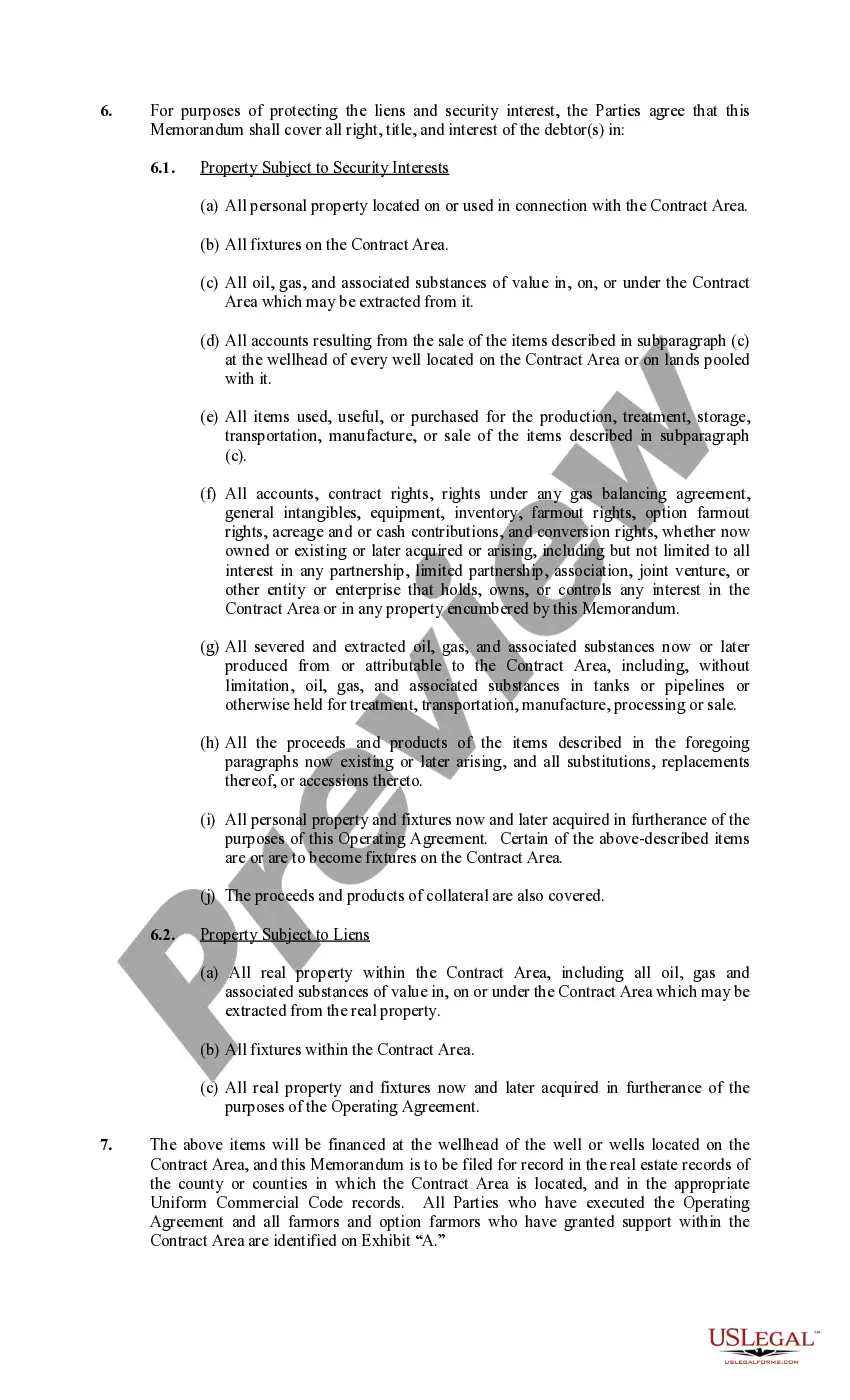

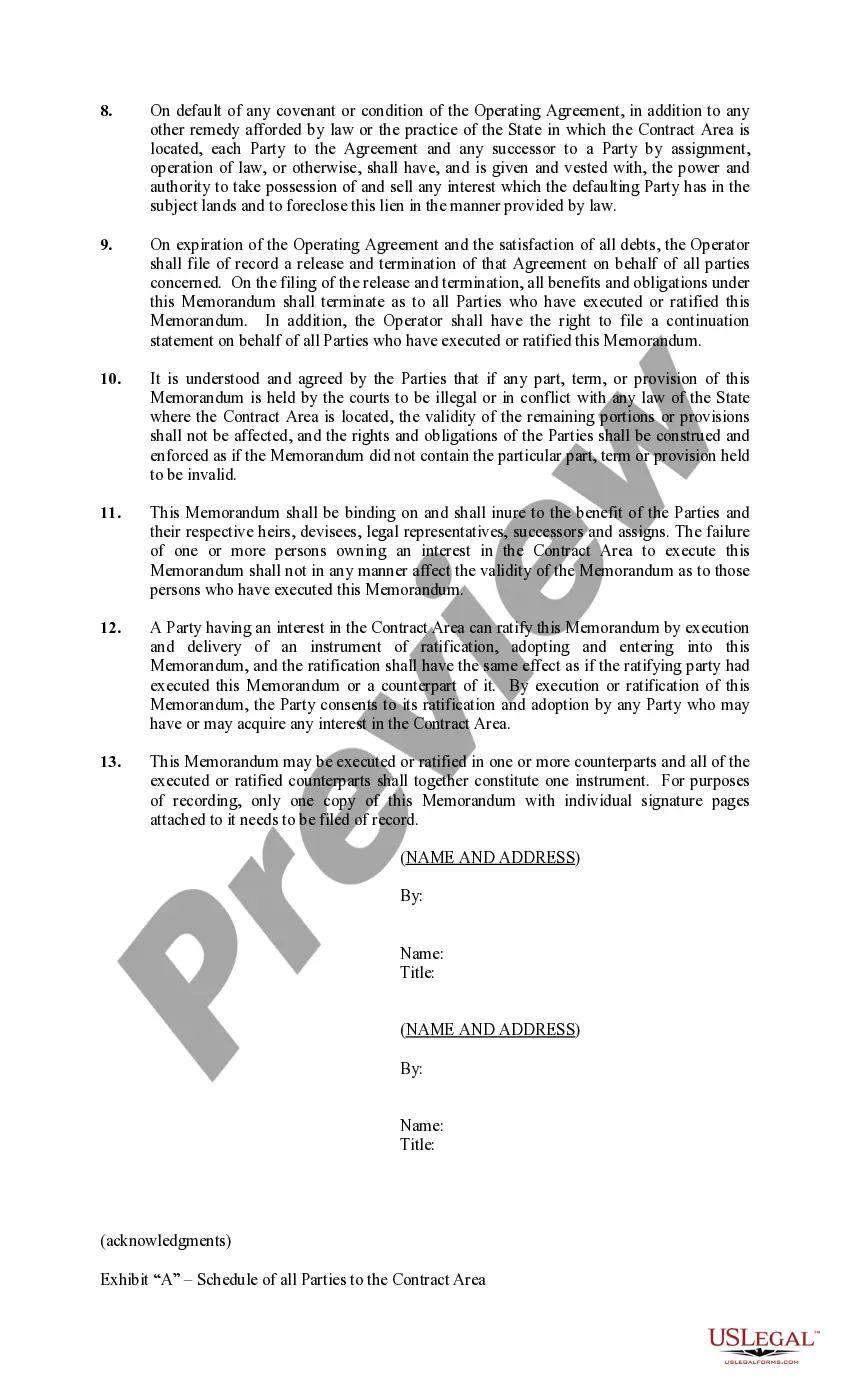

Palm Beach Florida Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1

Description

How to fill out Palm Beach Florida Exhibit H To Operating Agreement Memorandum Of Operating Agreement And Financing Statement - Form 1?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business objective utilized in your county, including the Palm Beach Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Palm Beach Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1 will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Palm Beach Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Palm Beach Exhibit H to Operating Agreement Memorandum of Operating Agreement and Financing Statement - Form 1 on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

If you do choose to draft an LLC Operating Agreement for your Florida LLC, there is no requirement for it to be notarized. You can simply print out the agreement, have all members sign it, give a copy to all members, and keep an additional copy on file.

No, Florida law does not require an LLC to have an operating agreement. Instead, the LLC must have an Articles of Organization, which is a simple document using a form provided by the Division of Corporations.

An operating agreement is not filed with the State of Florida and should be kept in a safe and accessible place by each member....How to Form an LLC in Florida (5 steps) Step 1 Nominate a Registered Agent.Step 2 Entity Type.Step 3 Filing Fee.Step 4 Operating Agreement.Step 5 Employer Identification Number (EIN)

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

All Florida LLCs must file an Annual Report to maintain "active" status. Your LLC's first report is due the year after you form the company. You can file the report online between January 1st and May 1st. The fee for the annual report is $138.75.

It is a document in which the structure and rules of an operation are defined. An Operating Agreement does not need to be filed with any Florida governmental entity, but it is an agreement or contract retained by the owners of the LLC (called members).

Florida doesn't require that you have an Operating Agreement for your Limited Liability Company (LLC), but it is recommended that you have one. When setting up your company, it's beneficial to seek legal advice from a Florida LLC Business litigation attorney.

What Is an LLC Operating Agreement in Florida? An LLC operating agreement is a contract between owners, or members, of a Florida LLC that regulates, among other things, members' contributions of money to the LLC, distributions of LLC profits, and how decisions are made within the LLC.

An operating agreement is a legally binding document that limited liability companies (LLCs) use to outline how the company is managed, who has ownership, and how it is structured. If a company is a multi-member LLC , the operating agreement becomes a binding contract between the different members.

Tip: It is unwise to operate without an operating agreement even though most states do not require a written document. Regardless of your state's law, think twice before opting out of this provision. Where should operating agreements be kept? Operating agreements should be kept with the core records of your business.