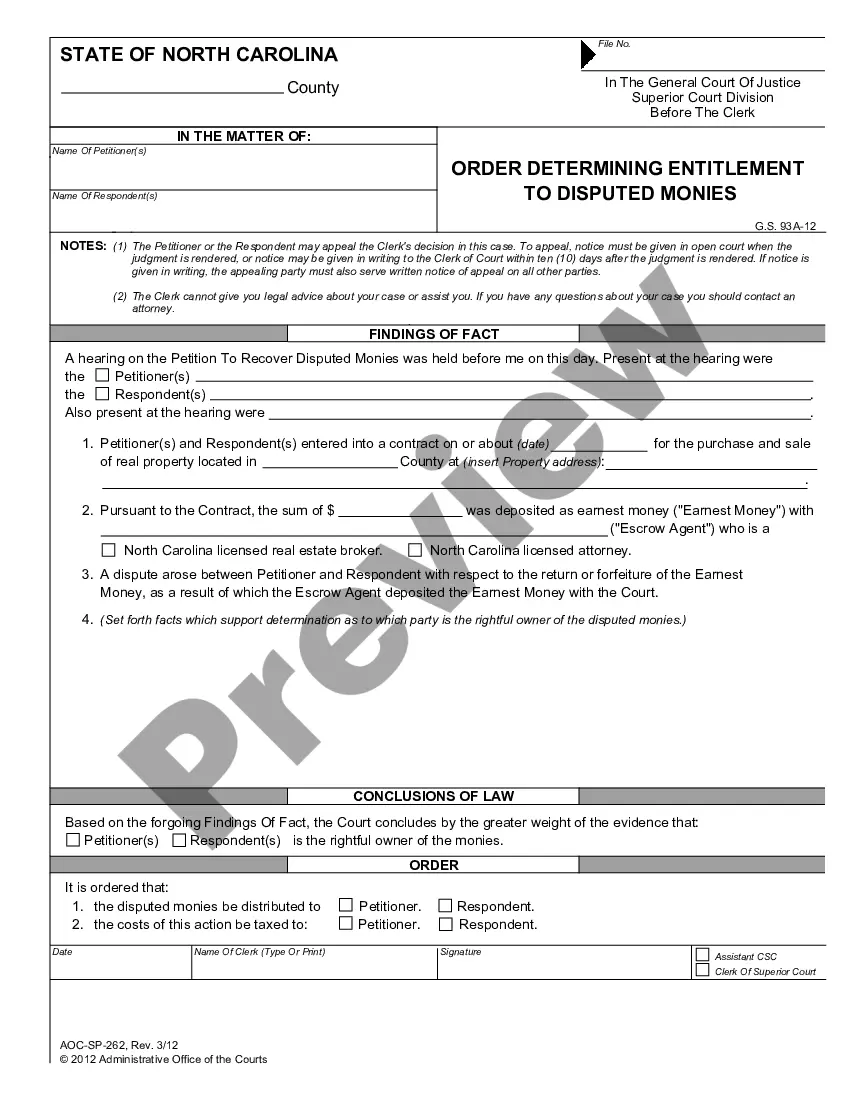

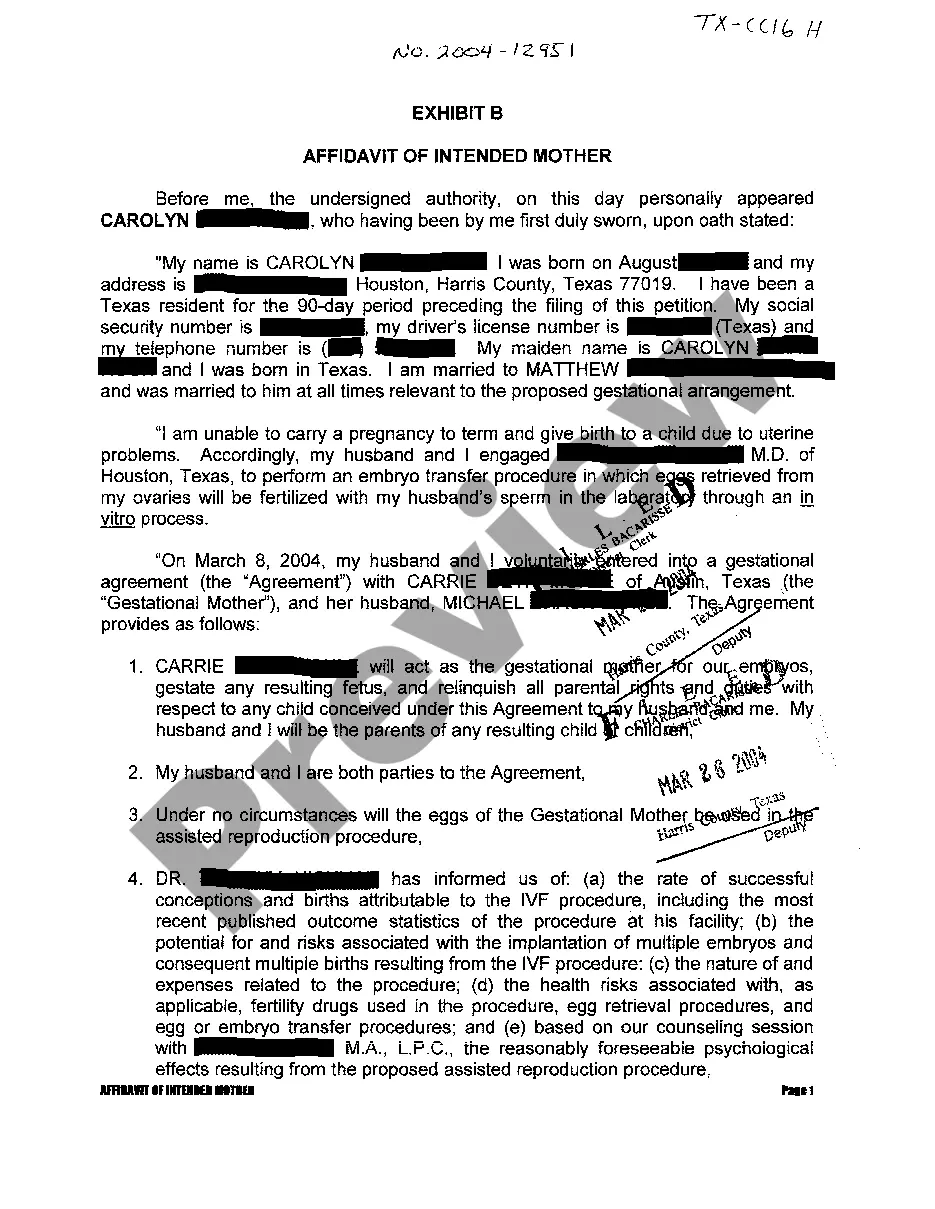

Maricopa, Arizona, Exhibit D to Operating Agreement Insurance — Form 2 is an important document that outlines the insurance requirements and provisions for businesses operating within Maricopa, Arizona. This legally binding agreement ensures that businesses maintain adequate insurance coverage to mitigate risks and protect themselves, their partners, and the community. This form serves as a specific exhibit within the operating agreement, which is a contract between the business owners or partners, defining their rights, responsibilities, and the overall operation of the business. By including Exhibit D, the agreement becomes more comprehensive, addressing critical insurance-related considerations that every business in Maricopa, Arizona should adhere to. Different types of Maricopa, Arizona, Exhibit D to Operating Agreement Insurance — Form 2 may include: 1. General Liability Insurance: This type of insurance covers claims arising from property damage or bodily harm caused by the business's operations, products, or employees. It is essential for all businesses to protect against potential lawsuits and cover associated legal costs. 2. Property Insurance: This insurance protects the business's physical assets, including buildings, equipment, inventory, and furniture, against damages caused by fire, theft, vandalism, or natural disasters. It ensures that businesses can recover and continue their operations in case of loss or damage. 3. Workers' Compensation Insurance: This insurance is required by law and provides coverage for employees who suffer work-related injuries or illnesses. It includes medical expenses, rehabilitation costs, and lost wages, thereby safeguarding both employees and employers. 4. Professional Liability Insurance: Also known as errors and omissions insurance, this coverage is crucial for businesses in professional services, such as consultants, accountants, or healthcare providers. It protects against claims of negligence, errors, or professional malpractice that may result in financial losses for clients. 5. Commercial Auto Insurance: If the business owns or uses vehicles for its operations, commercial auto insurance becomes necessary. It covers damages resulting from accidents, vandalism, or theft involving company-owned vehicles and can also include liability coverage for bodily injuries or property damage caused by these vehicles. 6. Cyber Insurance: In today's digital age, businesses are exposed to various cyber risks, such as data breaches, hacking, or ransomware attacks. Cyber insurance provides coverage for financial losses and legal liabilities arising from these incidents, helping businesses recover and protect their reputation. Maricopa, Arizona, Exhibit D to Operating Agreement Insurance — Form 2 emphasizes the importance of maintaining adequate insurance coverage tailored to the specific risks businesses face. It ensures that all parties involved are protected and dictates the minimum insurance requirements to align with local regulations. By carefully considering and obtaining the right types and levels of insurance coverage, businesses can operate with greater confidence and resilience in Maricopa, Arizona.

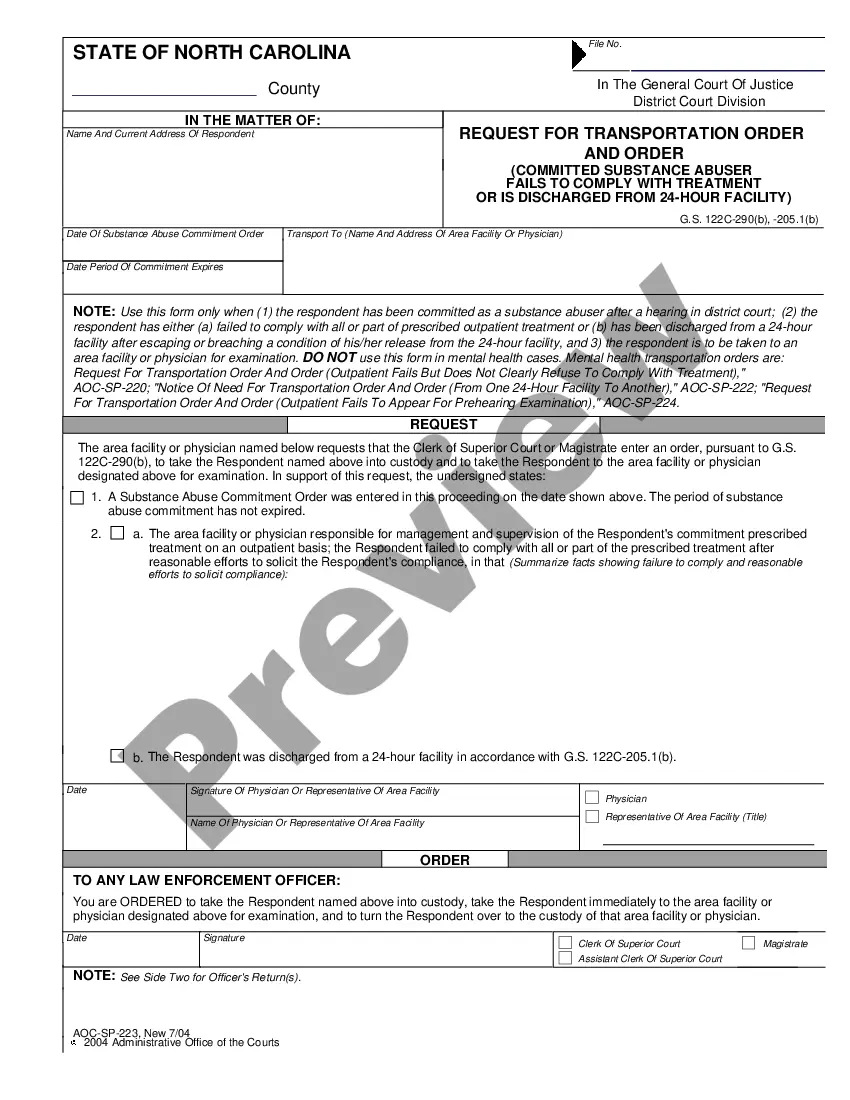

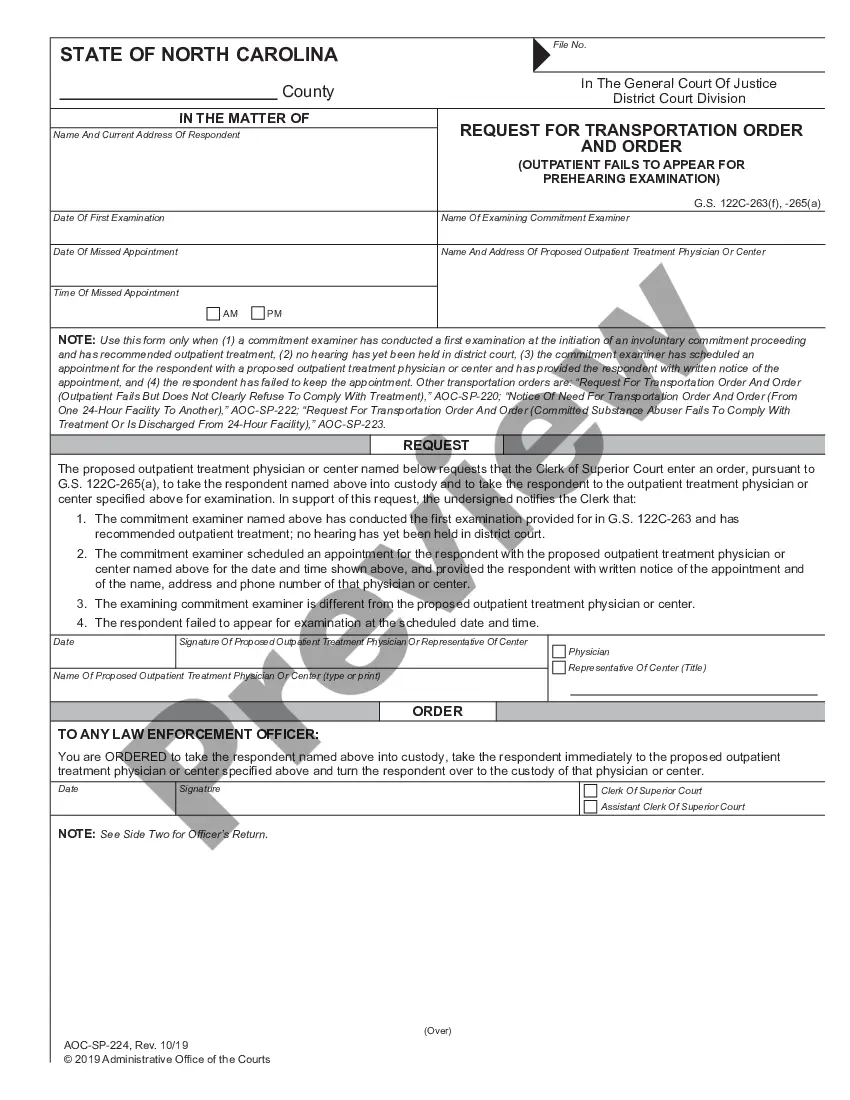

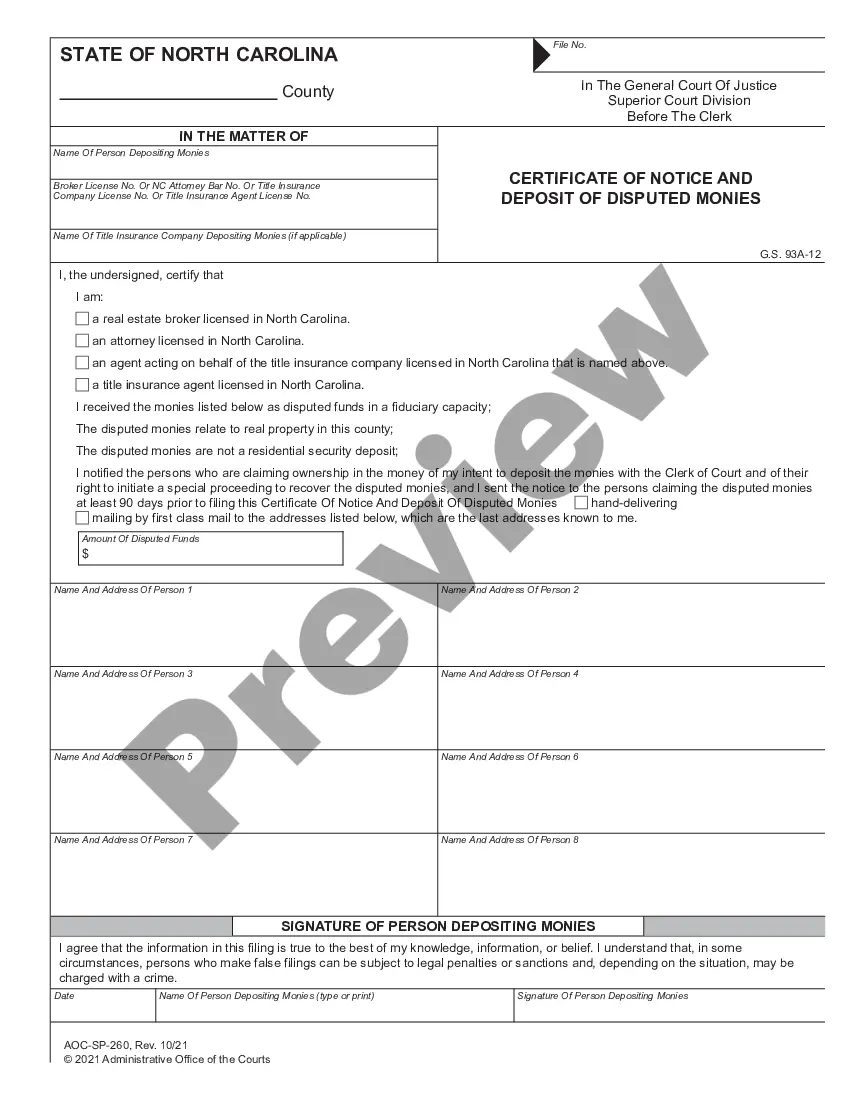

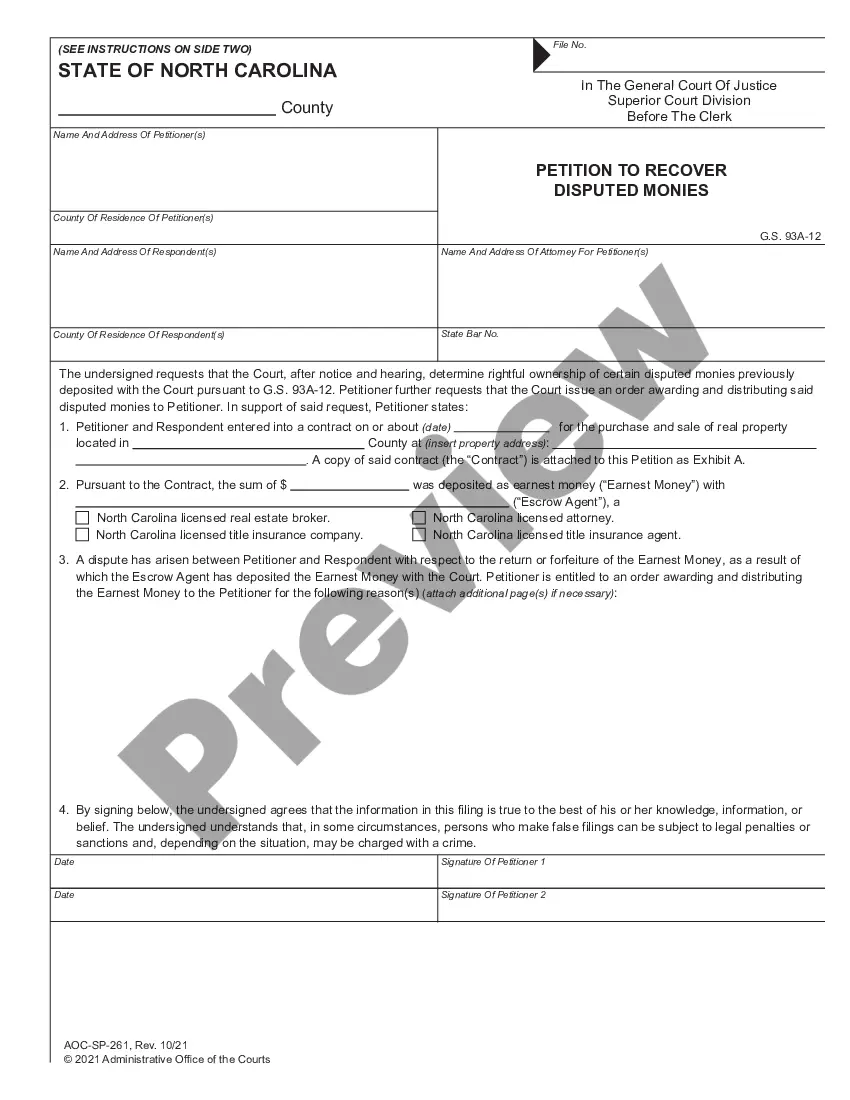

Maricopa Arizona Exhibit D to Operating Agreement Insurance - Form 2

Description

How to fill out Maricopa Arizona Exhibit D To Operating Agreement Insurance - Form 2?

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Maricopa Exhibit D to Operating Agreement Insurance - Form 2, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case accumulated all in one place. Therefore, if you need the current version of the Maricopa Exhibit D to Operating Agreement Insurance - Form 2, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Maricopa Exhibit D to Operating Agreement Insurance - Form 2:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Maricopa Exhibit D to Operating Agreement Insurance - Form 2 and save it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!