1. Introduction to Clark Nevada Exhibit to Operating Agreement Escrow Agreement: The Clark Nevada Exhibit to Operating Agreement Escrow Agreement is a legal document that is often utilized in real estate transactions or business partnerships. It serves as an additional agreement to the main operating agreement, providing specific provisions for the escrow arrangement to protect the interests of the parties involved. 2. Key Features of Clark Nevada Exhibit to Operating Agreement Escrow Agreement: — Escrow arrangement: This agreement outlines the terms and conditions regarding the establishment and management of an escrow account, ensuring secure handling of funds, documents, or assets related to the transaction. — Parties involved: The agreement clearly identifies the involved parties, such as the buyer, seller, or partners, each having specific roles and responsibilities throughout the escrow period. — Funds and asset management: It details the specific conditions under which funds and assets may be deposited into the escrow account, including the disbursement process or release triggers upon meeting predetermined conditions. — Document handling: The agreement addresses the handling and safekeeping of important documents related to the transaction, such as title deeds, permits, licenses, or leases. — Dispute resolution: It establishes mechanisms for resolving disputes that may arise during the escrow period, including mediation, arbitration, or legal remedies. 3. Types of Clark Nevada Exhibit to Operating Agreement Escrow Agreements: a) Purchase and Sale Agreement Escrow Agreement: This type of escrow agreement primarily focuses on the purchase and sale of real estate properties. It includes specific provisions for depositing earnest money, inspection contingencies, and other conditions related to the property transfer. b) Partnership Operating Agreement Escrow Agreement: In the context of business partnerships, this escrow agreement ensures that contributions made by each partner are properly handled, whether they are financial investments, intellectual property rights, or other valuable assets. c) Merger and Acquisition Escrow Agreement: This escrow agreement is commonly used during merger or acquisition transactions to hold funds or assets as a safeguard until all agreed-upon conditions, such as regulatory approvals or due diligence, are met. d) Intellectual Property Escrow Agreement: This specific escrow agreement pertains to the deposit and management of intellectual property rights, allowing parties to license or transfer those rights upon fulfillment of predefined conditions. In conclusion, the Clark Nevada Exhibit to Operating Agreement Escrow Agreement is a supplementary legal document that establishes the terms and conditions for managing an escrow arrangement in various contexts, such as real estate transactions, business partnerships, mergers and acquisitions, or intellectual property transfers. It provides necessary protections and guidelines for the secure handling of funds, assets, and documents throughout the escrow period.

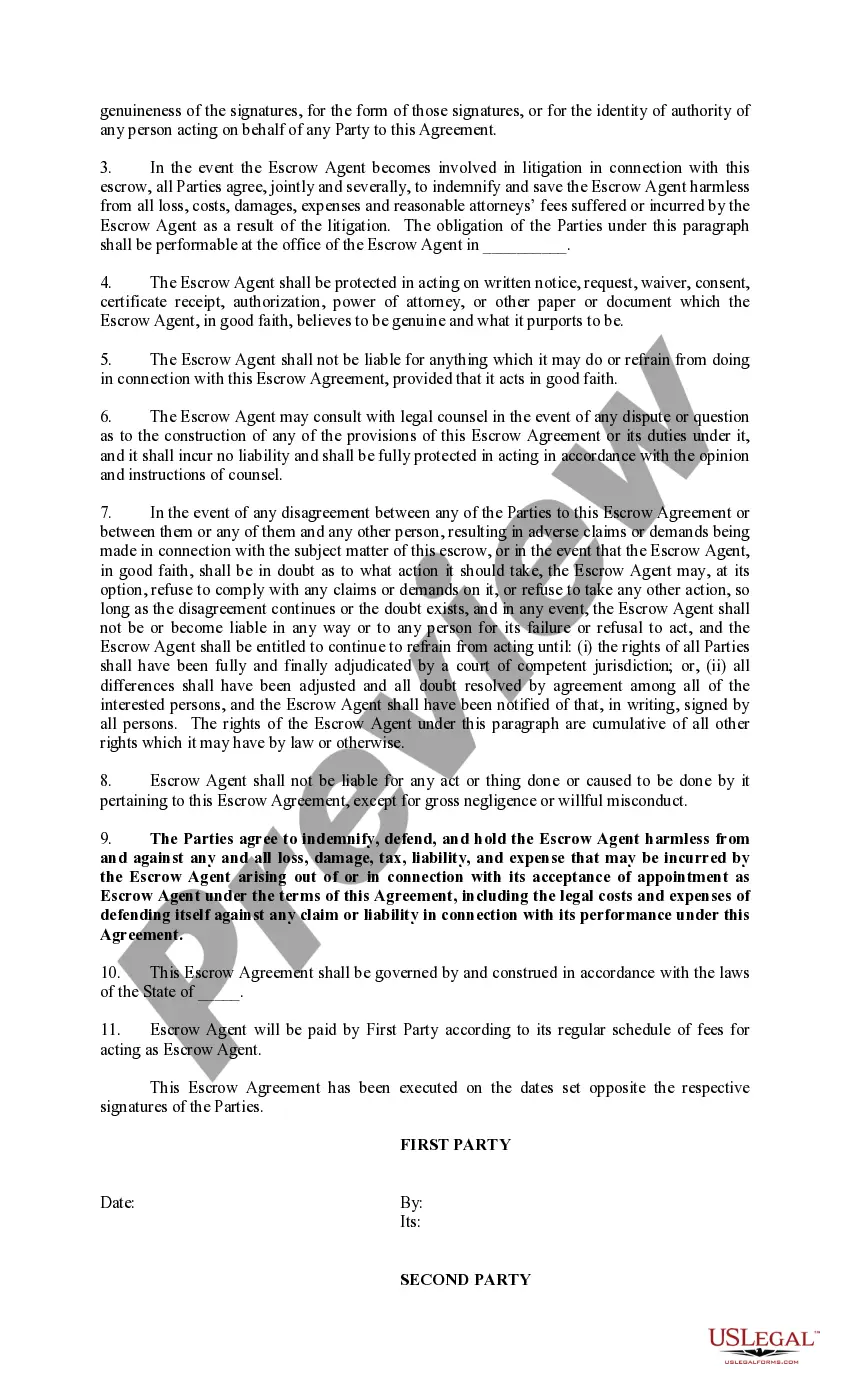

Clark Nevada Exhibit to Operating Agreement Escrow Agreement

Description

How to fill out Clark Nevada Exhibit To Operating Agreement Escrow Agreement?

If you need to get a reliable legal form provider to find the Clark Exhibit to Operating Agreement Escrow Agreement, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it easy to get and execute various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to search or browse Clark Exhibit to Operating Agreement Escrow Agreement, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Clark Exhibit to Operating Agreement Escrow Agreement template and take a look at the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate contract, or complete the Clark Exhibit to Operating Agreement Escrow Agreement - all from the convenience of your sofa.

Join US Legal Forms now!