Mecklenburg North Carolina Exhibit D to Operating Agreement Insurance — Form 2 is a legal document that specifically pertains to the state of North Carolina and the county of Mecklenburg. This exhibit serves as an attachment to the operating agreement insurance and provides detailed information regarding the insurance coverage and clauses related to the agreement. The purpose of Mecklenburg North Carolina Exhibit D is to outline the specific insurance requirements and provisions that are necessary for the smooth operation of a business or organization in Mecklenburg County. It ensures that all parties involved are adequately protected against potential risks and liabilities. This exhibit includes various types of insurance coverage that may be required within the operating agreement. Some essential insurance types mentioned in Mecklenburg North Carolina Exhibit D may include: 1. General Liability Insurance: This coverage protects against claims of bodily injury, property damage, or personal injury caused by the insured party's operations, premises, or products. 2. Property Insurance: This insurance type provides coverage for physical assets such as buildings, equipment, inventory, and furniture against damages caused by fire, theft, vandalism, or natural disasters. 3. Workers' Compensation Insurance: This insurance is mandatory for businesses in Mecklenburg County and provides coverage for employees in case of work-related injuries or illnesses. 4. Professional Liability Insurance: Often referred to as errors and omissions insurance, this coverage is crucial for businesses providing professional services. It protects against claims of negligence, errors, or omissions in the performance of professional duties. 5. Employment Practices Liability Insurance: This insurance safeguards against claims made by employees related to wrongful termination, discrimination, harassment, or other employment-related issues. In addition to these common insurance types, Mecklenburg North Carolina Exhibit D may also address specific insurance requirements based on the nature of the business or organization involved. For example, industries such as healthcare, construction, or transportation may require specific insurance coverages due to their unique risks. Overall, Mecklenburg North Carolina Exhibit D to Operating Agreement Insurance — Form 2 plays a crucial role in establishing a comprehensive insurance framework for businesses operating in Mecklenburg County. It ensures that all necessary insurance coverages are explicitly outlined and agreed upon, minimizing potential disputes and risks for all parties involved in the operating agreement.

Mecklenburg North Carolina Exhibit D to Operating Agreement Insurance - Form 2

Description

How to fill out Mecklenburg North Carolina Exhibit D To Operating Agreement Insurance - Form 2?

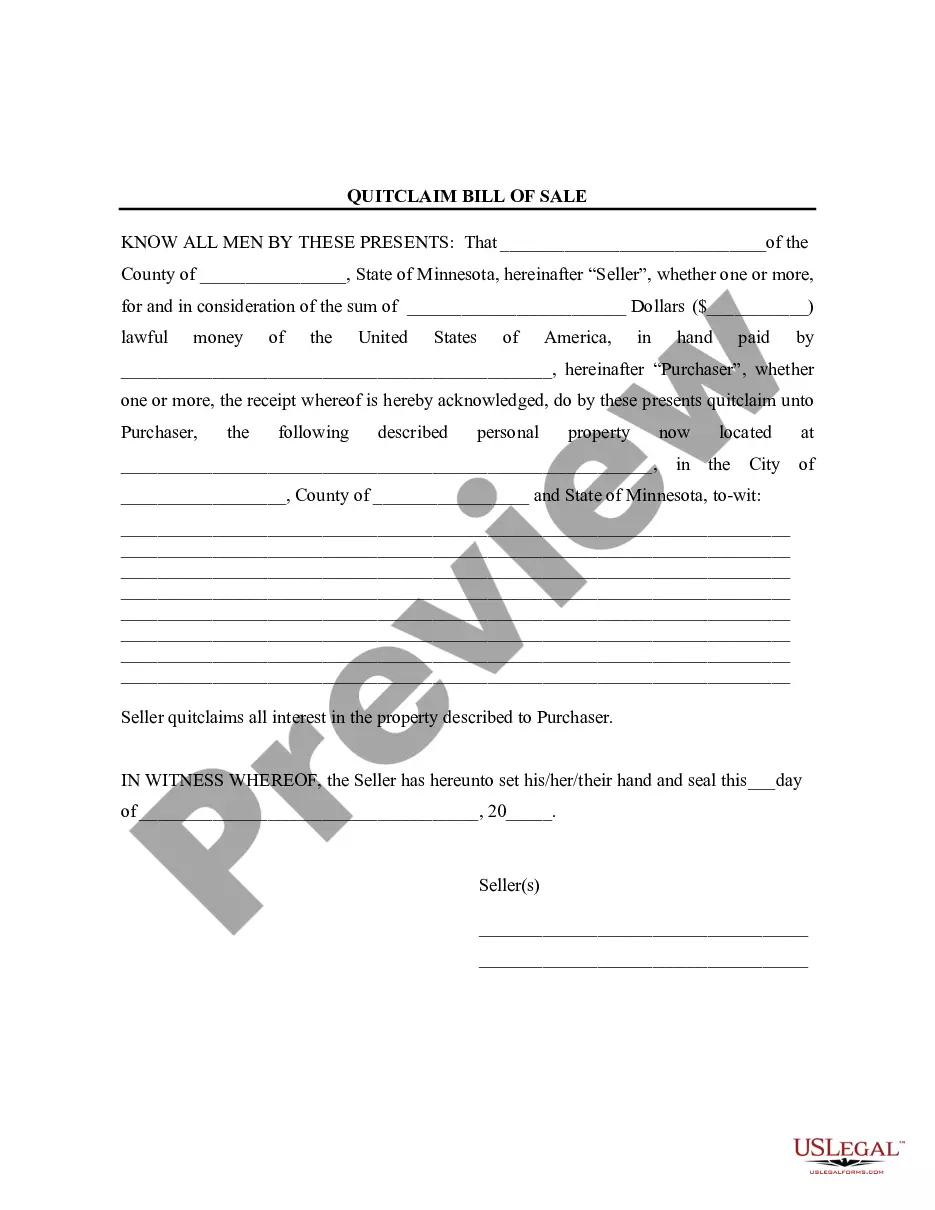

Do you need to quickly draft a legally-binding Mecklenburg Exhibit D to Operating Agreement Insurance - Form 2 or probably any other document to take control of your own or business affairs? You can go with two options: hire a professional to draft a legal paper for you or create it entirely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific document templates, including Mecklenburg Exhibit D to Operating Agreement Insurance - Form 2 and form packages. We provide documents for an array of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, carefully verify if the Mecklenburg Exhibit D to Operating Agreement Insurance - Form 2 is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the search again if the template isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Mecklenburg Exhibit D to Operating Agreement Insurance - Form 2 template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. In addition, the documents we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!