Lima Arizona Exhibit D to Operating Agreement Insurance — Form 2 is a legal document that specifically outlines the insurance requirements and provisions for operating agreements in Lima, Arizona. This exhibit serves as an essential component of an operating agreement, providing detailed information regarding insurance coverage and responsibilities for various parties involved in business operations. It ensures that all parties are adequately protected against potential risks and liabilities. The Lima Arizona Exhibit D to Operating Agreement Insurance — Form 2 encompasses various types of insurance policies and their requirements. Several key types of insurance that may be included in this exhibit are: 1. General Liability Insurance: This policy covers claims related to bodily injury, property damage, and personal injury that may occur during business operations. It protects against lawsuits and provides financial coverage for legal expenses and settlement costs. 2. Property Insurance: This type of insurance protects physical assets, including buildings, equipment, inventory, and other property owned by the business. It guards against losses caused by events such as fire, theft, or natural disasters. 3. Workers' Compensation Insurance: This policy provides coverage for medical expenses and lost wages in the event of employee injuries or illnesses that occur on the job. It ensures that employees are adequately compensated for work-related incidents while protecting the employer from potential lawsuits related to workplace injuries. 4. Professional Liability Insurance: Also known as errors and omissions insurance, this coverage applies to professional service providers, such as consultants or contractors. It safeguards against claims arising from inadequate advice, negligence, or mistakes made during the provision of services. 5. Cyber Liability Insurance: In today's digital age, businesses face increased risks of data breaches, cyber-attacks, and information theft. Cyber liability insurance offers protection against financial losses, legal expenses, and reputational damages associated with such incidents. 6. Commercial Auto Insurance: If the business utilizes vehicles for its operations, commercial auto insurance is necessary. It covers liability and physical damage resulting from accidents involving company vehicles. These are some potential types of insurance that may be addressed and outlined in the Lima Arizona Exhibit D to Operating Agreement Insurance — Form 2. The exhibit further elaborates on the required coverage limits, additional insured parties, notice requirements, and any specific provisions related to insurance in the context of Lima, Arizona.

Pima Arizona Exhibit D to Operating Agreement Insurance - Form 2

Description

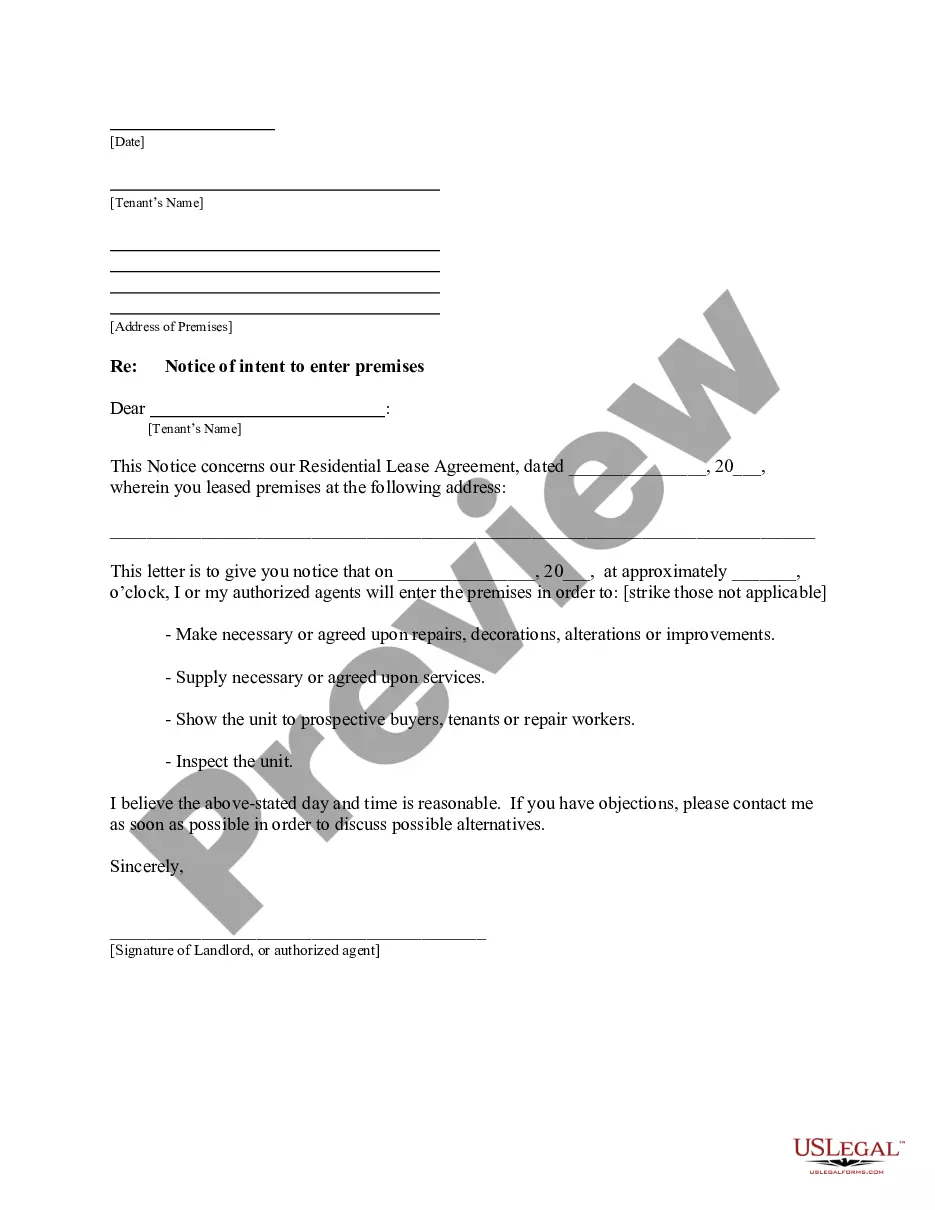

How to fill out Pima Arizona Exhibit D To Operating Agreement Insurance - Form 2?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Pima Exhibit D to Operating Agreement Insurance - Form 2, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information resources and tutorials on the website to make any activities associated with document completion simple.

Here's how to locate and download Pima Exhibit D to Operating Agreement Insurance - Form 2.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can affect the validity of some records.

- Check the similar forms or start the search over to find the correct file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and purchase Pima Exhibit D to Operating Agreement Insurance - Form 2.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Pima Exhibit D to Operating Agreement Insurance - Form 2, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you need to cope with an extremely complicated case, we advise using the services of a lawyer to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant documents effortlessly!

Form popularity

FAQ

Complete the legal document to determine where to attach the exhibit. Include a typed notation within the body of the legal document where the exhibit should be referenced.Label the exhibit with the assigned identifying number or letter.Insert a tab page at the end of the legal document.

Section J, List of attachments. The contracting officer shall list the title, date, and number of pages for each attached document, exhibit, and other attachment. Cross-references to material in other sections may be inserted, as appropriate.

An exhibit is an additional document attached to the end of a lease or contract. An exhibit frequently will include form documents ancillary to the main contract, such as agreed-upon closing documents attached to a real estate purchase contract or documents a tenant must sign, such as a lease guaranty.

An annex also refers to something that's added, attached, or appended. You might use the term annex interchangeably with exhibit and appendix. In general, the term "annex" is much less common than the other terms.

There may be an addendum to be signed once the parties agree on the official lease start date. Often exhibits consist of agreed forms or documents to be signed later, such as closing documents attached to a real estate contract.

An annex also refers to something that's added, attached, or appended. You might use the term annex interchangeably with exhibit and appendix. In general, the term "annex" is much less common than the other terms.

Exhibits are not considered to be part of the definitive agreement. Exhibits are typically viewed as samples (also known as specimens) of documents that the parties intend to either execute or deliver at some point in the future.

To cite a museum exhibition, follow the MLA format template. Include the exhibition's name as the title of your source, followed by the opening and closing dates of the exhibition and the museum and city as the location: Unbound: Narrative Art of the Plains.

Complete the legal document to determine where to attach the exhibit. Include a typed notation within the body of the legal document where the exhibit should be referenced.Label the exhibit with the assigned identifying number or letter.Insert a tab page at the end of the legal document.

An Appendix is a supplementary document attached to the end of a writing. an Annexure is something that is attached, such as a document to a report.