Phoenix, Arizona Employee Agreement Incentive Compensation and Stock Bonus is an employment contract clause that outlines the additional benefits and rewards offered to employees based in Phoenix, Arizona. This agreement serves as a motivating factor for employees to achieve their performance goals and contribute positively to the company's success. There are various types of Phoenix, Arizona Employee Agreement Incentive Compensation and Stock Bonus that companies can offer based on their specific objectives and strategies. These include: 1. Performance-Based Incentive Compensation: This type of incentive compensation is directly linked to an employee's individual or team performance. It encourages employees to meet or exceed predetermined targets, such as sales goals, customer satisfaction ratings, or project completion milestones. Performance-based compensation can be in the form of a one-time bonus, profit-sharing, or commission. 2. Stock-Based Incentive Compensation: Stock options or restricted stock units (RSS) are commonly used to incentivize employees in Phoenix, Arizona. By offering these equity-based incentives, companies grant employees the right to buy or receive company shares at a future date, usually at a discounted price. The objective is to align the interests of employees with those of the company, as they become partial owners and benefit from the company's success. 3. Sign-On or Retention Bonuses: To attract and retain top talent in Phoenix, Arizona, companies may offer sign-on bonuses to new hires or retention bonuses to existing employees. These one-time payments serve as an additional incentive for individuals to join or remain with the company, and they are usually contingent upon meeting certain employment milestones or staying with the company for a specific period. 4. Profit-Sharing: This type of incentive compensation involves distributing a portion of the company's profits to eligible employees in Phoenix, Arizona. Companies typically set predetermined criteria, such as years of service or job level, to determine an employee's share in the company's profits. Profit-sharing plans can be implemented annually, quarterly, or on a project-specific basis. 5. Performance Stock Units (Plus): Plus are a stock-based compensation plan that employees can earn based on the achievement of specific performance targets. These targets can include financial metrics, operational goals, or strategic objectives. Once earned, employees receive a predetermined number of company shares or cash equivalent. In conclusion, Phoenix, Arizona Employee Agreement Incentive Compensation and Stock Bonus offer employees additional financial rewards and ownership opportunities to drive performance, attract top talent, and retain valuable employees. By customizing these incentives to suit the company's goals and employees' needs, businesses in Phoenix, Arizona can foster a motivated and dedicated workforce while maintaining a competitive edge in the market.

Phoenix Arizona Employee Agreement Incentive Compensation and Stock Bonus

Description

How to fill out Phoenix Arizona Employee Agreement Incentive Compensation And Stock Bonus?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your county, including the Phoenix Employee Agreement Incentive Compensation and Stock Bonus.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Phoenix Employee Agreement Incentive Compensation and Stock Bonus will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Phoenix Employee Agreement Incentive Compensation and Stock Bonus:

- Ensure you have opened the correct page with your localised form.

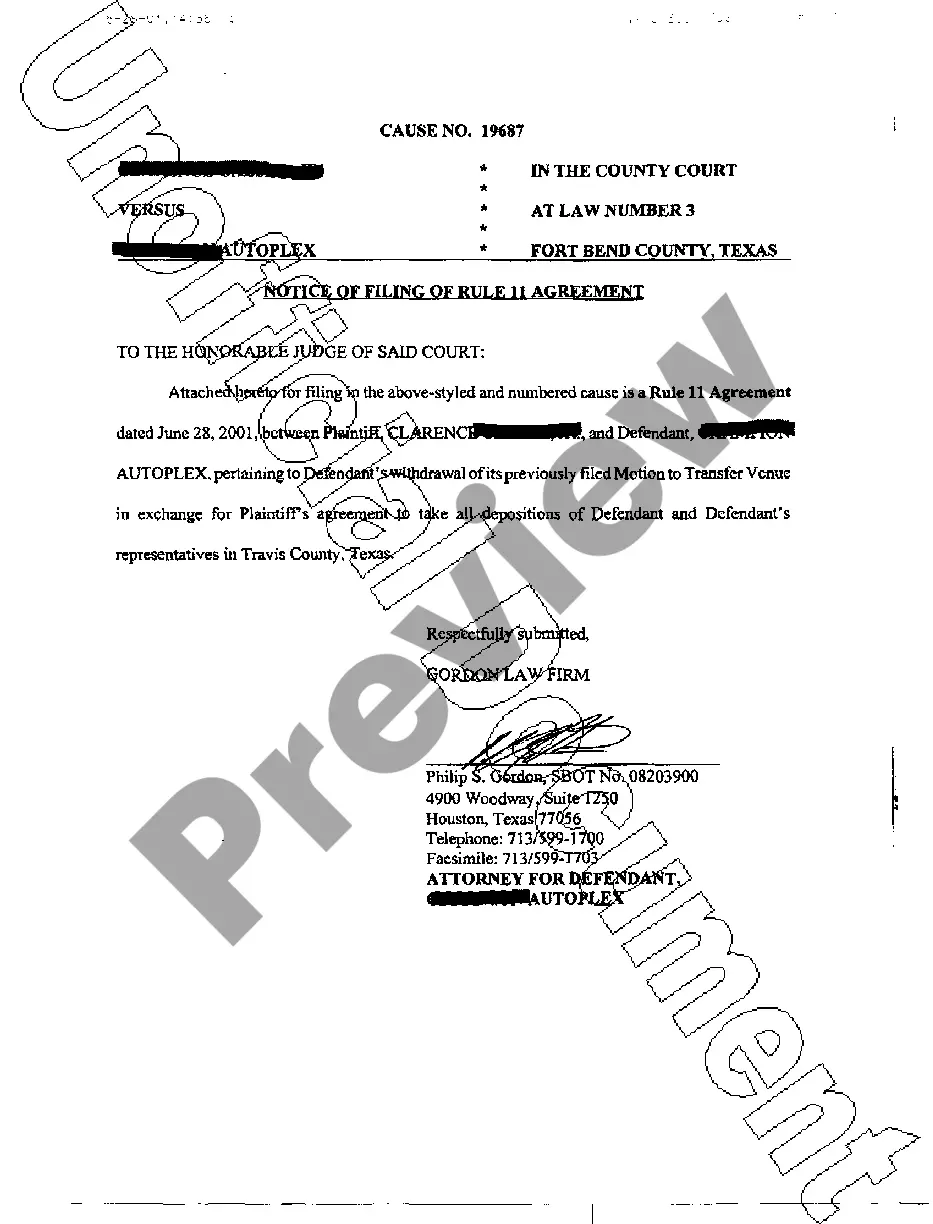

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Phoenix Employee Agreement Incentive Compensation and Stock Bonus on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!