: D&O insurance protects the company's directors and officers against claims alleging wrongful acts, negligence, or breach of fiduciary duty committed in their managerial capacities. It provides financial protection for individual directors and officers and helps attract top talent. 7. Commercial Auto Insurance: This type of insurance is essential for companies with vehicles used for business purposes. It covers damages to company-owned vehicles, third-party liability for bodily injury or property damage caused by company vehicles, and medical expenses for injured employees. Having a comprehensive Los Angeles California Exhibit D to Operating Agreement Insurance — Form 2 is crucial for businesses operating in the region. It ensures that the company has the necessary insurance coverage to protect its interests, comply with legal requirements, and minimize potential financial risks.

Los Angeles California Exhibit D to Operating Agreement Insurance - Form 2

Description

How to fill out Los Angeles California Exhibit D To Operating Agreement Insurance - Form 2?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Los Angeles Exhibit D to Operating Agreement Insurance - Form 2, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Los Angeles Exhibit D to Operating Agreement Insurance - Form 2 from the My Forms tab.

For new users, it's necessary to make several more steps to get the Los Angeles Exhibit D to Operating Agreement Insurance - Form 2:

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

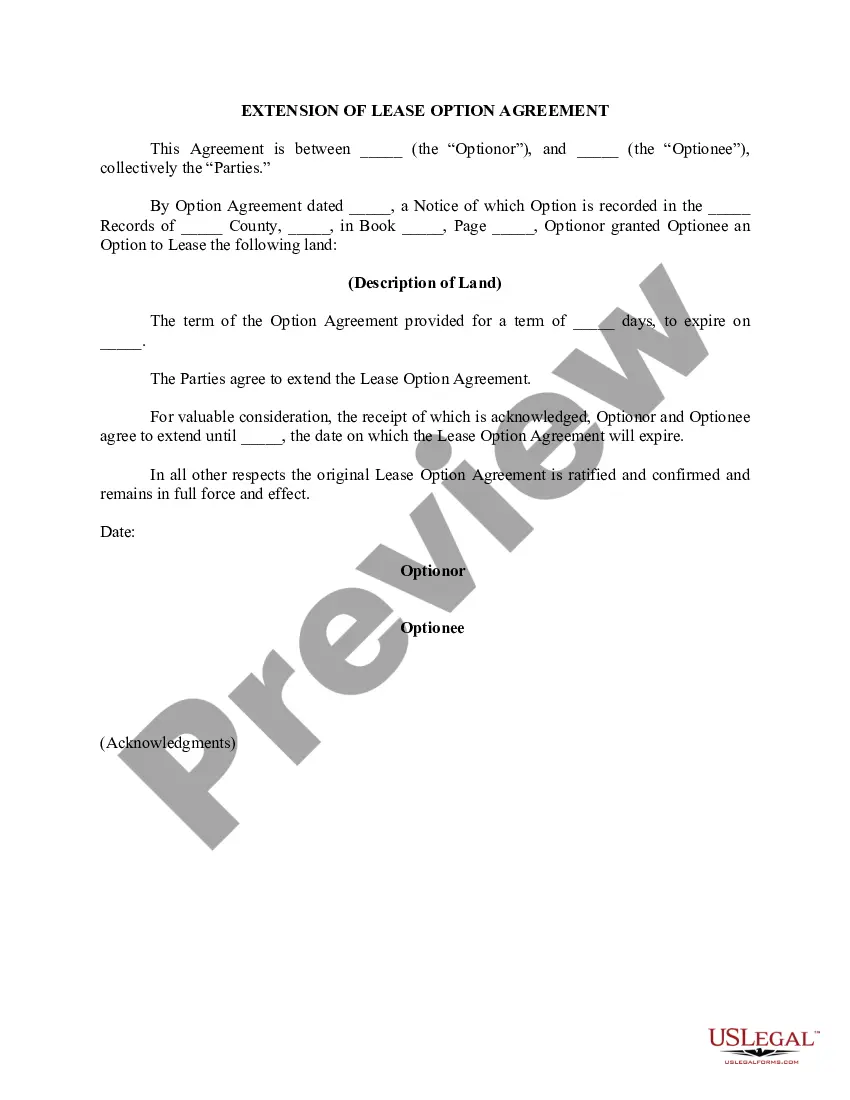

Although you're able to make an Operating Agreement at any time, it's often best to make one at the very beginning to help guide all business decisions. An LLC Operating Agreement can be for a single-member or multi-member LLC.

The functionality of internal affairs is outlined in the operating agreement including but not limited to: Percentage of members' ownership. Voting rights and responsibilities. Powers and duties of members and managers. Distribution of profits and loses. Holding meetings.

A better name for an operating agreement might be a membership agreement. This agreement is similar in form to a partnership agreement for a business partnership.

The LLC operating agreement, also known as an LLC agreement, establishes the rules and structure for the LLC and can help address any issues that arise during business operations. Most states have default provisions that address many of these difficulties, but the operating agreement can override these presumptions.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

How to Write an Operating Agreement ? Step by Step Step One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

Articles of Organization are also called a Certificate of Formation in some states. It is a document filed with the appropriate state when registering a limited liability company (LLC). An Operating Agreement is the document LLC members look to when they need to resolve issues or disputes within the company.

How to Write an Operating Agreement ? Step by Step Step One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.