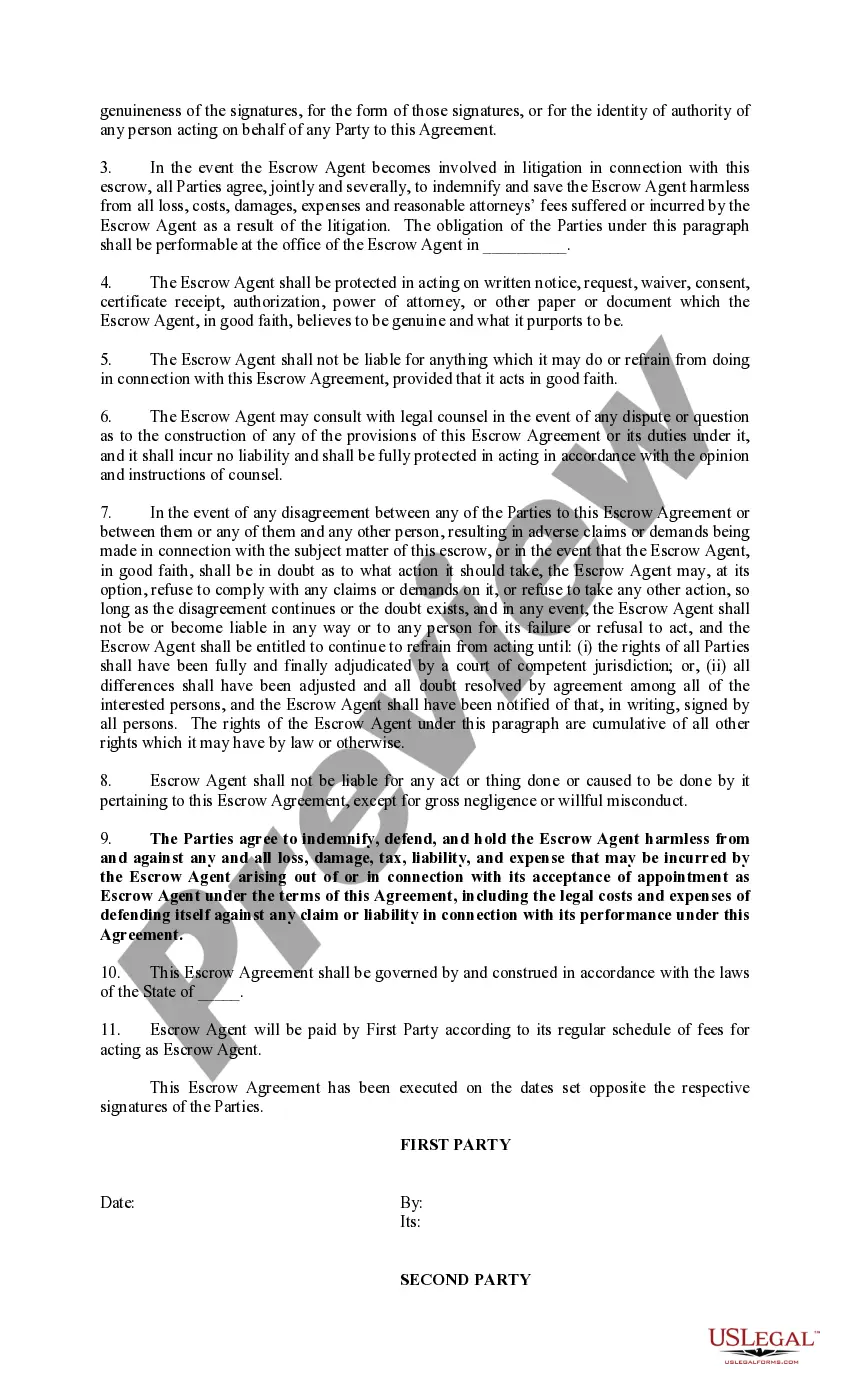

Chicago Illinois Exhibit to Operating Agreement Escrow Agreement is a legally-binding document that serves as an addendum to an existing operating agreement, specifically tailored to businesses operating in Chicago, Illinois. This agreement is crucial for establishing clear guidelines and provisions for escrow services and ensures transparency, security, and trust among parties involved in financial transactions. The Chicago Illinois Exhibit to Operating Agreement Escrow Agreement outlines the specific terms and conditions governing the escrow arrangement, protection of funds, dispute resolution procedures, and the responsibilities and obligations of each party involved. Keywords: Chicago, Illinois, Exhibit, Operating Agreement, Escrow Agreement, addendum, businesses, guidelines, provisions, escrow services, transparency, security, trust, financial transactions, terms and conditions, protection, funds, dispute resolution, responsibilities, obligations. Different types of Chicago Illinois Exhibit to Operating Agreement Escrow Agreement might include: 1. Real Estate Escrow Agreement: This type of agreement is specific to real estate transactions in Chicago, Illinois. It outlines how the escrow funds will be held and disbursed during the buying or selling process. It may include provisions related to property inspections, title searches, and contingent conditions. 2. Commercial Escrow Agreement: This agreement focuses on businesses engaging in commercial transactions within the Chicago, Illinois area. It addresses the unique aspects of commercial deals such as purchase agreements, mergers, acquisitions, and financing arrangements. It may also touch upon confidential information protection and non-disclosure agreements. 3. Construction Escrow Agreement: This type of agreement pertains to construction projects in Chicago, Illinois. It discusses the disbursement of funds based on specified milestones, completion of work, and compliance with building codes, permits, and regulations. It may also include provisions for handling change orders, inspections, and warranties. 4. Intellectual Property Escrow Agreement: This agreement is relevant for businesses involving intellectual property rights, such as patents, trademarks, or copyrights, within Chicago, Illinois. It outlines the release of funds held in escrow upon certain conditions or milestones related to the intellectual property, such as licensing, infringement disputes, or transfers. 5. Partnership Escrow Agreement: This particular agreement is used when partners within a Chicago-based business wish to establish an escrow arrangement. It outlines the procedures for allocating and distributing profits, handling disputes, and managing a partner's buyout or exit from the partnership. By utilizing a Chicago Illinois Exhibit to Operating Agreement Escrow Agreement, businesses in Chicago can establish a solid foundation for financial transactions by ensuring the proper handling of BS crowed funds and providing clear guidelines for all parties involved.

Chicago Illinois Exhibit to Operating Agreement Escrow Agreement

Description

How to fill out Chicago Illinois Exhibit To Operating Agreement Escrow Agreement?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Chicago Exhibit to Operating Agreement Escrow Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find detailed materials and guides on the website to make any tasks associated with document completion simple.

Here's how to purchase and download Chicago Exhibit to Operating Agreement Escrow Agreement.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the validity of some documents.

- Examine the related document templates or start the search over to locate the right file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment gateway, and purchase Chicago Exhibit to Operating Agreement Escrow Agreement.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Chicago Exhibit to Operating Agreement Escrow Agreement, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to deal with an extremely challenging case, we recommend getting a lawyer to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific paperwork effortlessly!