Collin Texas Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit)

Description

How to fill out Affidavit As To Heirship Of (Name Of Person), Deceased (With Corroborating Affidavit)?

Whether you intend to launch your enterprise, engage in a transaction, request your identification renewal, or address familial legal matters, you need to prepare specific documentation in accordance with your local statutes and regulations.

Finding the appropriate documents may require considerable time and effort unless you utilize the US Legal Forms library.

This service offers users over 85,000 expertly crafted and validated legal templates for any personal or business event. All documents are categorized by state and area of use, making it quick and easy to select a form like Collin Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit).

Documents provided by our platform are reusable. With an active subscription, you can access all your previously purchased paperwork anytime in the My documents section of your profile. Stop wasting time on an endless quest for current official documentation. Join the US Legal Forms platform and maintain your paperwork organized with the most extensive online form library!

- Ensure the template meets your individual requirements and adheres to state law regulations.

- Review the form description and examine the Preview if available on the page.

- Utilize the search feature by entering your state above to find additional templates.

- Click Buy Now to acquire the document once you locate the correct one.

- Select the subscription plan that best fits your needs to move forward.

- Log in to your account and pay for the service using a credit card or PayPal.

- Download the Collin Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) in your desired file format.

- Print the document or complete it and sign it electronically through an online editor for efficiency.

Form popularity

FAQ

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

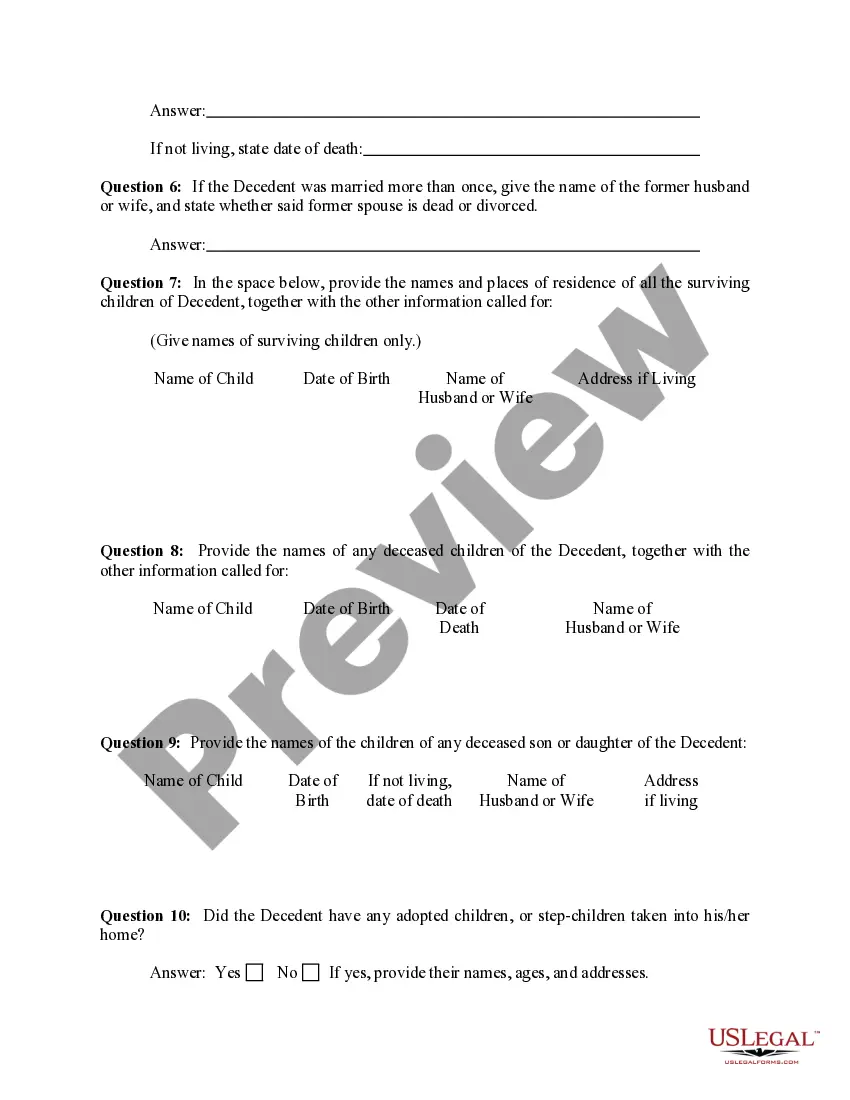

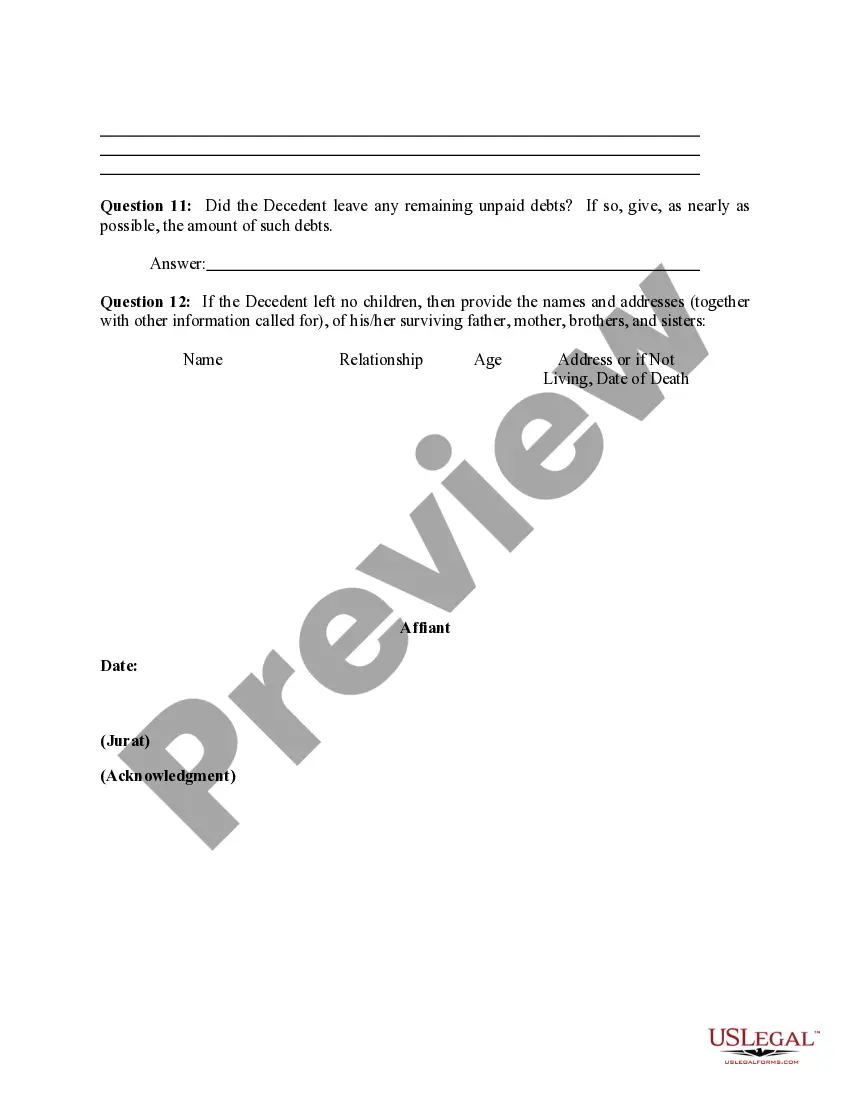

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

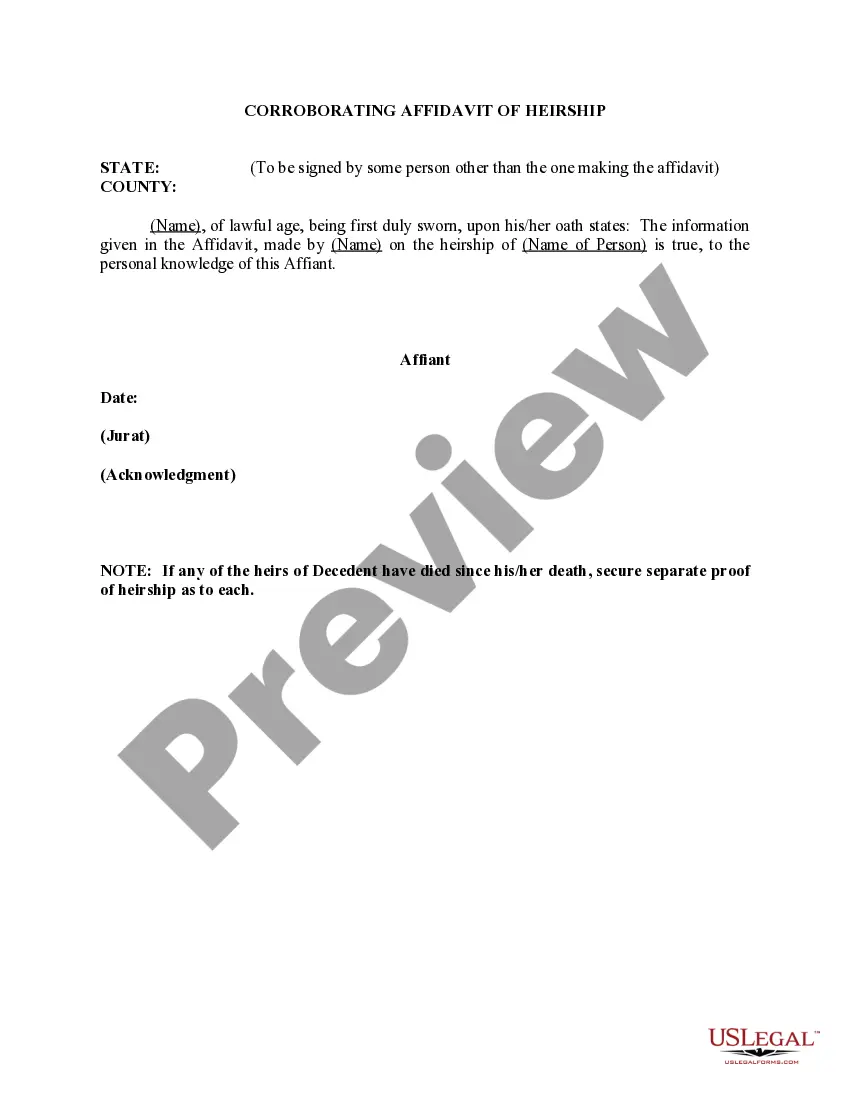

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

(b) Except as provided by Subsection (c), in a proceeding to declare heirship, testimony regarding a decedent's heirs and family history must be taken from two disinterested and credible witnesses in open court, by deposition in accordance with Section 51.203, or in accordance with the Texas Rules of Civil Procedure.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

Where do you file an affidavit of heirship? An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

An Affidavit of Heirship is a sworn statement that identifies the heirs of a deceased property owner. Good to know: By Texas law, all property owned by the deceased passes to the Heirs at Law of the deceased unless there is a valid Will or other estate plan in place stating otherwise.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

If the deceased doesn't leave a will (intestate proceeding), the estate will have no free portion and will be divided equally among the surviving spouse and legitimate children. If there are illegitimate children, they are entitled to the equivalent of ½ the share of the legitimate children.