Dallas, Texas Assignment of Overriding Royalty Interest (No Proportionate Reduction) is a legal document that allows the transfer of overriding royalty interests from one party to another without reducing the proportionate share. Dallas, Texas, known as the Lone Star State's vibrant and populous city, is home to a thriving oil and gas industry, making assignments of overriding royalty interests a crucial part of the region's business landscape. An overriding royalty interest (ORRIS) refers to a percentage of revenue or profits derived from the production of oil, gas, or other minerals that is separate from the landowner's royalty interest. These interests are often granted to third parties, such as investors or land brokers, who did not originally own the mineral rights but participated in the exploration or development of the property. The Dallas, Texas Assignment of Overriding Royalty Interest (No Proportionate Reduction) comes in various forms to cater to different circumstances and requirements. Some common types include: 1. Absolute Assignment: This type of assignment involves the complete transfer of overriding royalty interests from the assignor to the assignee. The assignee assumes full ownership and responsibility for the assigned interest, without any ongoing obligations on the part of the assignor. 2. Partial Assignment: In certain cases, an assignor may choose to transfer only a portion of their overriding royalty interest. This type of assignment allows the assignor to retain a share of the interest while granting the assignee a portion. 3. Assignments with Limitations: The Dallas, Texas Assignment of Overriding Royalty Interest (No Proportionate Reduction) may also include specific limitations or conditions, such as restrictions on geographic area or time duration. These limitations can be tailored to suit the needs and preferences of both parties involved in the assignment. 4. Assignments for Consideration: In some instances, an assignee may offer consideration or compensation to the assignor in exchange for the overriding royalty interest. This consideration could be in the form of cash, other mineral rights, or any other agreed-upon asset. The Dallas, Texas Assignment of Overriding Royalty Interest (No Proportionate Reduction) serves as a legally binding document that protects the rights and interests of both parties involved in the assignment. It outlines the details of the transfer, including the assignor's name, the assignee's name, the assigned interest percentage, any limitations or conditions, and the effective date of the assignment. This document provides clarity and security, ensuring a smooth and transparent transfer of overriding royalty interests in the Dallas, Texas oil and gas industry.

Dallas Texas Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Dallas Texas Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

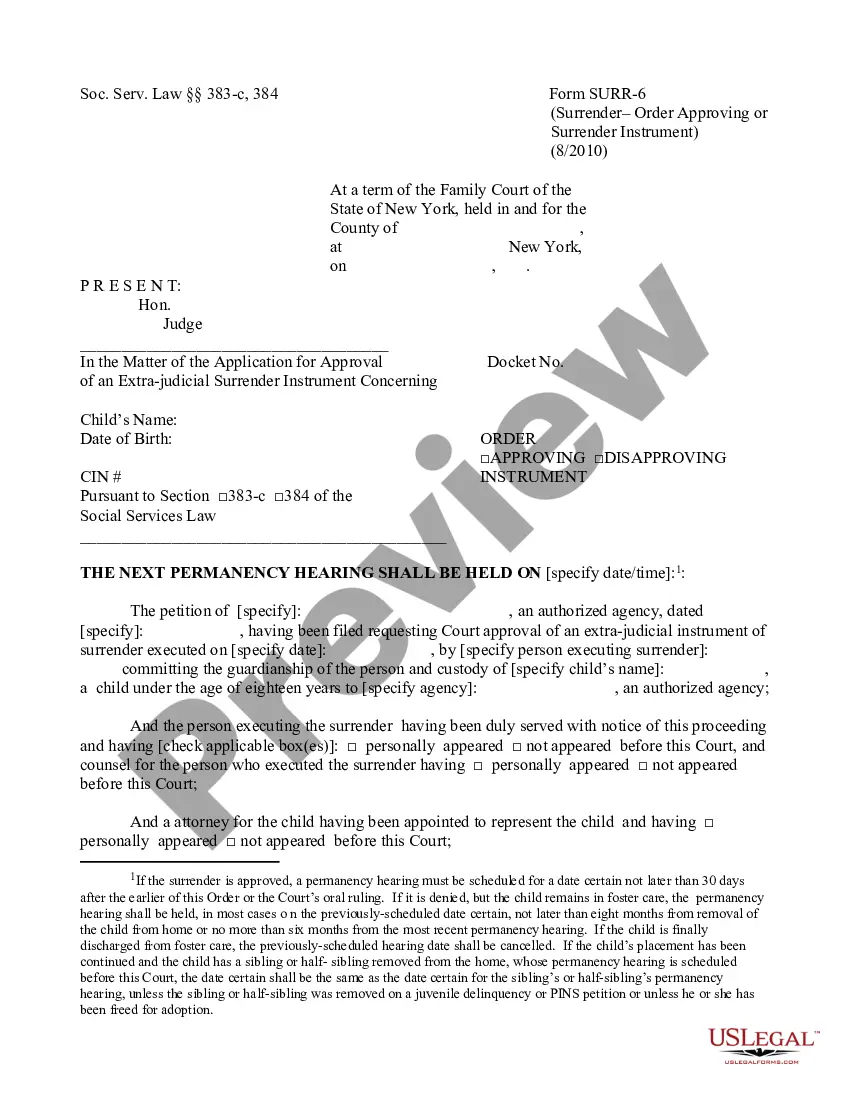

Draftwing forms, like Dallas Assignment of Overriding Royalty Interest (No Proportionate Reduction), to manage your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can consider your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for various scenarios and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Dallas Assignment of Overriding Royalty Interest (No Proportionate Reduction) template. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before getting Dallas Assignment of Overriding Royalty Interest (No Proportionate Reduction):

- Ensure that your form is compliant with your state/county since the regulations for creating legal documents may differ from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Dallas Assignment of Overriding Royalty Interest (No Proportionate Reduction) isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin utilizing our service and download the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

If you know the decimal interest in your mineral tract and you have the legal description, you can calculate the Net Acres owned. Here's an Example: Net Revenue Interest = Net Mineral Acres / Drilling Spacing Unit Acres Royalty Rate. So, our NRI = 17.78 / 1280 0.15 = 0.0020835.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

The formula to calculate NPRI without proportionate share reduction is LRR RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners. The formula using proportionate reduction is LRR RI = NPRI.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain royalty interest it is expensefree, bearing no operational costs of production.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.