Collin Texas Assignment of Overriding Royalty Interest (No Proportionate Reduction) is a legal document that transfers the right to receive royalty payments from the minerals produced on a specific property located in Collin County, Texas. This assignment is typically used in oil and gas transactions and allows the assignee to collect a portion of the proceeds generated from the sale of the mineral resources. Keywords: Collin Texas, Assignment of Overriding Royalty Interest, No Proportionate Reduction, royalty payments, minerals, property, Collin County, Texas, oil and gas, transactions, assignee, mineral resources, sale. Types of Collin Texas Assignment of Overriding Royalty Interest (No Proportionate Reduction): 1. Standard Assignment of Overriding Royalty Interest: This type of assignment transfers a fixed percentage or fraction of the royalty interest to the assignee without any proportionate reduction. The assignee will be entitled to receive royalties based on the percentage allotted in the assignment agreement. 2. Special Assignment of Overriding Royalty Interest: This type of assignment may include additional terms and conditions that make it unique to the specific transaction. It could involve specific limitations, enhanced royalty provisions, or other special considerations based on the agreement between the assignor and assignee. 3. Limited Assignment of Overriding Royalty Interest: In certain cases, the assignment may be limited to a specific period or a particular section of the property. This type of assignment transfers the overriding royalty interest for a defined time frame or only for a certain area, as outlined in the assignment agreement. 4. Absolute Assignment of Overriding Royalty Interest: This type of assignment transfers the entire overriding royalty interest to the assignee, making them the sole recipient of the royalty payments without any proportionate reduction. The assignee assumes full control and ownership over the assigned royalty interest. 5. Partial Assignment of Overriding Royalty Interest: In some situations, an assignment may involve transferring only a portion of the overriding royalty interest. The assignee will receive royalties based on the assigned fraction or percentage, while the assignor retains ownership of the remaining royalty interest. It is essential to consult an attorney or legal professional who specializes in mineral rights and assignments to ensure a thorough understanding of the specific type of Collin Texas Assignment of Overriding Royalty Interest being utilized in a particular transaction.

Collin Texas Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Collin Texas Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Collin Assignment of Overriding Royalty Interest (No Proportionate Reduction), you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Collin Assignment of Overriding Royalty Interest (No Proportionate Reduction) from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Collin Assignment of Overriding Royalty Interest (No Proportionate Reduction):

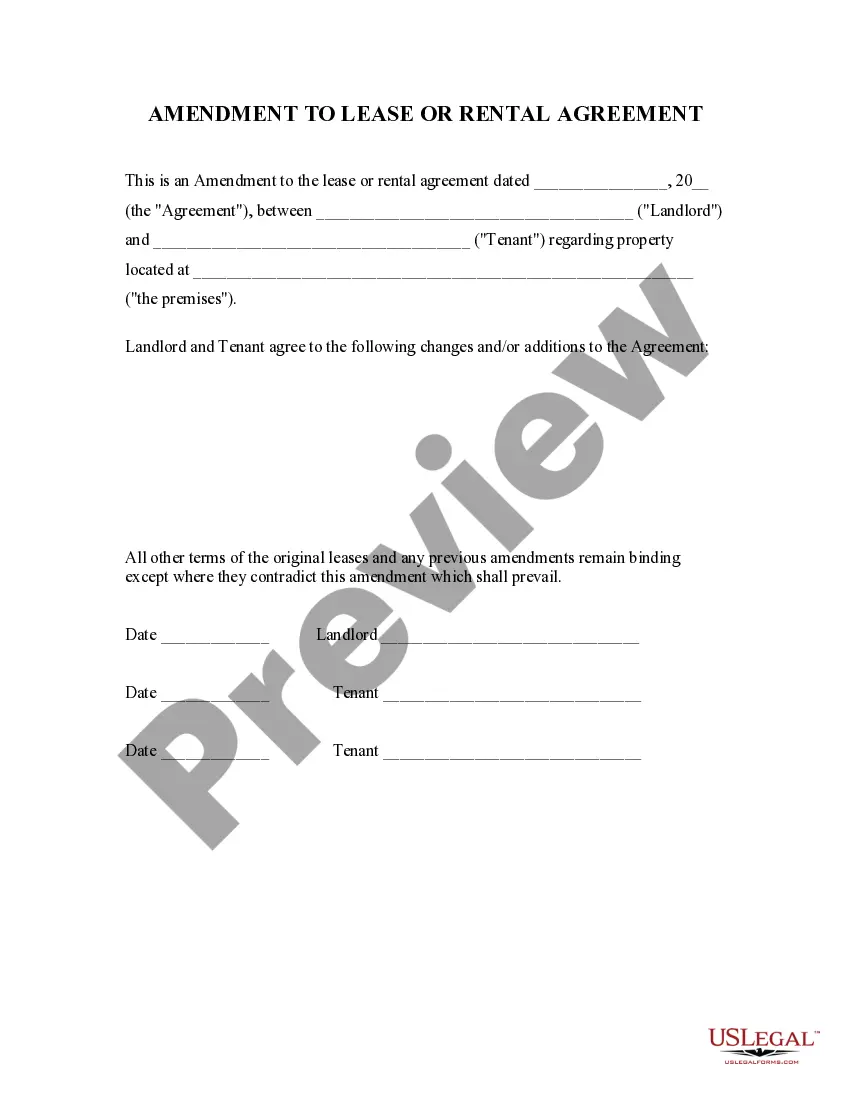

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!