Cuyahoga Ohio Exhibit to Operating Agreement Escrow Agreement is a legally binding agreement that is often used in business transactions involving the transfer of ownership or assets. This agreement serves as a safeguard, ensuring that all parties involved fulfill their obligations and protect their interests. Below, we provide a detailed description of what this agreement entails, the types of agreements that fall under this category, and relevant keywords to further explain their importance. Description: The Cuyahoga Ohio Exhibit to Operating Agreement Escrow Agreement is designed to regulate and oversee the transfer of ownership, assets, or other valuable items between two parties. These agreements are commonly used in real estate transactions, mergers and acquisitions, intellectual property transfers, and partnerships, among others. The purpose of this agreement is to establish an escrow arrangement, wherein a neutral third-party entity, known as an escrow agent, holds the assets or funds until all conditions specified in the agreement are met. Types of Cuyahoga Ohio Exhibit to Operating Agreement Escrow Agreement: 1. Real Estate Escrow Agreement: This agreement is specific to real estate transactions, where the escrow agent holds the purchase funds until the necessary conditions are met, such as obtaining a clear title, completing inspections, and meeting financing terms. 2. Mergers and Acquisitions Escrow Agreement: In mergers and acquisitions, parties may involve escrow agreements to secure funds for any post-closing liabilities, indemnification claims, or potential disputes that may arise after the transaction is completed. 3. Intellectual Property Escrow Agreement: When intellectual property, such as patents, copyrights, or trade secrets, is involved in a transaction, an escrow agreement can be used to assure the buyer that the assets are transferred correctly and to protect the seller's rights in case of any undisclosed issues or breaches. Keywords: — Cuyahoga Ohio: Refers to the county located in Ohio, where the agreement is being established. — Exhibit to Operating Agreement: An exhibit is a supplementary document that provides additional information to the main operating agreement, usually describing specific terms, conditions, or provisions related to escrow arrangements. — Escrow Agreement: The main agreement that outlines the terms and conditions for the escrow arrangement, including the responsibilities of the parties involved and the conditions under which the funds or assets will be released. — Escrow Agent: A neutral third-party entity responsible for holding and managing the funds, assets, or documents involved in the agreement until all obligations and conditions outlined in the agreement are satisfied. In conclusion, the Cuyahoga Ohio Exhibit to Operating Agreement Escrow Agreement is a crucial legal instrument used in various transactional scenarios. It plays a vital role in ensuring the smooth transfer of assets or funds, safeguarding the interests of all parties involved, and providing an extra layer of protection against risks and disputes.

Cuyahoga Ohio Exhibit to Operating Agreement Escrow Agreement

Description

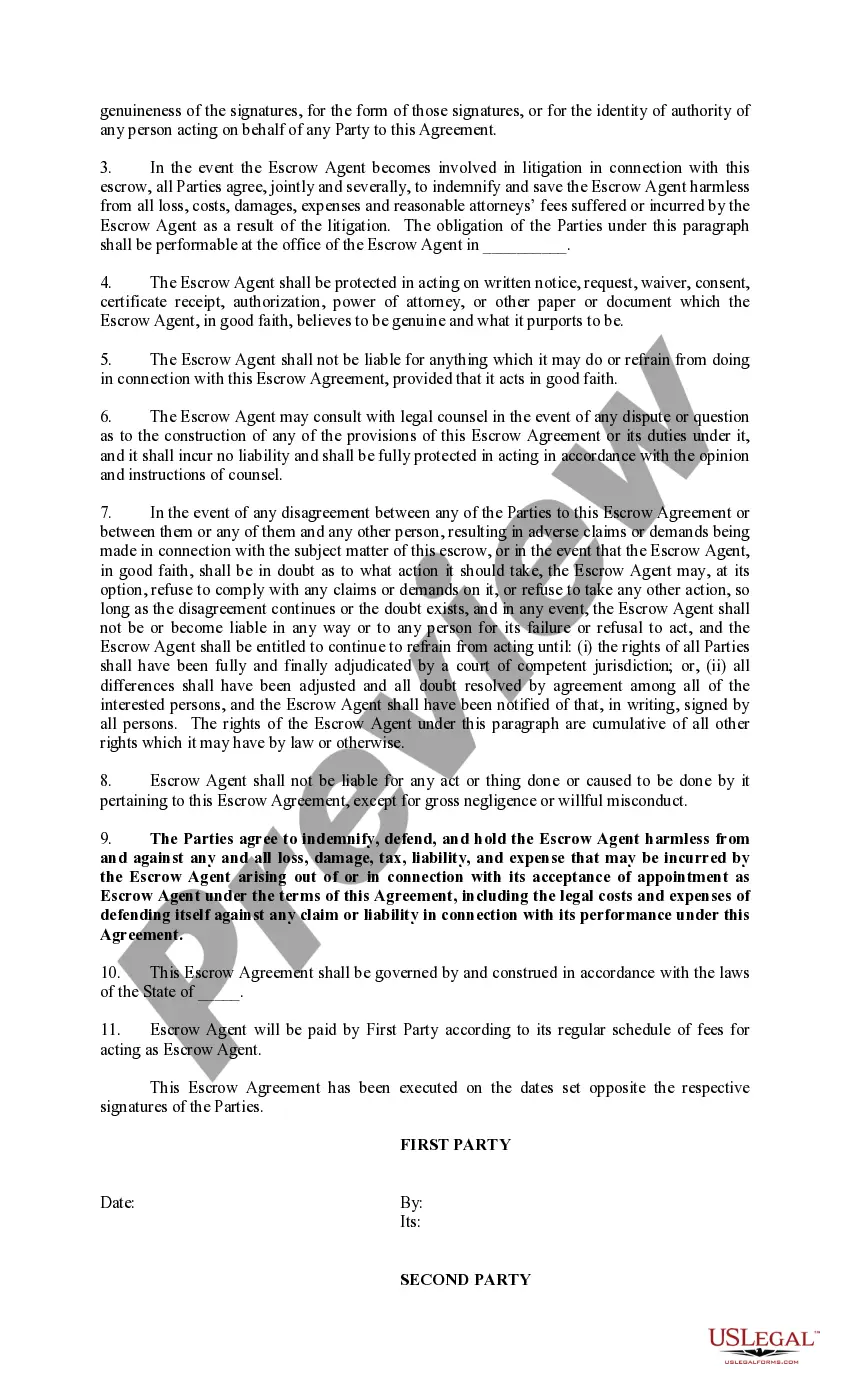

How to fill out Cuyahoga Ohio Exhibit To Operating Agreement Escrow Agreement?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Cuyahoga Exhibit to Operating Agreement Escrow Agreement, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find information materials and guides on the website to make any tasks related to document completion straightforward.

Here's how to find and download Cuyahoga Exhibit to Operating Agreement Escrow Agreement.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the legality of some records.

- Examine the related document templates or start the search over to locate the right document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase Cuyahoga Exhibit to Operating Agreement Escrow Agreement.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Cuyahoga Exhibit to Operating Agreement Escrow Agreement, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer entirely. If you have to cope with an exceptionally challenging situation, we recommend getting an attorney to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!