Santa Clara, California Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) is a legal contract that assigns a portion of the royalty interest in an oil or gas lease to a third party. This type of agreement typically applies to non-producing leases in Santa Clara, California, where the lessee has acquired the right to develop and extract natural resources within a specific area. In this particular assignment, the overriding royalty interest refers to a percentage of the revenue generated from the production and sale of oil or gas from the specified lease. It is an interest that "overrides" the standard royalty interest paid to the mineral rights' owner. The assignment of the overriding royalty interest is granted to a party other than the original lessee, providing an opportunity for investment or speculation in potentially lucrative oil and gas reserves. The Santa Clara, California Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) also reserves the right to pool the leased area with adjacent properties. Pooling allows multiple leases to be combined into one production unit, maximizing efficiency in extraction and minimizing costs. By reserving the right to pool, the original lessee retains the flexibility to consolidate operations and streamline the development process, which can lead to increased overall profitability. Keywords: Santa Clara, California, assignment, overriding royalty interest, non-producing lease, single lease, reserves right to pool, oil, gas, natural resources, legal contract, revenue, mineral rights, production, investment, speculation, pooling, adjacent properties, production unit, efficiency, extraction, profitability.

Santa Clara California Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

How to fill out Santa Clara California Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

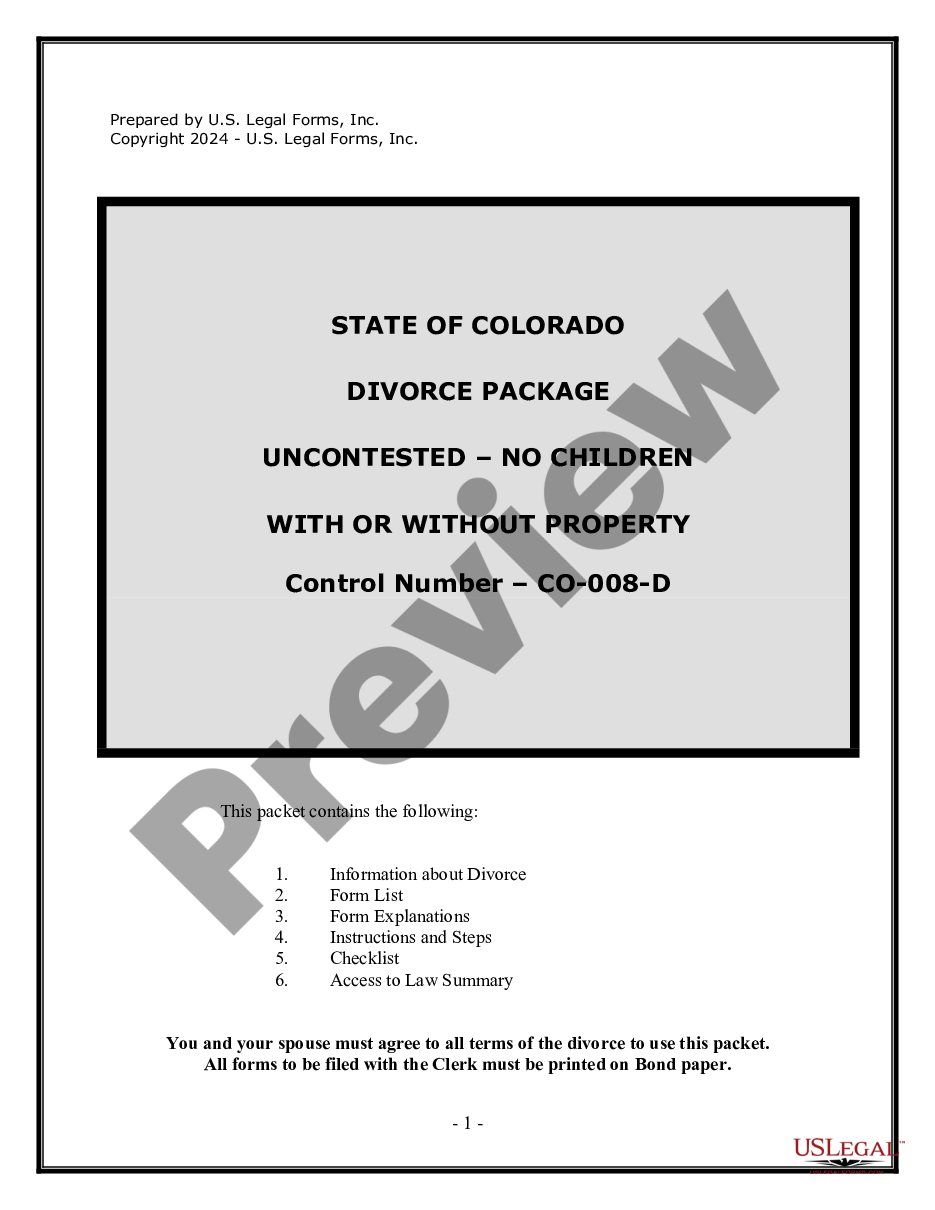

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Santa Clara Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool), with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information resources and guides on the website to make any tasks related to document completion simple.

Here's how to purchase and download Santa Clara Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool).

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Examine the related document templates or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Santa Clara Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool).

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Santa Clara Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool), log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you need to cope with an extremely challenging situation, we recommend using the services of a lawyer to examine your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-specific documents with ease!

Form popularity

FAQ

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.

Royalty Interest an ownership in production that bears no cost in production. Royalty interest owners receive their share of production revenue before the working interest owners. Working Interest an ownership in a well that bears 100% of the cost of production.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

Overriding Royalty Interest (ORRI) A royalty in excess of the royalty provided in the Oil & Gas Lease. Usually, an override is added during an intervening assignment. ORRIs are created out of the working interest in a property and do not affect mineral owners.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.