Philadelphia Pennsylvania Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Philadelphia Pennsylvania Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any personal or business objective utilized in your region, including the Philadelphia Deed (Including Acceptance of Community Property with Right of Survivorship).

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Philadelphia Deed (Including Acceptance of Community Property with Right of Survivorship) will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Philadelphia Deed (Including Acceptance of Community Property with Right of Survivorship):

- Make sure you have opened the right page with your localised form.

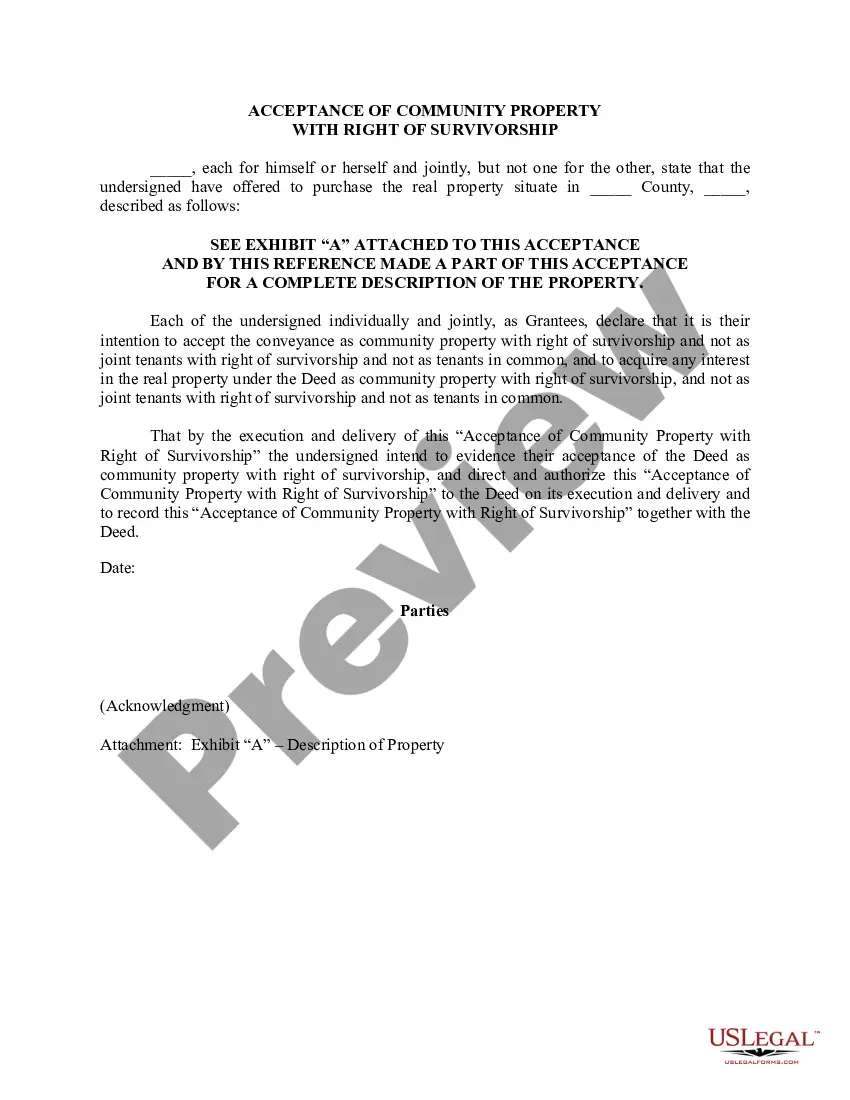

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Philadelphia Deed (Including Acceptance of Community Property with Right of Survivorship) on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Under the right of survivorship, each tenant possesses an undivided interest in the whole estate. When one tenant dies, the tenant's interest disappears and the others tenants' shares increase proportionally and obtain the rights to the entire estate.

In these stateswhich include Texas, California, Washington, and Arizonaspouses can hold title as community property with right of survivorship. This form of marital ownership allows the property to pass to the surviving spouse on the death of the first spouse to die.

The right of survivorship is a right granted to joint property owners that ensures the transfer of one owner's stake to the remaining property owner(s) in the case of his or her death.

As joint tenants, each person owns the whole of the property with the other. If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property.

The right of survivorship is an attribute or element of joint ownership. When jointly owned property includes a right of survivorship, the surviving owner automatically absorbs a dying owner's share of the property.

Community property with right of survivorship is a legal distinction that allows two spouses to equally share assets through marriage as well as pass on assets to the other spouse upon death without going through probate.

Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together.

The main difference between joint tenants vs community property with right of survivorship lies in how the property is taxed after the death of a spouse. In joint tenant agreements, the proceeds from the sale of a property (after the death of a spouse) would be subject to the capital gains tax.

If one of the co-owners dies, his share in the property does not pass to the other co-owners but to the person named in the will of the deceased. The inheritor becomes a tenant-in-common with the other surviving co-owners. This is usually when siblings pool money to buy property.

In Pennsylvania, property owned with rights of survivorship is called joint tenancy with rights of survivorship. In Pennsylvania, when the only joint owners are husband and wife, this type of ownership is known as tenancy by the entireties.