Allegheny Pennsylvania Assignment of Promissory Note & Liens is a legal document used in real estate transactions to transfer the rights and obligations of a promissory note from one party to another within Allegheny County, Pennsylvania. This document, also known as a Mortgage Assignment or Note Assignment, plays a crucial role in mortgage financing and ensures the smooth transfer of loan ownership. In this Assignment, the original lender (assignor) assigns their rights and interest in the promissory note to another party (assignee). By doing so, the assignee becomes the new owner of the promissory note and assumes the responsibility of collecting payments and enforcing the terms of the loan. It is essential to mention that the Assignment of Promissory Note & Liens focuses specifically on promissory notes associated with real estate transactions. Aside from the Assignment of Promissory Note, the concept of liens is also significant. A lien represents a legal claim or encumbrance placed on a property to secure the payment of debts or obligations, typically related to mortgages or unpaid taxes. In the context of Pittsburgh, Pennsylvania's Allegheny County, the Assignment of Promissory Note & Liens involves the transfer of both the promissory note and any associated liens to the assignee. There are a few different types of Allegheny Pennsylvania Assignment of Promissory Note & Liens, based on the specific circumstances of the transaction: 1. Full Assignment: This type of Assignment transfers the complete ownership of the promissory note, including both the rights and the obligations, to the assignee. The assignee assumes all responsibilities associated with the promissory note and any related liens. 2. Partial Assignment: In some cases, only a portion of the promissory note is assigned to the new party. This type of Assignment could be done when the assignor wants to transfer a part of the debt to the assignee, usually with a corresponding reduction in the loan amount. 3. Assignment with Recourse: In this type of Assignment, the assignor remains partially liable for the repayment of the promissory note even after transferring the ownership to the assignee. This option provides an additional layer of security for the assignee by allowing them to seek recourse from the assignor if the borrower defaults on the loan. 4. Collateral Assignment: A collateral Assignment involves assigning the rights to the security or collateral provided by the borrower to secure the promissory note. This type of Assignment grants the assignee the ability to foreclose on the property in case of default. In conclusion, the Allegheny Pennsylvania Assignment of Promissory Note & Liens serves as a vital legal instrument in real estate transactions within Allegheny County, Pennsylvania. It facilitates the transfer of promissory note ownership and associated liens from the original lender to the assignee while ensuring the seamless continuity of mortgage financing.

Allegheny Pennsylvania Assignment of Promissory Note & Liens

Description

How to fill out Allegheny Pennsylvania Assignment Of Promissory Note & Liens?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Allegheny Assignment of Promissory Note & Liens, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains available in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Allegheny Assignment of Promissory Note & Liens from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Allegheny Assignment of Promissory Note & Liens:

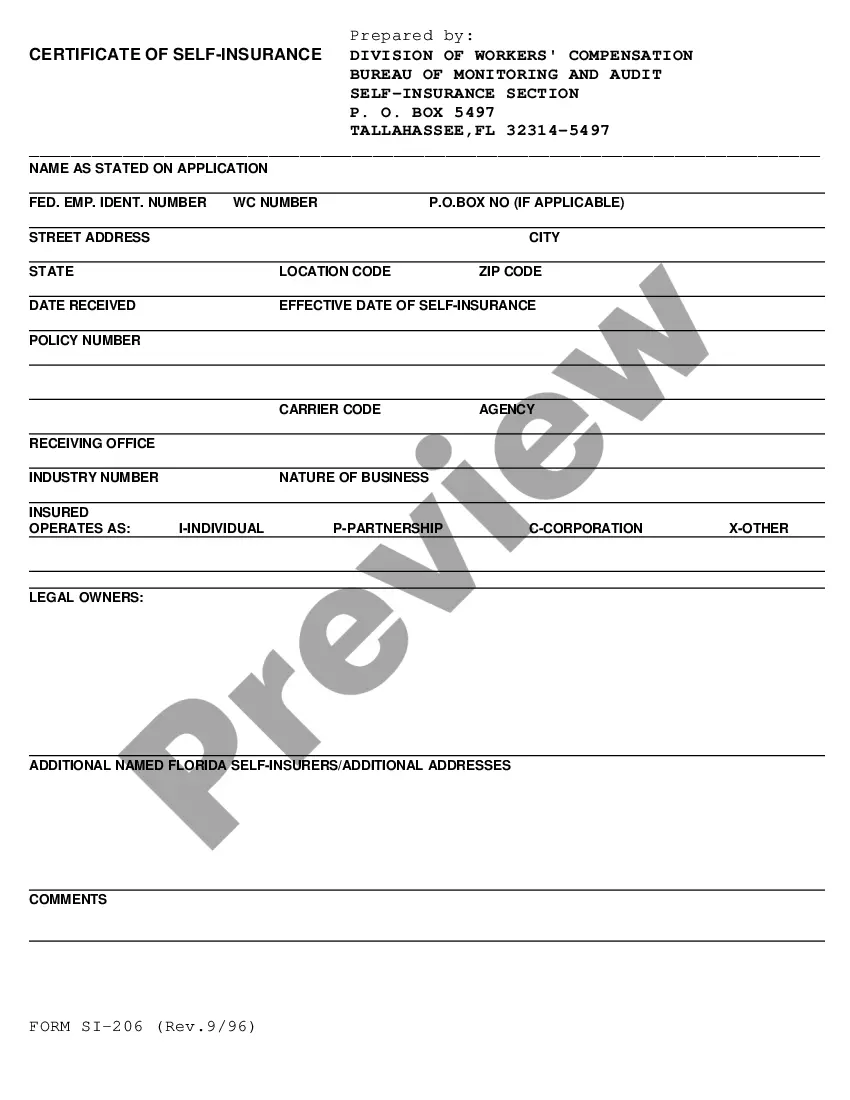

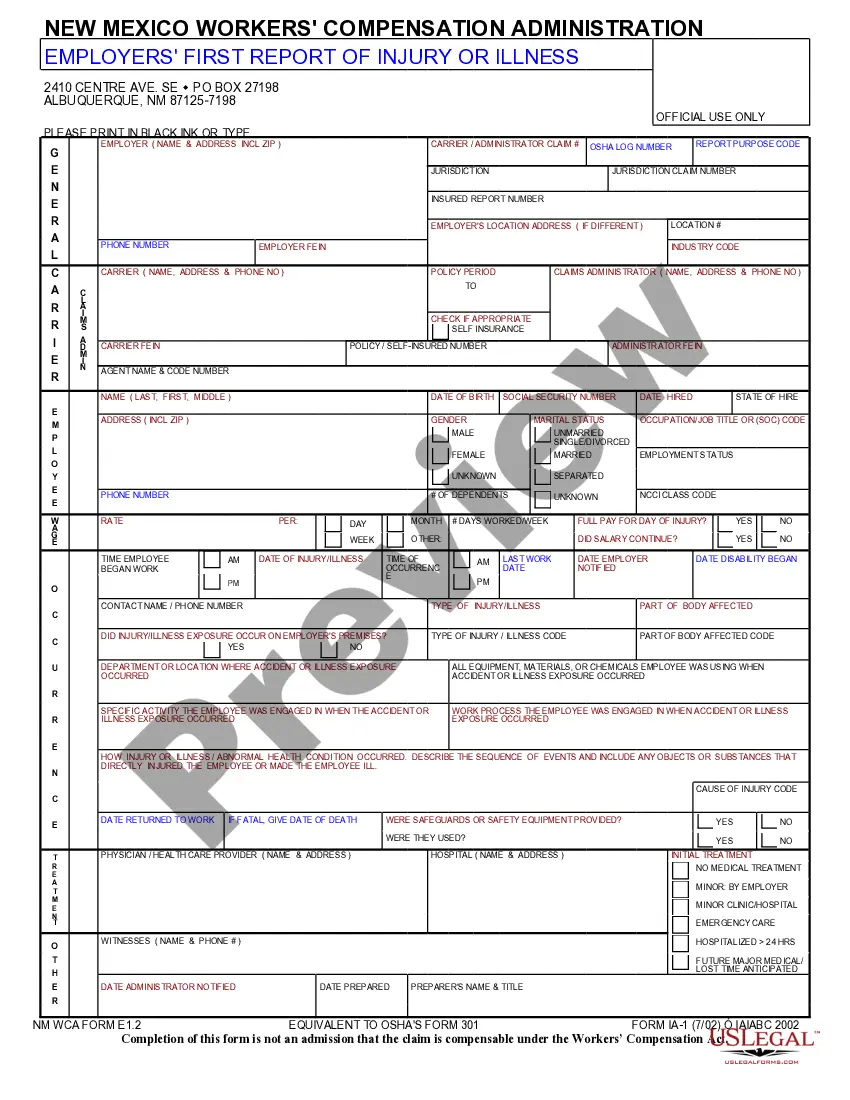

- Take a look at the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A promissory note can be transferred to a revocable living trust by assignment. An assignment is accomplished by the payee signing over the note to the trustee or trustees of the revocable living trust. The assignment should be in writing and a copy of the promissory note should be attached.

To transfer a promissory note, it must be negotiable and/or have a provision that allows and explains transfer. In addition, it must comply with state statutes governing promissory notes and assignments thereof. Create a Promissory Note Transfer Agreement.

There is no legal requirement for most promissory notes to be witnessed or notarized in Pennsylvania (promissory notes related to real estate may need to be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Promissory Notes. A promissory note can be transferred to a revocable living trust by assignment. An assignment is accomplished by the payee signing over the note to the trustee or trustees of the revocable living trust. The assignment should be in writing and a copy of the promissory note should be attached.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

This Promissory Note is transferable and assignable by the Lender to any person or entity previously approved by the Company. The Company agrees to issue replacement Notes to facilitate such approved transfers and assignments.

Send a Keep note to another app On your Android phone or tablet, open the Keep app . Tap a note you want to send. In the bottom right, tap Action . Tap Send . Pick an option: To copy the note as a Google Doc, tap Copy to Google Docs. Otherwise, tap Send via other apps. Pick an app to copy your note's contents into.

The borrower is required to sign the note, but the lender may choose not to sign it. A promissory note is a legally binding note that is often used between parties who know each other personally, and it is totally customizable.

To transfer a promissory note, it must be negotiable and/or have a provision that allows and explains transfer. In addition, it must comply with state statutes governing promissory notes and assignments thereof. Create a Promissory Note Transfer Agreement.