Hillsborough Florida Assignment of Overriding Royalty Interest (No Proportionate Reduction) is a legal document that pertains to the transfer of rights to receive royalty payments from the production of oil, gas, or minerals in Hillsborough County, Florida. This type of assignment specifically excludes any reduction in the proportionate share of the royalty interest being transferred. In Hillsborough County, there are various types of Assignment of Overriding Royalty Interest (No Proportionate Reduction) agreements. These agreements can differ based on the specific terms and conditions negotiated between the parties involved. Some common variations include: 1. Fixed Royalty Assignment: This agreement involves the transfer of a fixed royalty interest percentage to the assignee, which remains unchanged regardless of changes in production volumes or the working interest owner's share. 2. Non-Dilution Assignment: In this type of agreement, the assignor guarantees that the assignee's royalty interest will not be reduced proportionately if the working interest owner's share in the production increases. 3. Non-Participating Assignment: This agreement allows the assignee to receive royalty payments without having any decision-making authority or right to participate in the management of the mineral lease or the operations related to it. 4. Enhanced Royalty Assignment: In this variation, the assignee receives a higher royalty interest percentage compared to the initial lease agreement. This increase can be a result of negotiation, additional investment, or other considerations. 5. Fractional Assignment: With a fractional assignment, the assignor transfers a fraction of the overriding royalty interest, while retaining a portion for themselves. This arrangement allows for shared participation in the benefits of the minerals produced. 6. Partial Assignment: This agreement involves the transfer of a specific portion of the overriding royalty interest, typically expressed as a percentage, without any changes to other terms of the original lease agreement. It is important for individuals involved in such agreements to ensure that they carefully review and understand the specific terms and conditions of the Assignment of Overriding Royalty Interest (No Proportionate Reduction) to protect their rights and interests in the resource production in Hillsborough County, Florida. Legal consultation is highly recommended ensuring compliance with local laws and regulatory requirements.

Hillsborough Florida Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Hillsborough Florida Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Hillsborough Assignment of Overriding Royalty Interest (No Proportionate Reduction) meeting all local requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Hillsborough Assignment of Overriding Royalty Interest (No Proportionate Reduction), here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Hillsborough Assignment of Overriding Royalty Interest (No Proportionate Reduction):

- Check the content of the page you’re on.

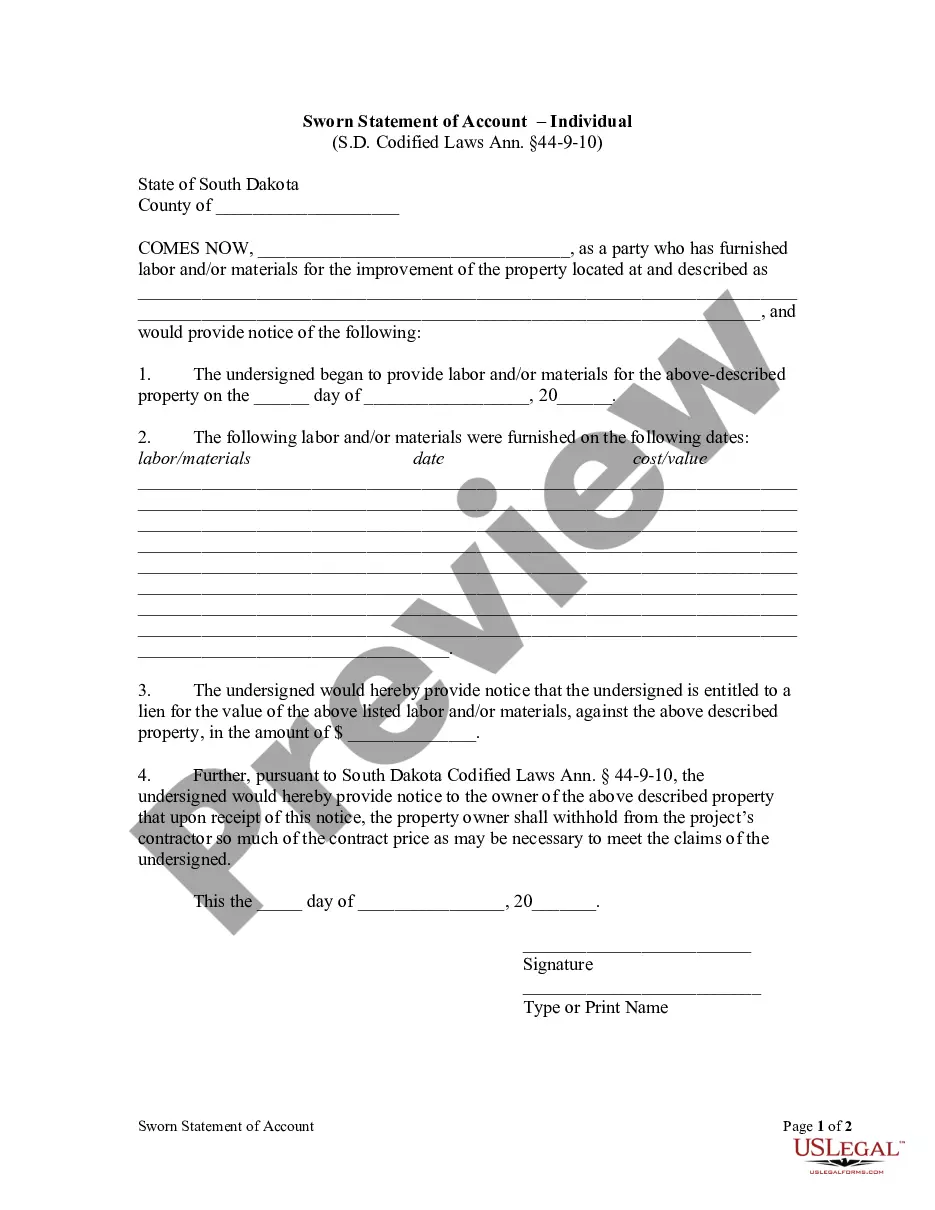

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Hillsborough Assignment of Overriding Royalty Interest (No Proportionate Reduction).

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!