Maricopa, Arizona Assignment of Promissory Note & Liens: Explained In Maricopa, Arizona, an Assignment of Promissory Note & Liens refers to a legal document that transfers the rights and interests of a promissory note and associated liens from one party to another. This transaction typically occurs when the original holder of the note (referred to as the assignor) wants to transfer their rights to another person or entity (known as the assignee). A promissory note is a written agreement that serves as evidence of a debt. It outlines the terms and conditions of the loan, including the principal amount, repayment schedule, interest rate, and any penalties or rights in case of default. The assignment of a promissory note allows the assignee to step into the shoes of the assignor and become the new holder of the debt obligation. Along with the promissory note, a lien may also be assigned. A lien is a legal claim against a property that serves as collateral for the loan. By assigning a lien, the assignor transfers their right to enforce the lien and potentially foreclose on the property to the assignee. There are several types of Maricopa, Arizona Assignment of Promissory Note & Liens, some of which include: 1. Absolute Assignment: This type of assignment involves a complete transfer of the promissory note and all associated liens. The assignor relinquishes all their rights and interests to the assignee, who assumes full responsibility for collecting payments and enforcing the liens. 2. Collateral Assignment: In a collateral assignment, the assignor transfers only a portion of the rights and interests in the promissory note. This allows the assignee to collect certain payments or enforce specific liens. The assignor retains the remaining rights and interests. 3. Partial Assignment: Unlike a collateral assignment, a partial assignment transfers a limited portion of the promissory note, such as a specific amount or specific installments. The assignee becomes entitled only to the assigned portion, while the assignor retains rights to the remaining portion. 4. Silent Assignment: A silent assignment occurs when the assignment is not explicitly stated or disclosed to the borrower or other relevant parties. The assignee essentially becomes an undisclosed beneficiary, collecting payments without the knowledge of the borrower. In Maricopa, Arizona, the transfer of a promissory note and liens through an assignment requires proper documentation and legal procedures to ensure validity and enforceability. It is advisable to consult with a qualified attorney or legal professional specializing in real estate and finance to ensure compliance with local laws and regulations. Overall, the Assignment of Promissory Note & Liens provides the mechanism for transferring debt obligations and associated liens from one party to another in Maricopa, Arizona. It allows for the efficient transfer of financial interests while ensuring the rights of both the assignor and the assignee are protected.

Maricopa Arizona Assignment of Promissory Note & Liens

Description

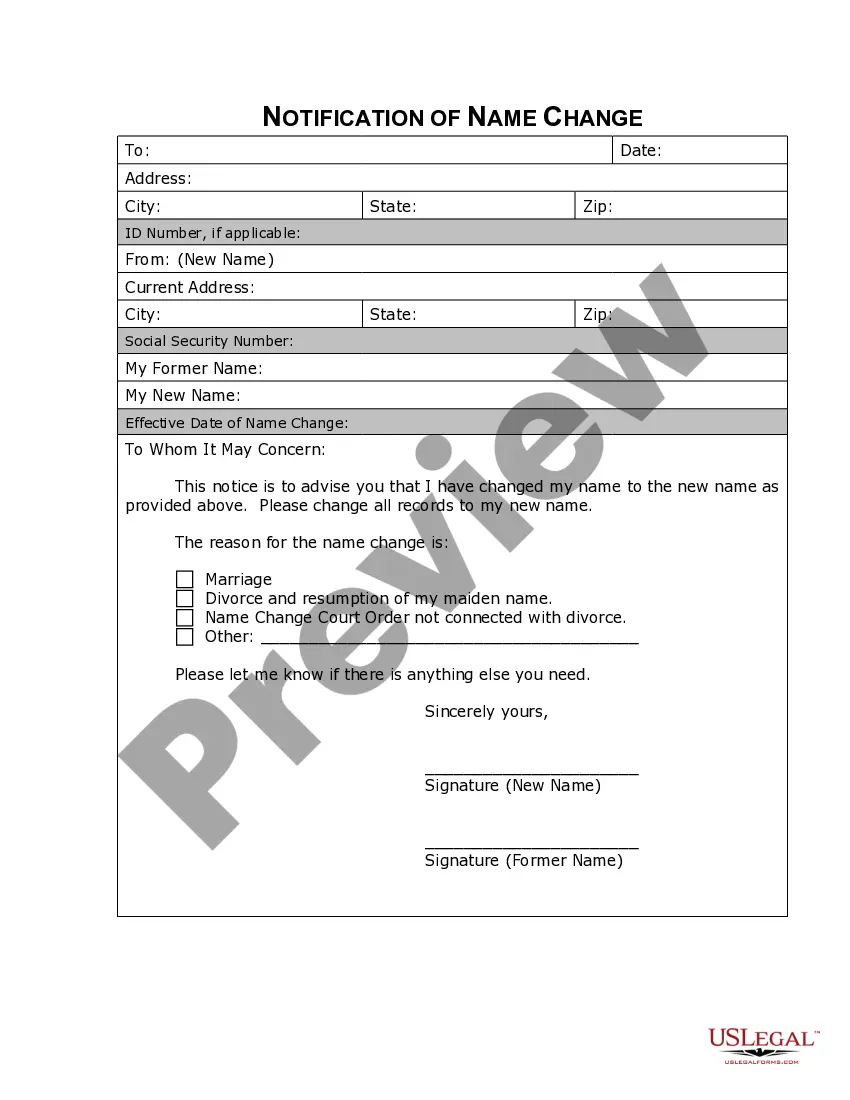

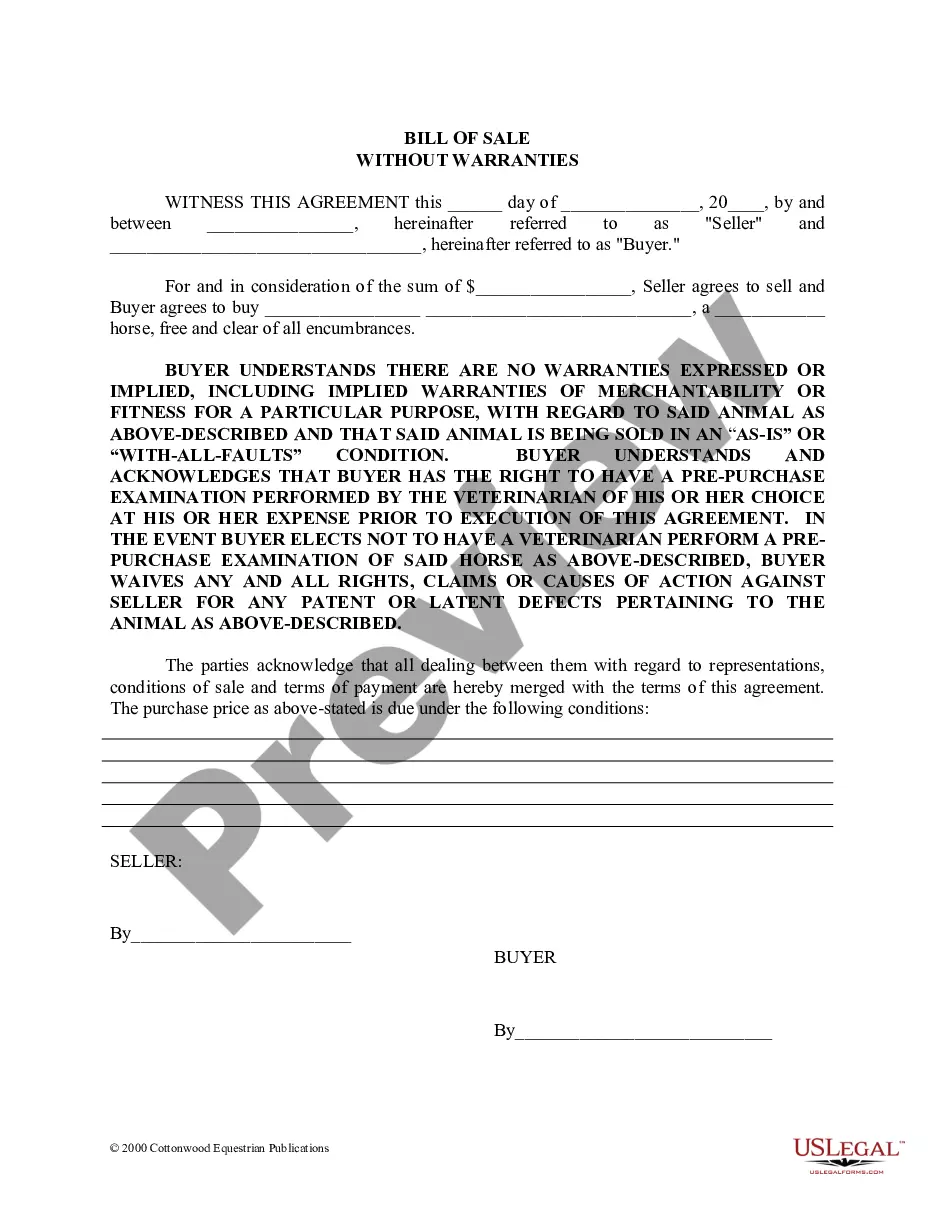

How to fill out Maricopa Arizona Assignment Of Promissory Note & Liens?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the Maricopa Assignment of Promissory Note & Liens.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Maricopa Assignment of Promissory Note & Liens will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Maricopa Assignment of Promissory Note & Liens:

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Maricopa Assignment of Promissory Note & Liens on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!