Nassau, New York, is a county located in the state of New York, United States. It is part of the Long Island region and is known for its diverse communities, vibrant culture, and beautiful landscapes. Within this county, the concept of "Assignment of Overriding Royalty Interest (No Proportionate Reduction)" plays a significant role in the oil and gas industry. Assignment of Overriding Royalty Interest (No Proportionate Reduction) is a legal agreement that allows an individual or entity to transfer their interest in the profits generated from oil and gas operations to another party, without reducing their proportionate share. In other words, it ensures that the assignee receives a fixed percentage or predetermined share of the revenue without any reduction due to other stakeholders. This type of assignment is particularly relevant in Nassau, New York, due to its rich history in the oil and gas sector. The county is known for its vast reserves of natural resources, making it an attractive option for companies and individuals seeking investment opportunities in the energy industry. Within the context of Nassau, New York, there are various types of Assignment of Overriding Royalty Interest (No Proportionate Reduction) agreements. These may include: 1. Individual Assignment: This involves an individual assigning their overriding royalty interest to another party or entity. It could be a landowner selling their interest to an oil and gas company, for example. 2. Corporate Assignment: In this scenario, a corporation transfers its overriding royalty interest to another business entity. This type of assignment is common when companies merge or consolidate their assets. 3. Partial Assignment: Sometimes, an overriding royalty interest may only be partially assigned, allowing multiple parties to benefit from the royalties generated by oil and gas operations in Nassau, New York. 4. Voluntary Assignment: This occurs when the assignment of overriding royalty interest is done willingly by the assignor, without any contractual obligations or external pressure. 5. Assignment with Consideration: In some cases, an overriding royalty interest may be assigned in exchange for a financial consideration, such as a lump sum payment or annual royalties. The Assignment of Overriding Royalty Interest (No Proportionate Reduction) in Nassau, New York, is governed by specific laws and regulations to protect the rights of all parties involved. It is essential for individuals or companies interested in such assignments to consult with experienced attorneys or professionals well-versed in the local legal framework to ensure compliance and maximize their benefits.

Nassau New York Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Nassau New York Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

Drafting papers for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Nassau Assignment of Overriding Royalty Interest (No Proportionate Reduction) without expert assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Nassau Assignment of Overriding Royalty Interest (No Proportionate Reduction) on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, follow the step-by-step instruction below to get the Nassau Assignment of Overriding Royalty Interest (No Proportionate Reduction):

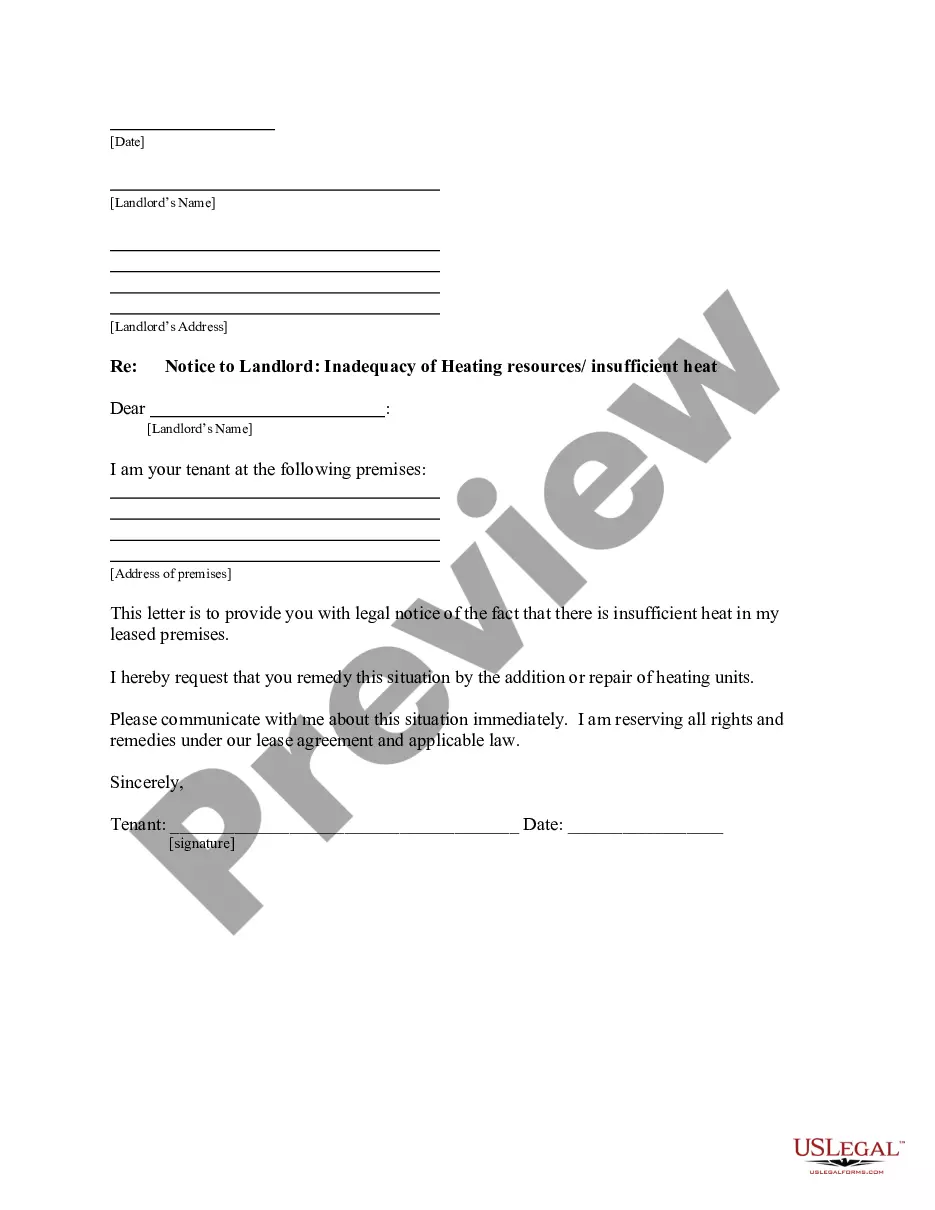

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that fits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!