Chicago Illinois Employee Agreement Incentive Compensation and Stock Bonus is a legally binding contract that outlines the terms and conditions regarding financial incentives offered by employers to employees in Chicago, Illinois. This agreement serves as a means to motivate and reward employees for their exceptional performance, loyalty, and commitment towards the growth and success of the company. Keywords: Chicago Illinois, employee agreement, incentive compensation, stock bonus, legal contract, financial incentives, motivate, reward, exceptional performance, loyalty, commitment, company growth, success. There are several types of Chicago Illinois Employee Agreement Incentive Compensation and Stock Bonus, which include: 1. Performance-Based Bonus: This type of incentive compensation is directly linked to an employee's individual or team performance. It may be based on achieving certain sales targets, meeting project deadlines, or exceeding performance metrics. The bonus amount can vary depending on predefined criteria and can be given as a lump sum payment or a percentage of the employee's base salary. 2. Profit-Sharing Plan: Under this type of compensation, eligible employees receive a share of the company's profits. The amount is usually determined based on a predetermined formula that considers factors such as the employee's salary, length of service, and contribution to the company's success. The profit-sharing bonus is generally distributed annually or quarterly. 3. Stock Options: Employees may be granted stock options as part of their incentive compensation package. Stock options provide the right to purchase company stocks at a predetermined price within a specified timeframe. This benefit allows employees to benefit from the potential appreciation of company stock value. 4. Restricted Stock Units (RSS): RSS are another form of equity-based compensation granted to employees. With RSS, employees receive a specific number of shares or units, often subject to a vesting period. Once the vesting conditions are met, the employees gain ownership of the shares, allowing them to benefit from any price appreciation. 5. Performance Shares: Similar to stock options and RSS, performance shares provide employees with an opportunity to acquire company shares based on their performance against specific targets or goals. The number of shares earned is usually tied to the level of achievement and the timeframe specified in the agreement. In summary, the Chicago Illinois Employee Agreement Incentive Compensation and Stock Bonus serves as a comprehensive contract that governs the various types of financial incentives provided to employees in the region. By incorporating performance-based bonuses, profit-sharing plans, stock options, RSS, and performance shares, employers aim to attract, motivate, and retain talented individuals while aligning their interests with the company's success.

Chicago Illinois Employee Agreement Incentive Compensation and Stock Bonus

Description

How to fill out Chicago Illinois Employee Agreement Incentive Compensation And Stock Bonus?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Chicago Employee Agreement Incentive Compensation and Stock Bonus, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how you can locate and download Chicago Employee Agreement Incentive Compensation and Stock Bonus.

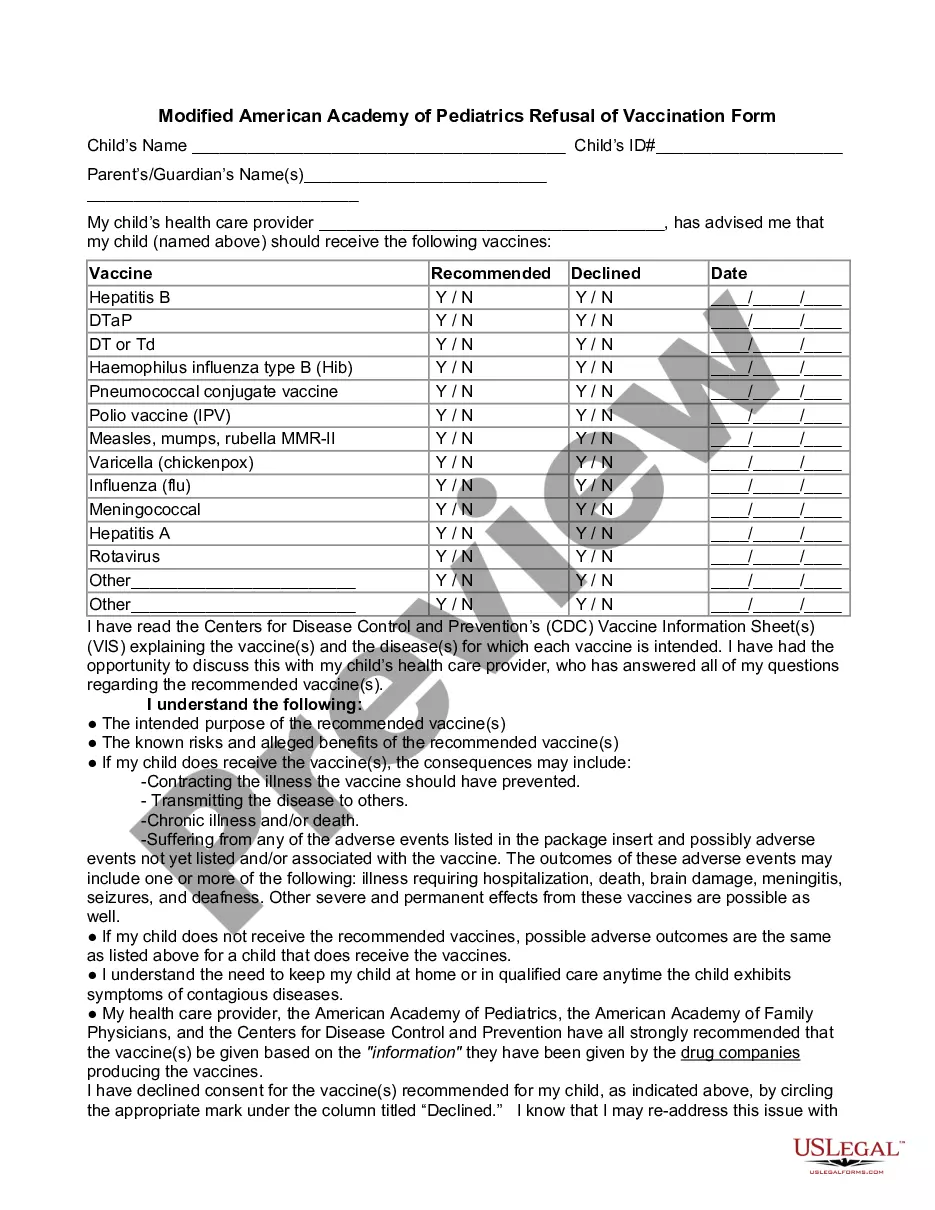

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some records.

- Examine the similar forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and buy Chicago Employee Agreement Incentive Compensation and Stock Bonus.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Chicago Employee Agreement Incentive Compensation and Stock Bonus, log in to your account, and download it. Of course, our website can’t replace a lawyer completely. If you have to deal with an extremely challenging case, we recommend using the services of an attorney to review your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork with ease!