Harris Texas Employee Agreement Incentive Compensation and Stock Bonus is a comprehensive program designed to motivate and reward employees of Harris Texas, a prominent company operating in the state of Texas. This employee agreement outlines the terms and conditions related to the compensation and bonuses provided to employees as incentives for their hard work, dedication, and outstanding performance. Under this agreement, employees are eligible for various types of incentive compensation and stock bonuses. These bonuses are structured to align the employees' interests with the overall success of the company, fostering a culture of excellence and stimulating personal and professional growth. The Harris Texas Employee Agreement Incentive Compensation and Stock Bonus encompasses both short-term and long-term rewards. Short-term incentives can include annual performance bonuses, individual or team-based recognition rewards, commission-based incentives, or spot bonuses for exceptional contributions. These monetary rewards serve as immediate acknowledgment of an employee's exceptional performance, driving motivation and enhancing job satisfaction. In addition to short-term incentives, the Harris Texas Employee Agreement also offers employees the opportunity to participate in long-term incentive programs, such as stock bonuses. Stock bonuses are an enticing form of compensation that enables employees to acquire ownership stakes in the company over time. These stock grants are usually subject to vesting periods, incentivizing employees to remain with the company, contributing to its growth and profitability in the long run. The Harris Texas Employee Agreement ensures that the incentive compensation and stock bonus plans are fair, transparent, and based on clear performance metrics. These metrics may vary depending on the employee's role and level within the organization, ensuring a tailored approach to incentivization. The company may consider factors such as individual performance goals, team or department objectives, financial targets, and other key performance indicators when determining the incentive compensation and stock bonus structure. It's important to note that the specific details of the Harris Texas Employee Agreement Incentive Compensation and Stock Bonus may vary depending on the employee's position, department, or seniority within the company. The agreement's terms and conditions are usually provided to employees during the onboarding process or when they become eligible for such compensation and bonus programs. Consequently, it is crucial for employees to carefully review the terms of the agreement to fully understand the benefits, requirements, and limitations associated with the incentive compensation and stock bonus plans provided by Harris Texas. In summary, the Harris Texas Employee Agreement Incentive Compensation and Stock Bonus is a comprehensive program designed to motivate and reward employees for their exceptional performance. It offers various types of incentives, including short-term bonuses and long-term stock grants, which are aligned with the company's success. This agreement provides a clear framework for employees to understand how they can participate in these programs and benefit by contributing to Harris Texas's growth and prosperity.

Harris Texas Employee Agreement Incentive Compensation and Stock Bonus

Description

How to fill out Harris Texas Employee Agreement Incentive Compensation And Stock Bonus?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Harris Employee Agreement Incentive Compensation and Stock Bonus, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Harris Employee Agreement Incentive Compensation and Stock Bonus, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Employee Agreement Incentive Compensation and Stock Bonus:

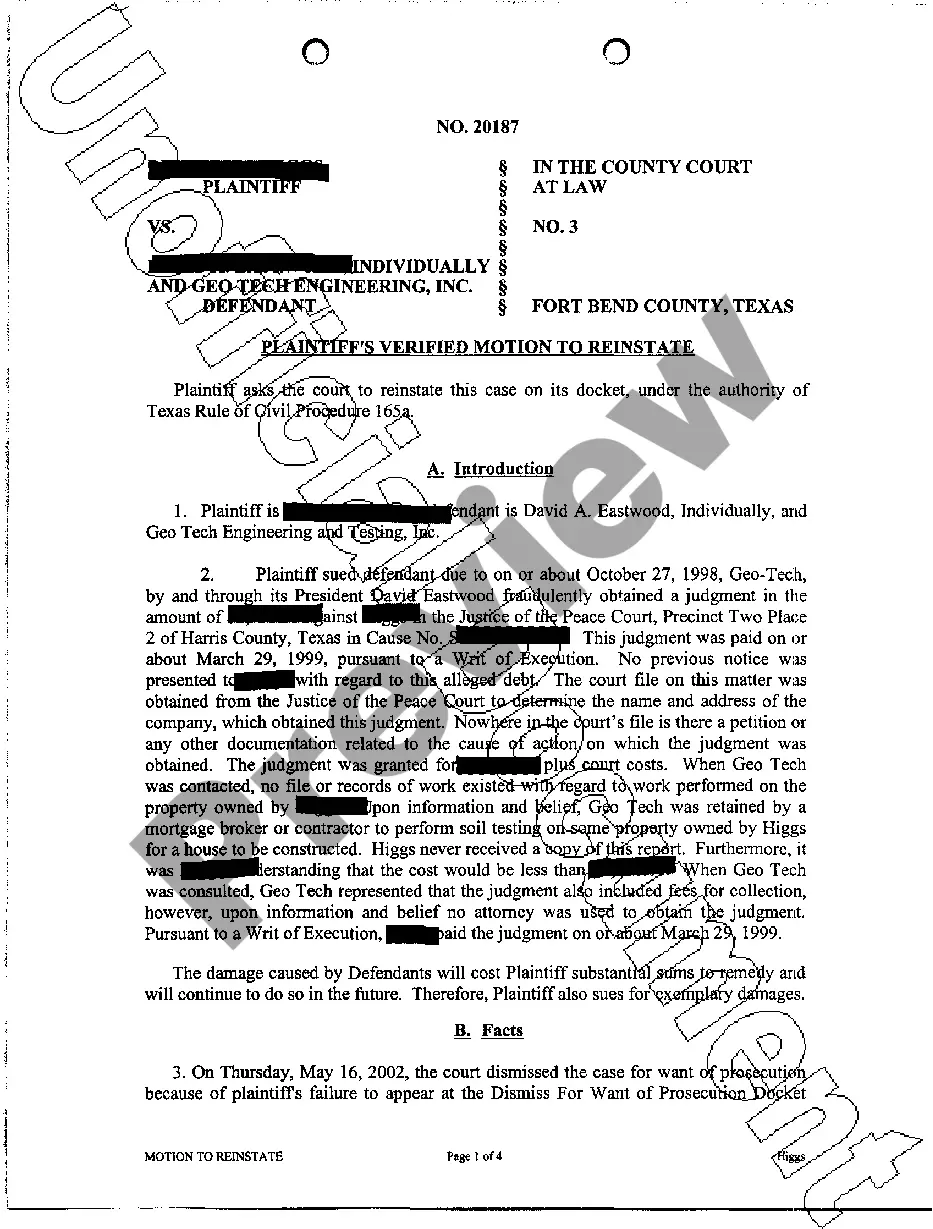

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

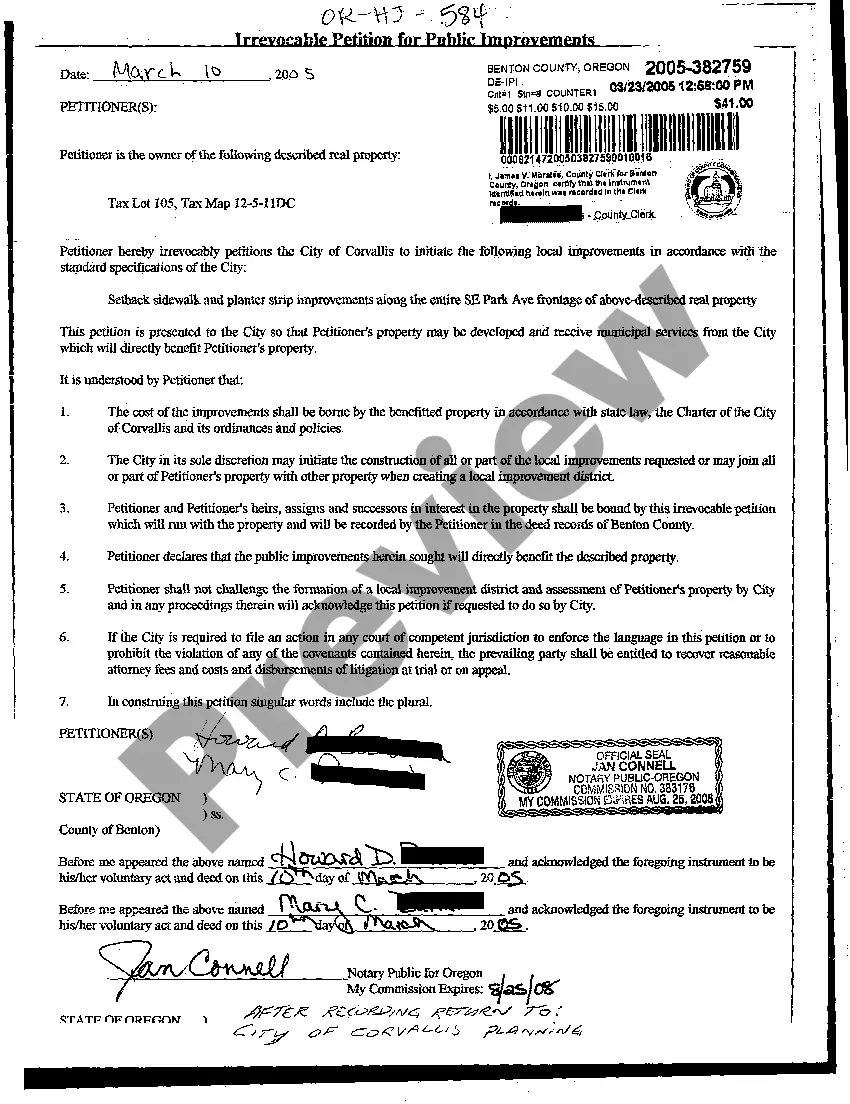

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Harris Employee Agreement Incentive Compensation and Stock Bonus and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!