Alameda, California is a vibrant city located in Alameda County, situated on the Alameda Island. This beautiful coastal community is known for its charming streets, stunning views of the San Francisco skyline, and a rich history. With a population of approximately 78,000, Alameda offers a diverse array of attractions, such as unique shops, waterfront parks, excellent schools, and a thriving arts scene. When it comes to the legal aspect of Alameda, Assignment of Overriding Royalty Interest (By Owner of Override) plays a crucial role in the oil and gas industry. This type of assignment refers to the transfer of ownership or control of a portion of the royalty interest in an oil or gas lease, which overrides the primary rights typically held by the lessee or assignee. It grants the owner of the override the right to receive a percentage of the revenue generated from the production of oil and gas from the property. In Alameda, there are different types of Assignment of Overriding Royalty Interest (By Owner of Override), each with its own specifications and significance. Some of these types include: 1. Working Interest Override: In this type of assignment, the overriding royalty interest owner acquires a share of the working interest, granting them both a percentage of the production and the responsibility for a proportional share of expenses related to drilling, operation, and maintenance. 2. Non-Participating Interest Override: This assignment refers to the transfer of a certain percentage of the royalty interest, while the overriding royalty interest owner remains non-participating in the operations of the leased property. They are entitled to receive royalties without incurring any expenses or obligations. 3. Leasehold Override: This type of assignment involves a transfer of the interest in the lease itself, granting the overriding royalty interest owner control over the leasehold estate. They have the authority to negotiate leases, execute agreements, and receive all payments associated with the lease. In conclusion, understanding the concept of Alameda California Assignment of Overriding Royalty Interest (By Owner of Override) is crucial in the context of the oil and gas industry. With different types available, it is important to carefully consider the specific terms and conditions associated with each assignment to ensure all parties involved are properly informed and protected.

Alameda California Assignment of Overriding Royalty Interest (By Owner of Override)

Description

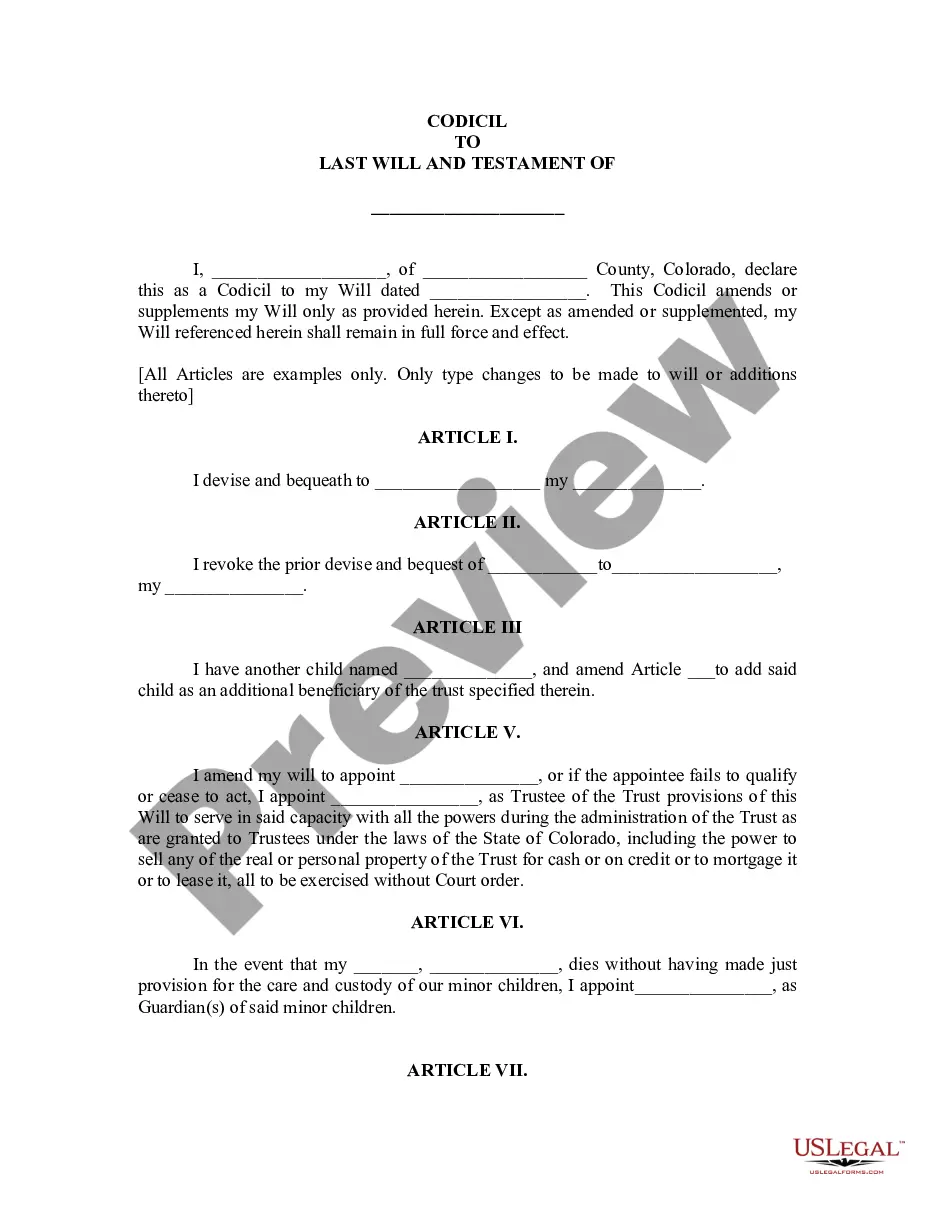

How to fill out Alameda California Assignment Of Overriding Royalty Interest (By Owner Of Override)?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Alameda Assignment of Overriding Royalty Interest (By Owner of Override), you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Alameda Assignment of Overriding Royalty Interest (By Owner of Override) from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Alameda Assignment of Overriding Royalty Interest (By Owner of Override):

- Analyze the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Legal Definition of overriding royalty : an interest in and royalty on the oil, gas, or minerals extracted from another's land that is carved out of the producer's working interest and is not tied to production costs compare royalty.