This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

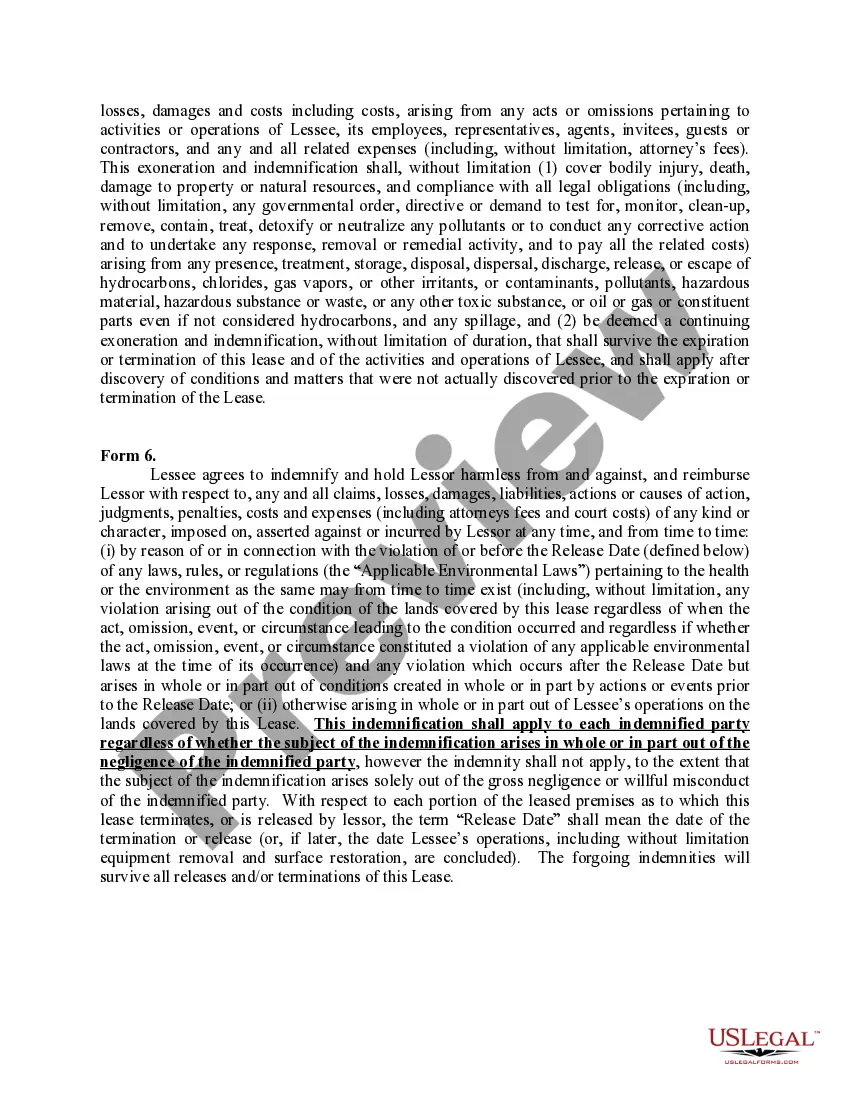

Harris Texas Indemnification of Lessor is a legal provision that aims to protect lessors from financial loss or liability resulting from actions or claims brought against them by lessees or third parties. This provision can be found in lease agreements and serves as an important safeguard for lessors in Harris County, Texas. The following content provides a detailed description of Harris Texas Indemnification of Lessor, highlighting its significance and potential variations: 1. Definition and Purpose: Harris Texas Indemnification of Lessor refers to the contractual agreement wherein a lessee formally agrees to compensate the lessor for any losses, damages, or liabilities incurred as a result of the lessee's actions, negligence, or breach of terms outlined in the lease agreement. The primary purpose of this provision is to shift the financial burden of potential legal claims or damages from the lessor to the lessee. 2. Key Components: a. Scope of Indemnification: The indemnification clause specifies the types of claims, losses, or liabilities covered by the lessee. It may include bodily injury, property damage, legal fees, or other losses incurred due to the lessee's actions. b. Indemnity Period: This clause establishes the time frame during which the lessee is responsible for indemnifying the lessor. It is typically valid during the lease term and may extend to post-termination obligations. c. Lessee's Obligations: It outlines the lessee's responsibilities to promptly notify the lessor of any claims or potential claims, cooperate in any legal proceedings, and take necessary steps to mitigate damages or losses. d. Maximum Liability: The indemnification clause may contain a provision limiting the lessee's maximum liability, thereby protecting them from excessive financial burdens. e. Insurance Requirements: The lease agreement may include a provision obligating the lessee to maintain adequate insurance coverage to fulfill their indemnification obligations. 3. Types of Harris Texas Indemnification of Lessor: a. General Indemnification: This type of indemnification typically covers a wide range of losses, damages, or liabilities attributable to the lessee's actions, including property damage, personal injury claims, or third-party lawsuits. b. Environmental Liability Indemnification: In certain lease agreements involving environmentally sensitive properties, lessors may require lessees to assume responsibility for any environmental damages or contamination caused during the lease term. c. Indemnification for Breach of Terms: This type of indemnification holds lessees financially accountable for losses or damages incurred by the lessor due to violations or breaches of specific lease terms, such as unauthorized alterations, misuse of property, or failure to make required repairs. In conclusion, Harris Texas Indemnification of Lessor is a crucial provision that protects lessors in Harris County, Texas, from potential financial losses or liabilities resulting from actions or claims brought against them by lessees or third parties. It encompasses various components and may come in different types, such as general indemnification, environmental liability indemnification, or indemnification for breach of terms. By understanding and including such provisions in lease agreements, lessors can mitigate potential risks and safeguard their financial interests.