Dallas Texas Employee Agreement Incentive Compensation and Stock Bonus refers to a legally binding agreement between an employer and employee in Dallas Texas, regarding the incentives, compensation, and stock bonuses offered to the employee as part of their employment package. This agreement outlines the specific terms and conditions, including the types of incentives, compensation plans, and stock bonus structures. In Dallas Texas, various types of Employee Agreement Incentive Compensation and Stock Bonus exist to cater to the diverse needs and goals of both employers and employees. Some different types of agreements include: 1. Performance-based Incentive Compensation: This type of agreement aligns employee compensation with their performance and achievements. It may involve strategies like sales commissions, profit-sharing, or monetary bonuses tied to individual or team performance goals. 2. Long-term Incentive Compensation: This agreement focuses on rewarding employees for their long-term commitment and contributions to the company. It typically includes stock options, restricted stock units (RSS), or employee stock purchase plans (ESPN) that provide employees with financial incentives tied to the company's growth. 3. Bonus Agreements: These agreements specify additional bonuses that employees may receive based on specific criteria established by the employer. Bonuses can be performance-related, discretionary, or tied to the achievement of specific milestones or objectives. 4. Stock Bonus Plans: These plans grant eligible employees ownership in the company through the distribution or allocation of company stocks or stock options. Stock bonuses incentivize employees by allowing them to participate in the company's success and future growth. Dallas Texas Employee Agreement Incentive Compensation and Stock Bonus agreements are designed to motivate employees, encourage loyalty, and attract top talent. These agreements typically outline the eligibility criteria, vesting schedules, performance metrics, and any specific terms and conditions related to the incentives and stock bonuses. It is crucial for both employers and employees to carefully review and negotiate each clause of the agreement to ensure clarity and fairness. Seeking legal advice is recommended to comply with relevant employment laws and regulations in Dallas Texas.

Dallas Texas Employee Agreement Incentive Compensation and Stock Bonus

Description

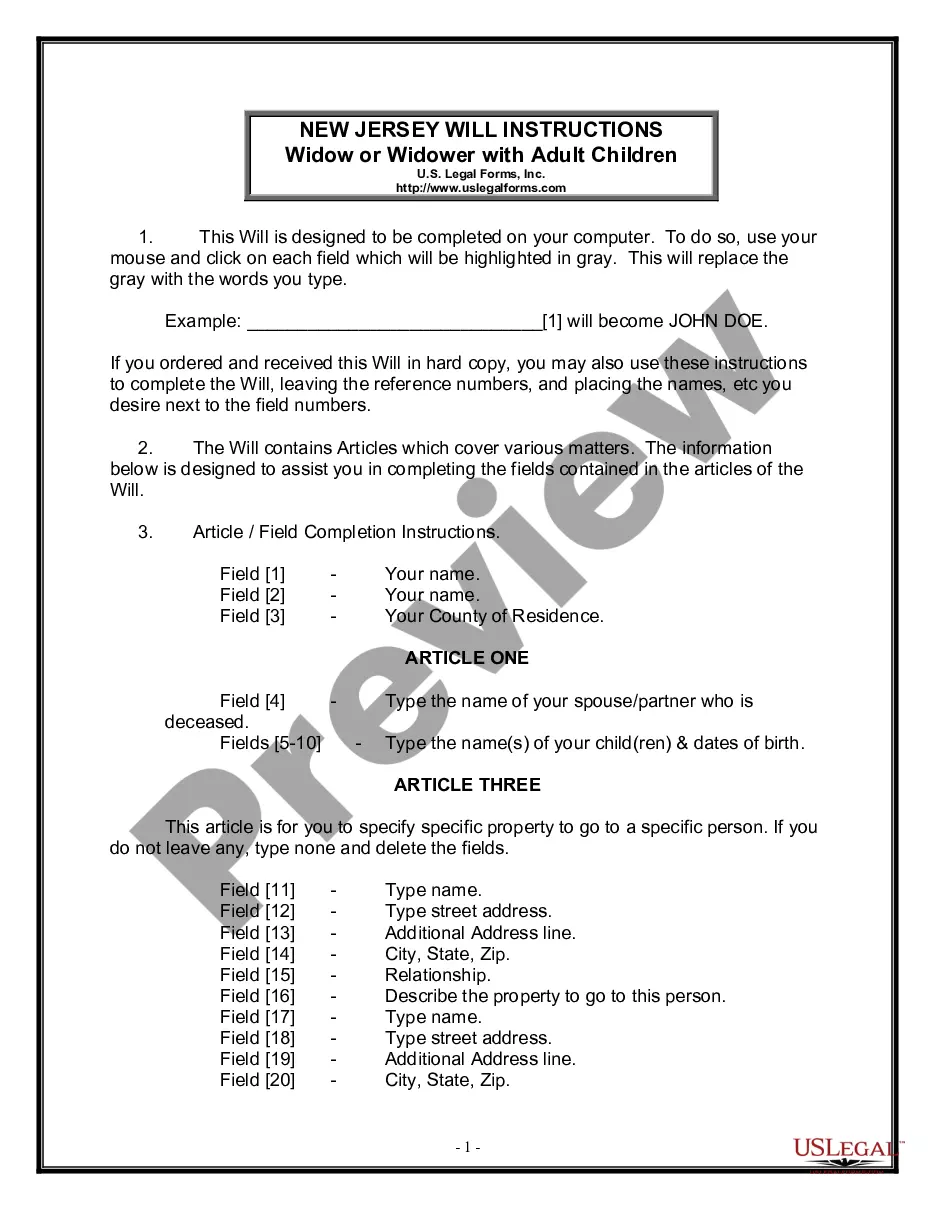

How to fill out Dallas Texas Employee Agreement Incentive Compensation And Stock Bonus?

Draftwing documents, like Dallas Employee Agreement Incentive Compensation and Stock Bonus, to manage your legal matters is a difficult and time-consumming task. Many situations require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for different scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Dallas Employee Agreement Incentive Compensation and Stock Bonus form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Dallas Employee Agreement Incentive Compensation and Stock Bonus:

- Ensure that your template is compliant with your state/county since the regulations for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Dallas Employee Agreement Incentive Compensation and Stock Bonus isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start utilizing our service and get the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Financial advisers, bankers and others within the financial industry receiving discretionary bonuses at the end of each year based on their earnings may have a case for discrimination if these are withheld based on disability or due to discrimination in any of the categories of Title VII.

It depends on policy of the company and also includes in appointment letter sometime. some companies announce bonuses after employees appraisal to appreciate good employees or bonus can also be a part of profit of the company which may distributed equally among employees.

If the employee resigns, he or she is entitled to a bonus only if continued employment is not a condition of payment and only if other applicable conditions are satisfied. However, there are different rules for the payment of commissions in such a situation.

If your company offers performance-based bonuses and you recently qualified for one, your employer has an obligation to follow through with their promise to pay you a bonus. If they refuse to do so, you have the right to take action and demand your unpaid wages in the form of a non-discretionary bonus.

A bonus is a payment made in addition to the employee's regular earnings. Under the FLSA, all compensation for hours worked, services rendered, or performance is included in the regular rate of pay.

When reviewing your bonus plan, first consider the purpose for the confidentiality statement. If the intent is to prevent employees from discussing their own bonuses with other employees, then the statement is best removed from the bonus plan entirely.

A bonus payment is additional pay on top of an employee's regular earnings. A bonus payment can be discretionary or nondiscretionary, depending on whether it meets certain criteria. Bosses hand out bonus payments for a variety of reasons, including as a reward for meeting individual or company goals.

It is still up to the employer whether or not he is willing to give such bonus. It is a privilege, not a right, to receive a bonus. An employee cannot demand to his employer to give him a bonus every time he does a great job. It is part of an employee's job to do his best, and deliver satisfactory work.

A normal year-end bonus will vary from position to position, but the average bonus pay in the U.S. is 11% of exempt employees' salaries, 6.8% of nonexempt employees' salaries, and 5.6% of hourly employees' salaries.

For example, your contract might specify a conditional sign-on bonus that must be repaid if you leave the company before 12 months of employment.