Chicago, Illinois is a vibrant city located in the heart of the United States. Home to millions of residents, it boasts a rich history, diverse culture, and numerous landmarks that make it a popular destination for tourists and investors alike. In the realm of oil, gas, and mineral rights, an Assignment of Overriding Royalty Interest (No Proportionate Reduction) is a legal document that grants an overriding royalty interest to the assignee without any reduction proportional to the lessee's ownership interest. This type of assignment is commonly used in the energy industry to provide a royalty interest to a third party. There are several types of Chicago, Illinois Assignment of Overriding Royalty Interest (No Proportionate Reduction) agreements, including the following: 1. Traditional Assignment: This type of agreement involves the transfer of an overriding royalty interest from the assignor (the current owner) to the assignee (the recipient). It outlines the terms and conditions of the assignment, including the percentage of the royalty interest and any associated payments. 2. Partial Assignment: In some cases, the assignor may choose to transfer only a portion of their overriding royalty interest to the assignee. This partial assignment allows both parties to benefit from the resources while maintaining some level of ownership for the assignor. 3. Non-Participating Assignment: A non-participating assignment is when the assignee receives the overriding royalty interest without any ability to participate in the operations of the oil, gas, or mineral rights. This type of arrangement is often chosen when the assignee prefers to passively earn royalty income. 4. Limited-Term Assignment: For a specific duration, the assignor may grant the assignee a limited-term overriding royalty interest. This type of assignment typically comes with an expiration date or specific conditions that determine the length of the agreement. 5. Lifetime Assignment: In some cases, the assignor may assign a lifetime overriding royalty interest to the assignee, allowing them to benefit from the resources for the duration of their life. This type of assignment is often seen in family or legacy arrangements. It is essential for all parties involved in a Chicago, Illinois Assignment of Overriding Royalty Interest (No Proportionate Reduction) to consult legal professionals to ensure that the agreement is structured correctly, protecting their rights and interests. With the proper documentation and consideration of key factors, these assignments can provide financial benefits for both the assignor and assignee in the context of oil, gas, and mineral rights ownership.

Chicago Illinois Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Chicago Illinois Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Chicago Assignment of Overriding Royalty Interest (No Proportionate Reduction), with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find information resources and guides on the website to make any tasks related to paperwork execution simple.

Here's how to find and download Chicago Assignment of Overriding Royalty Interest (No Proportionate Reduction).

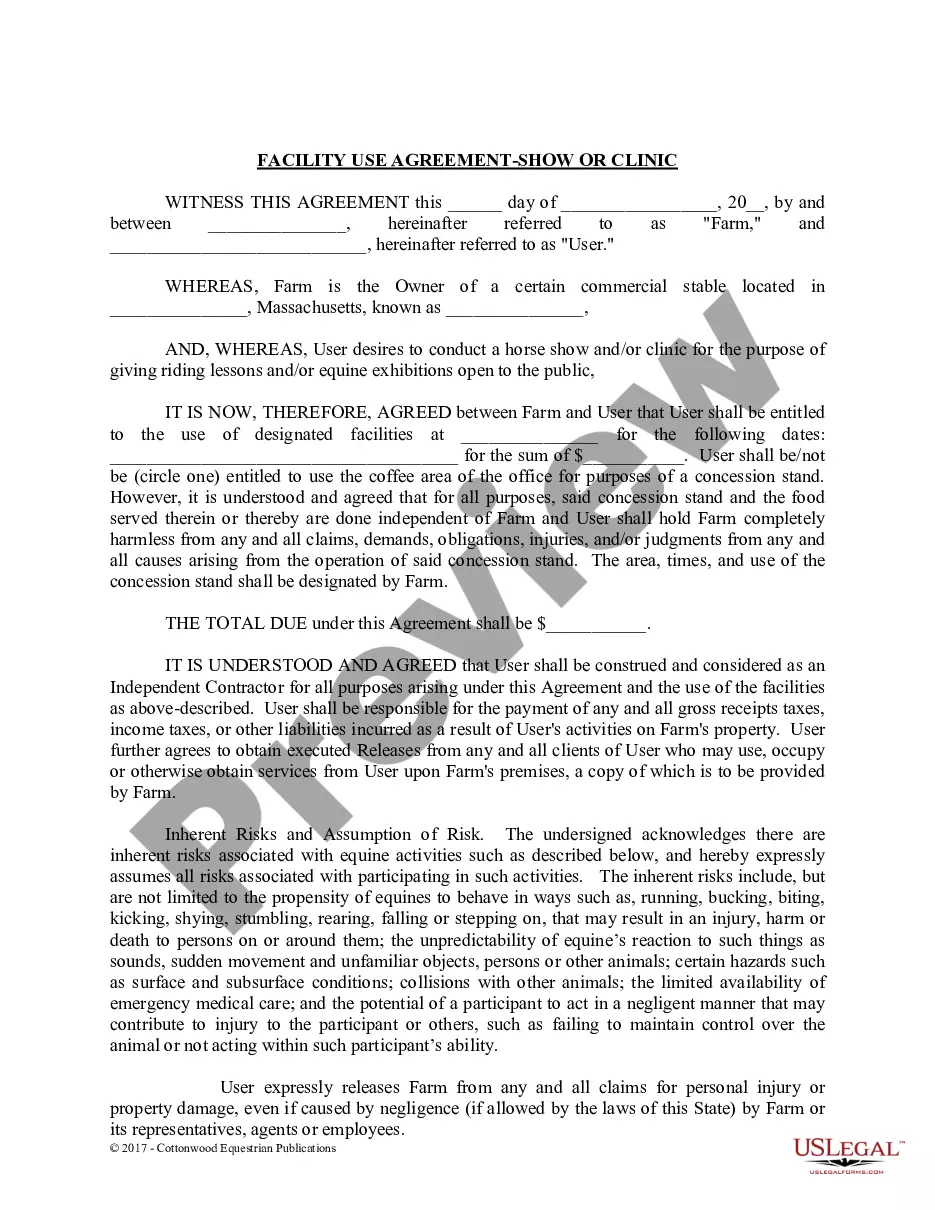

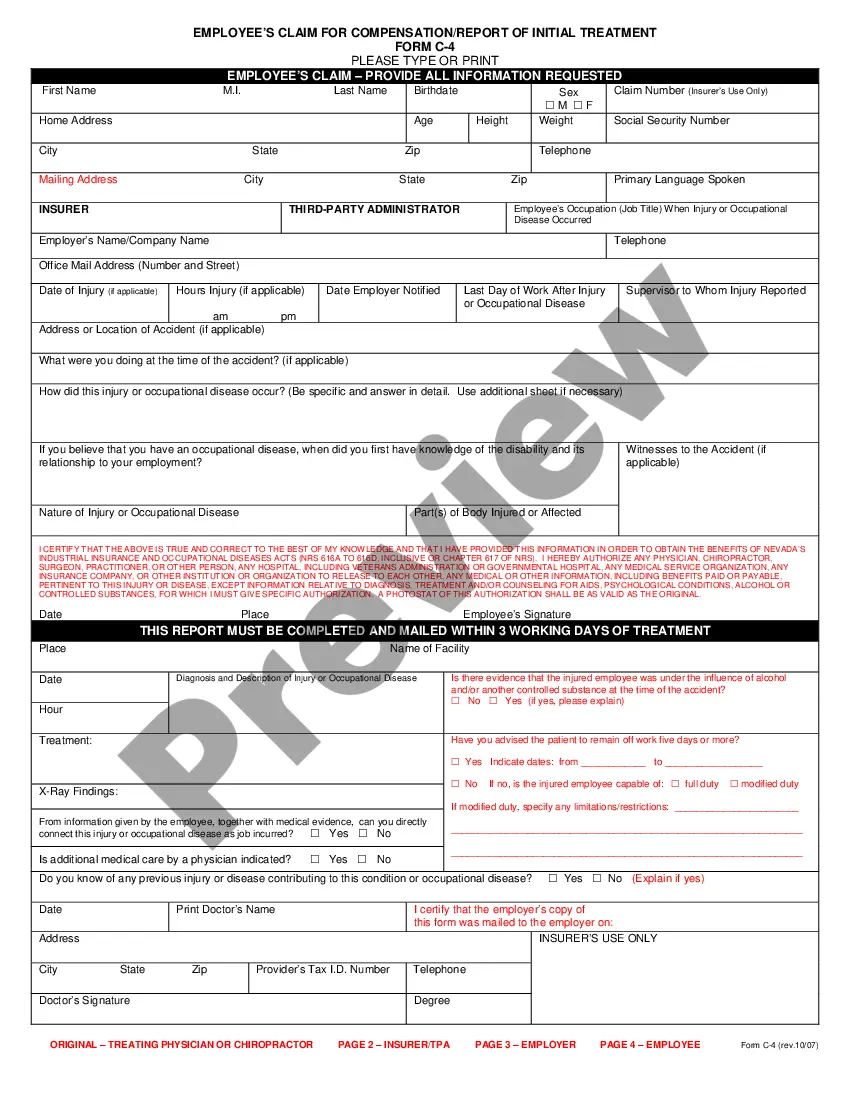

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the related forms or start the search over to find the right file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and buy Chicago Assignment of Overriding Royalty Interest (No Proportionate Reduction).

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Chicago Assignment of Overriding Royalty Interest (No Proportionate Reduction), log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you have to cope with an exceptionally difficult case, we recommend getting an attorney to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific documents effortlessly!