The Bronx, New York, is one of the five boroughs of New York City. It is located in the northern part of the city and is known for its rich history, diverse population, and vibrant cultural scene. This bustling borough offers a wide range of attractions, from world-class museums and iconic landmarks to beautiful parks and a thriving culinary scene. When it comes to the Bronx New York Assignment of Overriding Royalty Interest (No Proportionate Reduction), it refers to a legal agreement where the owner of an overriding royalty interest in an oil or gas property in the Bronx assigns or transfers their interest to another party without any reduction or proportionate distribution of the interest. This agreement allows the assignee to benefit from the royalty interest without any dilution or sharing with other interest holders. There are different types of Bronx New York Assignment of Overriding Royalty Interest (No Proportionate Reduction), which may include: 1. Oil and Gas Leases: This type involves the assignment of overriding royalty interest in oil and gas leases in the Bronx. It allows the assignee to receive a share of any revenue generated from the production of oil and gas on the leased property without any reduction in proportion to other interest holders. 2. Mineral Rights Assignments: This type involves the assignment of overriding royalty interest in mineral rights located in the Bronx. It allows the assignee to receive a portion of the proceeds from the extraction or exploration of minerals without any proportional reduction. 3. Production Sharing Agreements: This type involves the assignment of overriding royalty interest in production sharing agreements related to oil and gas exploration or production activities in the Bronx. The assignee receives a share of the production revenue without any proportionate reduction. 4. Non-Operated Working Interest Assignments: This type involves the assignment of overriding royalty interest in a non-operated working interest in the Bronx. The assignee is entitled to a share of the revenue generated from the working interest without any reduction in proportion to other interest holders. In conclusion, the Bronx, New York, is a vibrant borough home to diverse communities and exciting attractions. The Bronx New York Assignment of Overriding Royalty Interest (No Proportionate Reduction) refers to various legal agreements involving the assignment of royalty interests without any reduction or proportional distribution. These agreements can include oil and gas leases, mineral rights assignments, production sharing agreements, and non-operated working interest assignments.

Bronx New York Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Bronx New York Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Bronx Assignment of Overriding Royalty Interest (No Proportionate Reduction), you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Bronx Assignment of Overriding Royalty Interest (No Proportionate Reduction) from the My Forms tab.

For new users, it's necessary to make some more steps to get the Bronx Assignment of Overriding Royalty Interest (No Proportionate Reduction):

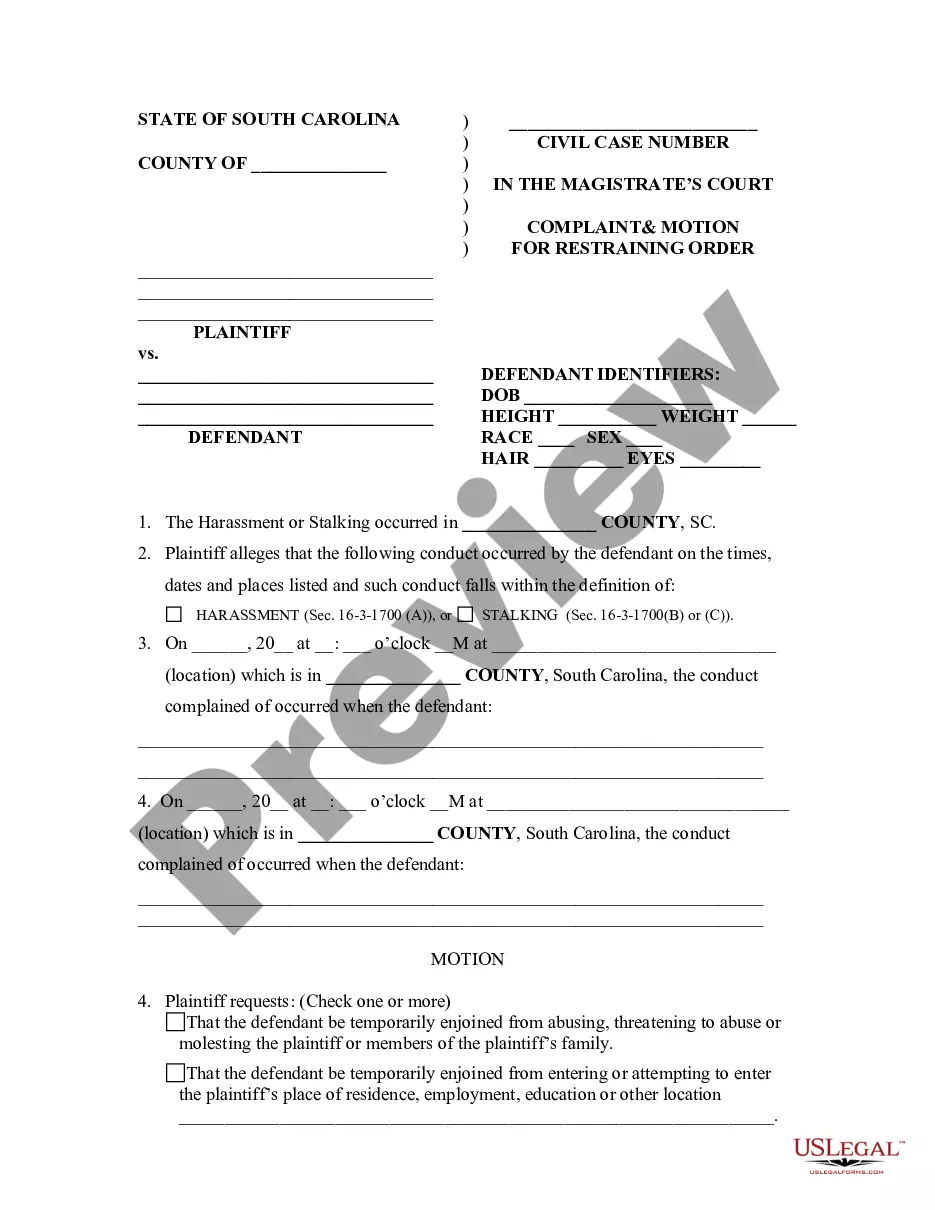

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!