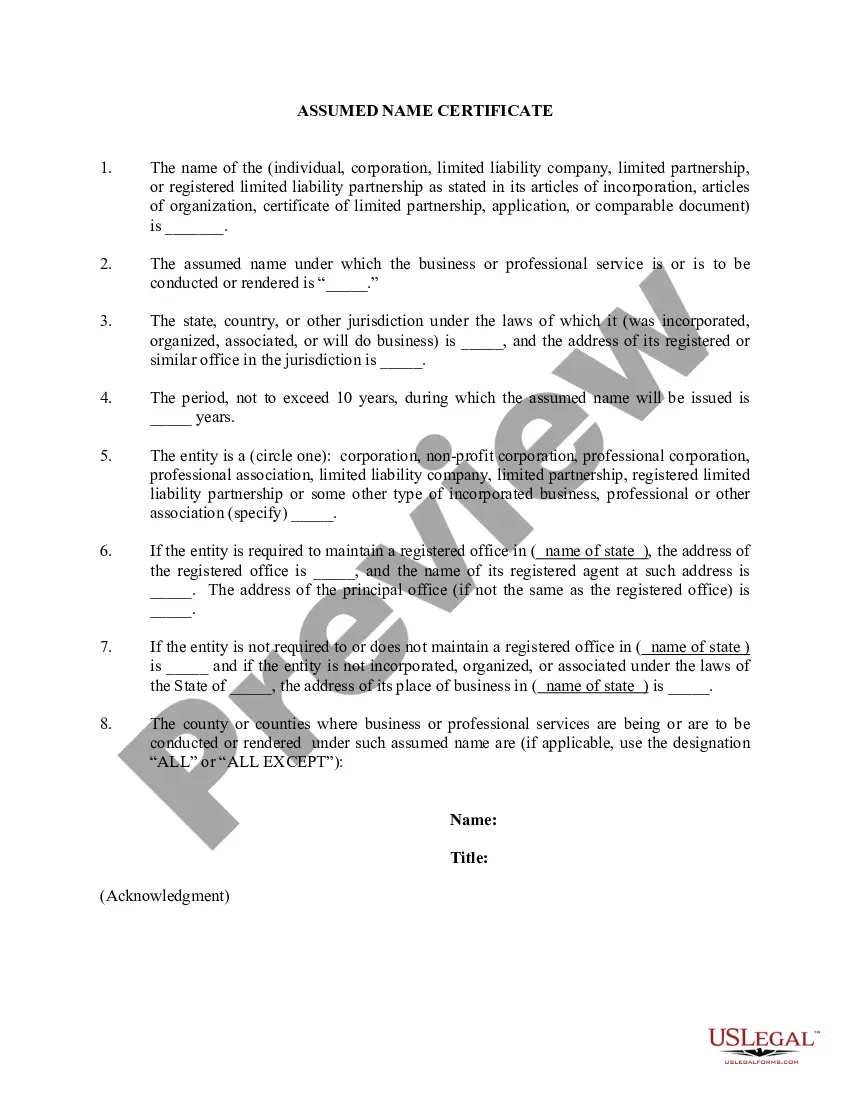

Harris Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) is a legal agreement that grants certain rights and interests to a party known as the assignee, in relation to oil and gas operations in Harris County, Texas. This type of assignment is specifically applicable to non-producing properties and involves a single lease, while also reserving the right to pool the interests. The assignment of overriding royalty interest refers to the transfer of a portion of the royalty interest from the assignor (current owner) to the assignee. The assignee becomes entitled to receive a percentage of the revenues generated from the production of oil and gas in the specified area covered by the lease. Harris Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) can have different variations and types based on the specific terms and conditions agreed upon by the parties involved. Some notable types include: 1. Fixed Percentage Assignment: In this type, a fixed percentage of the overriding royalty interest is assigned to the assignee, ensuring a stable and predictable income stream regardless of fluctuations in production or prices. 2. Term Assignment: A term assignment restricts the assignee's interest for a specific period, after which the assignor regains full control and ownership of the overriding royalty interest. 3. Limited Assignment: This type of assignment places limits on the assignee's rights, such as only applying to a particular well or defined area within the lease, rather than encompassing the entire lease. 4. Non-Participating Assignment: A non-participating assignment means that the assignee does not have any right to participate in the decision-making process of the operations or access to information regarding the production activities. 5. Carried Interest Assignment: This assignment type implies that the assignee is carried financially by the assignor for a specific period, bearing no responsibility or costs associated with operations until defined conditions are met, and only then begins to receive their assigned overriding royalty interest. In conclusion, the Harris Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) is a comprehensive legal document that defines the transfer of rights and interests related to non-producing oil and gas properties in Harris County, Texas. It can encompass various types, such as fixed percentage, term, limited, non-participating, and carried interest assignments, each offering different benefits and limitations to the assignee.

Harris Texas Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

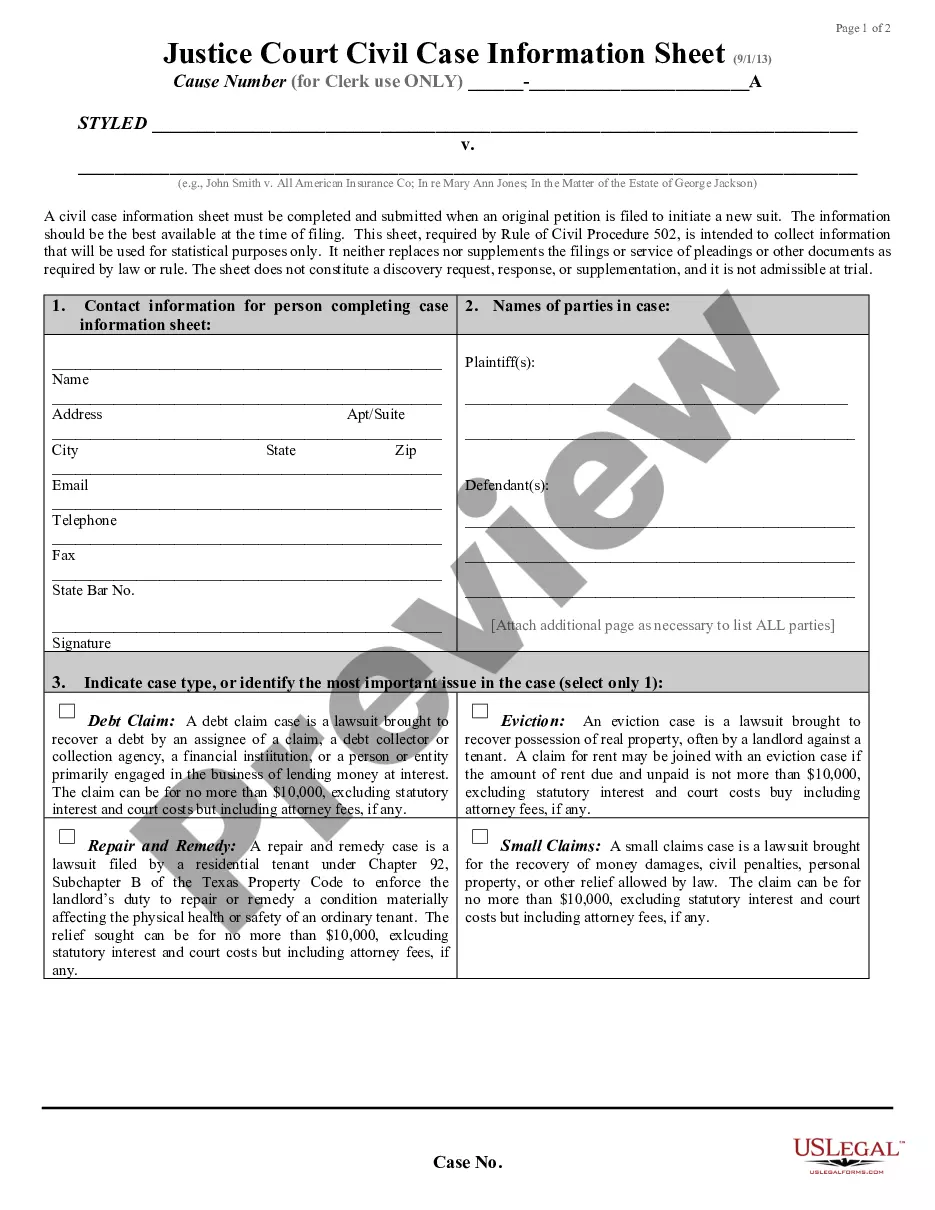

How to fill out Harris Texas Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

Do you need to quickly create a legally-binding Harris Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) or maybe any other document to take control of your own or corporate matters? You can go with two options: contact a legal advisor to draft a valid document for you or create it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you get professionally written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Harris Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) and form packages. We offer templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, carefully verify if the Harris Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) is tailored to your state's or county's regulations.

- In case the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by using the search bar in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Harris Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our services. Additionally, the documents we provide are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

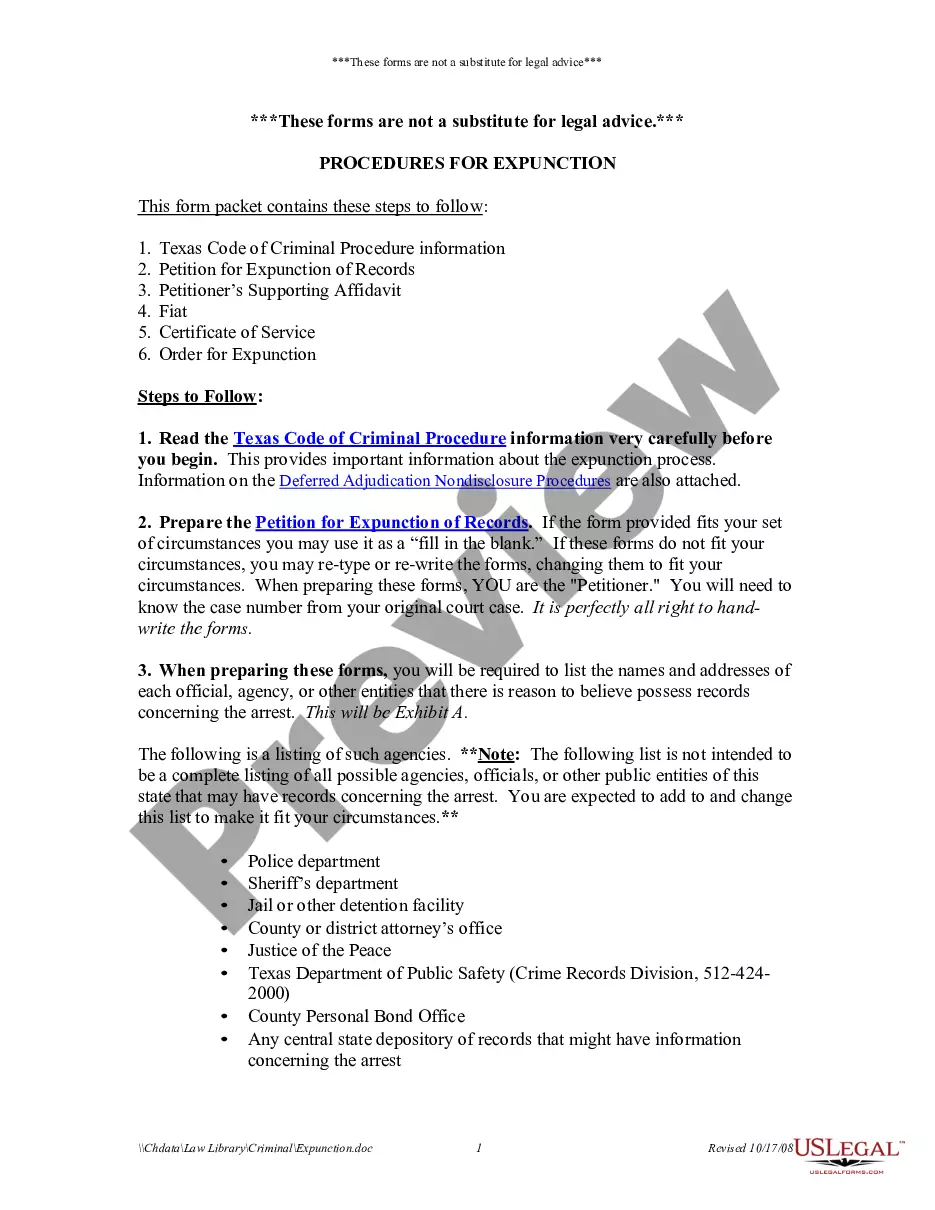

The Supreme Court reversed, holding that the ORRI is a real property interest that violates the Rule, but must be reformed, if possible, pursuant to section 5.043, and remanded for consideration of whether the ORRI in new leases can be reformed so as to not run afoul of the Rule.

The Bankruptcy Code defines a production payment as a type of term overriding royalty or an interest in liquid or gaseous hydrocarbons in place or to be produced from particular real property that entitles the owner thereof to a share of production, or the value thereof, for a term limited by time, quantity, or

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

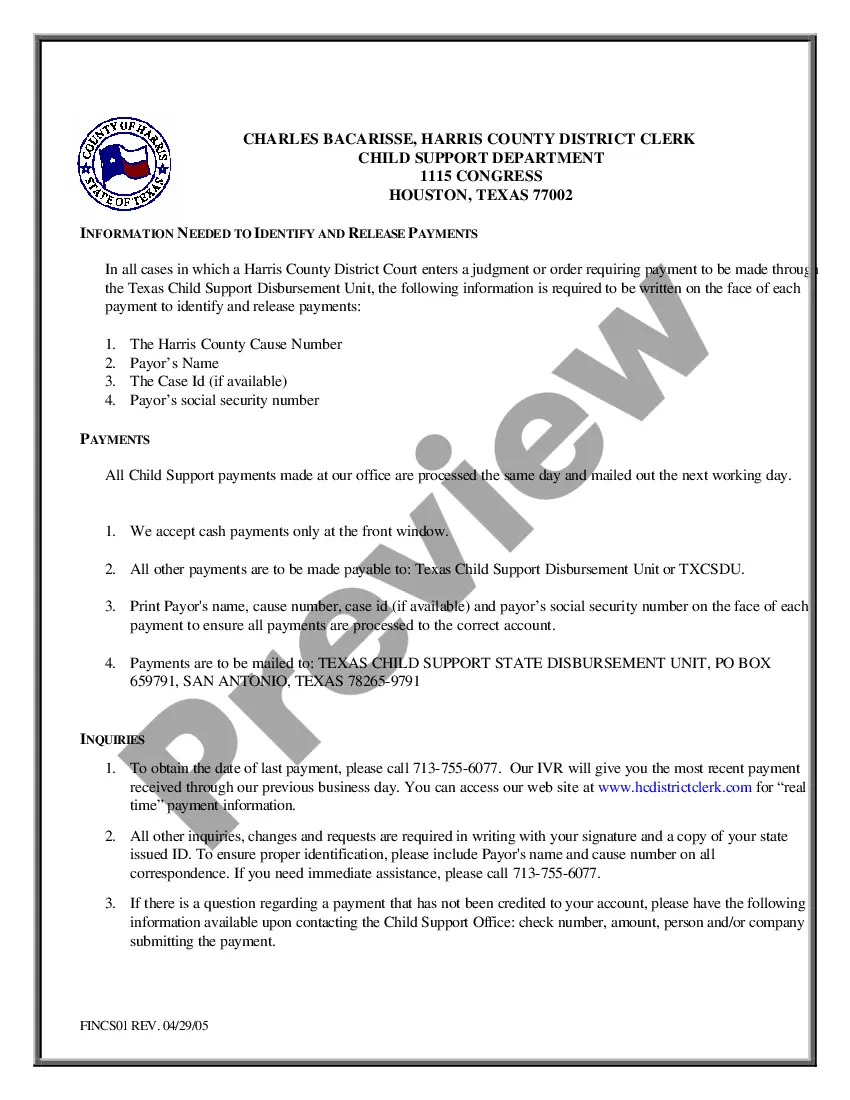

Under Texas law, if the mineral rights are separate property, then the bonus payments and royalty payments are separate property. If the mineral rights are community property, then the bonus money and royalties are community property.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.