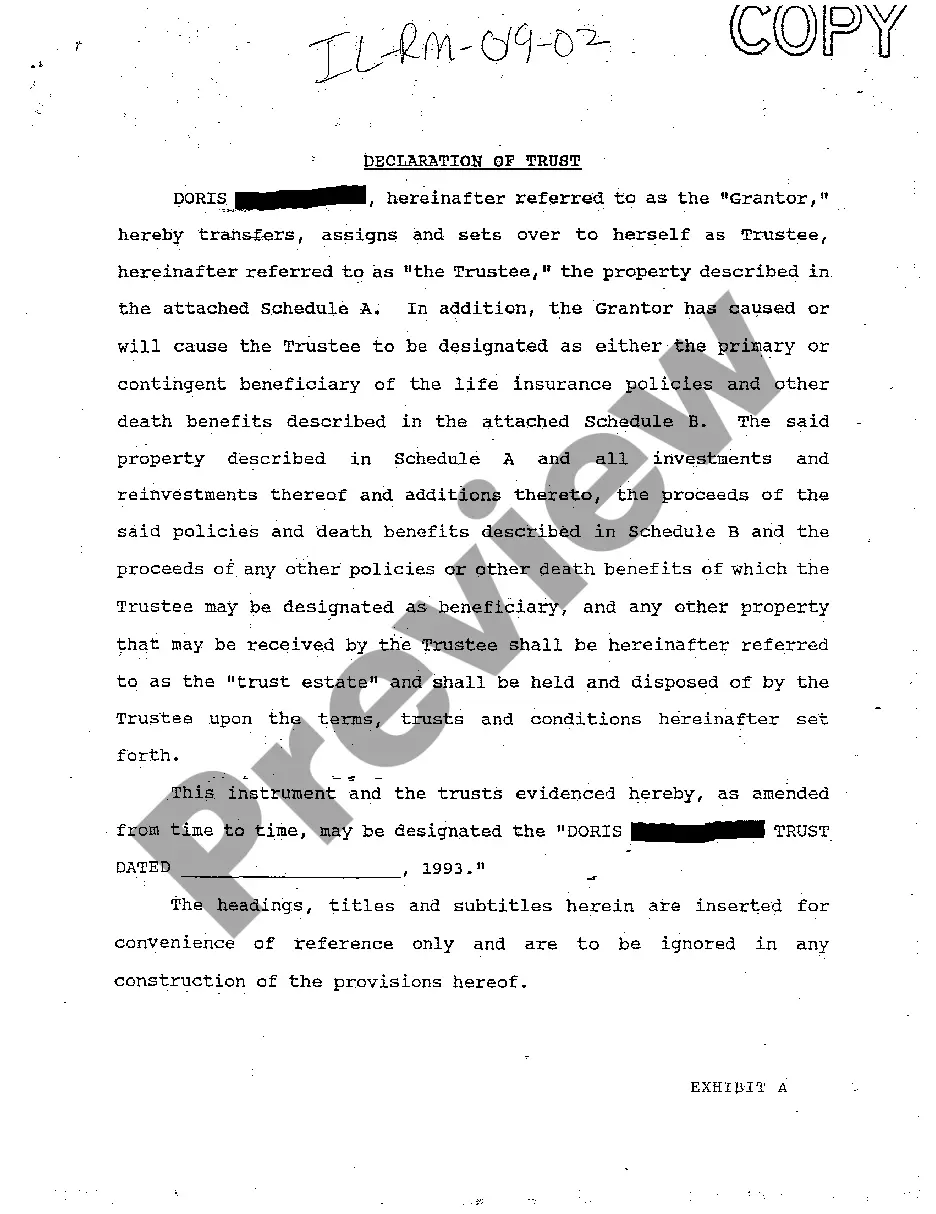

The Chicago, Illinois Memorandum of Operating Agreement and Financing Statement is a legal document that outlines the terms and conditions of an operating agreement and provides information about the financing involved. It serves as a binding contract between the parties involved in a business transaction in the Chicago, Illinois area. The memorandum of operating agreement section of the document includes detailed information about the structure and organization of the business entity, such as the name of the company, its principal place of business, and the purpose for which it was formed. It also outlines the roles and responsibilities of each party involved, including the members or managers of a limited liability company (LLC) or partners of a partnership. Furthermore, the memorandum covers important provisions such as capital contributions, profit and loss sharing, decision-making processes, and dispute resolution mechanisms among the parties. It sets out the rules and regulations that govern the day-to-day operations of the business, ensuring clarity and minimizing potential conflicts or misunderstandings. The financing statement section of the document focuses on the financial aspects of the agreement. It provides information about the financing arrangements and obligations of the parties involved. This may include details about secured loans, mortgages, liens, or any other financial interests or encumbrances on the business assets. In Chicago, Illinois, there are various types of Memorandum of Operating Agreement and Financing Statements that may be used depending on the type of business entity. For example, there could be separate agreements for limited liability companies (LCS), partnerships, corporations, or sole proprietorship. Each type of agreement may have specific provisions tailored to the requirements and characteristics of the particular business structure. These agreements are crucial for businesses operating in Chicago, Illinois, as they establish a legal framework that governs the rights, obligations, and financial aspects of the business transactions. By clearly defining the terms and conditions, the memorandum of operating agreement and financing statement provides a solid foundation for the parties involved to work cohesively and mitigate potential conflicts that may arise in the future.

Chicago Illinois Memorandum of Operating Agreement and Financing Statement

Description

How to fill out Chicago Illinois Memorandum Of Operating Agreement And Financing Statement?

Are you looking to quickly create a legally-binding Chicago Memorandum of Operating Agreement and Financing Statement or probably any other form to take control of your own or corporate matters? You can select one of the two options: contact a legal advisor to write a legal paper for you or draft it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific form templates, including Chicago Memorandum of Operating Agreement and Financing Statement and form packages. We provide documents for an array of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed template without extra hassles.

- To start with, double-check if the Chicago Memorandum of Operating Agreement and Financing Statement is adapted to your state's or county's laws.

- In case the form comes with a desciption, make sure to check what it's suitable for.

- Start the search over if the template isn’t what you were looking for by using the search box in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Chicago Memorandum of Operating Agreement and Financing Statement template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the documents we provide are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The LLC operating agreement, also known as an LLC agreement, establishes the rules and structure for the LLC and can help address any issues that arise during business operations. Most states have default provisions that address many of these difficulties, but the operating agreement can override these presumptions.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

An Illinois LLC operating agreement is a binding document that establishes the ownership, operations, officers, and responsibilities of company members. The agreement acts as the bylaws and oversees the day-to-day operations of the company.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

The most important step for forming an LLC in Illinois is to file articles of organization with the Illinois Secretary of State. You can either file your articles online for faster processing or mail in Form LLC-5.5. The filing fee is $150.

How to Write an Operating Agreement ? Step by Step Step One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

Operating agreements are contract documents that are generally between five and twenty pages long.

Illinois does not require an Operating Agreement to be submitted to the Secretary of State when filing your Articles of Organization paperwork, but the law does allow for an Operating Agreement to be adopted by the members of the LLC.

Articles of Organization are also called a Certificate of Formation in some states. It is a document filed with the appropriate state when registering a limited liability company (LLC). An Operating Agreement is the document LLC members look to when they need to resolve issues or disputes within the company.

How to Write an Operating Agreement ? Step by Step Step One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.