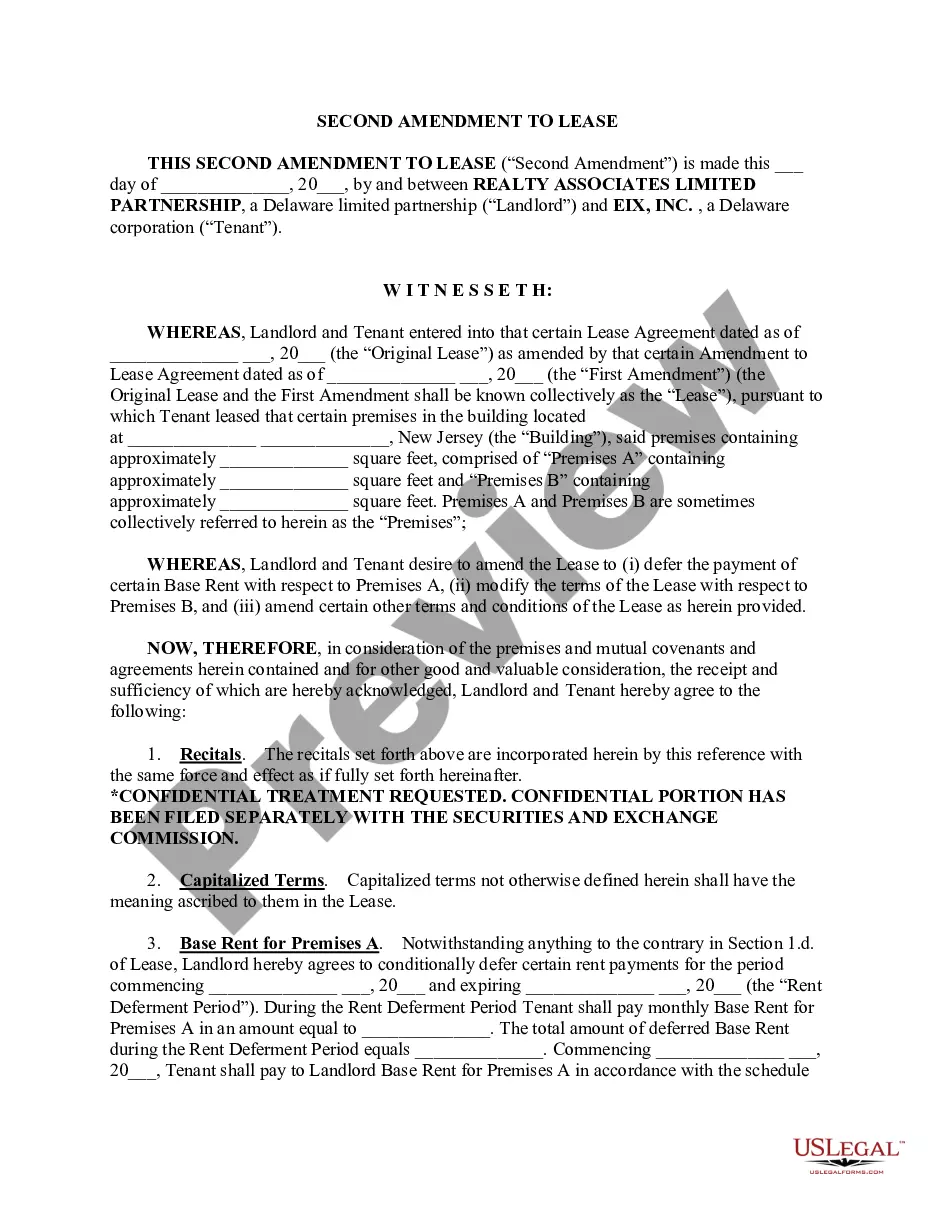

This office lease form is a more detailed, more complicated subordination provision stating that subordination is conditioned on the landlord providing the tenant with a satisfactory non-disturbance agreement.

Miami-Dade County, located in the southern part of Florida, governs a vast area with numerous municipalities and unincorporated areas. As part of its zoning regulations, Miami-Dade Florida includes a detailed subordination provision, also known as a subordination clause or provision, which plays a crucial role in property transactions and financing agreements. The Miami-Dade Florida Detailed Subordination Provision outlines the order of priority for various liens, mortgages, or encumbrances that may be placed on a property. In simple terms, it determines which party's claim takes precedence in case of default or foreclosure. This provision is essential for establishing the rights and interests of different stakeholders involved in real estate transactions. One type of Miami-Dade Florida Detailed Subordination Provision is related to mortgage subordination. Mortgage subordination occurs when a property owner seeks to take out a new loan, while an existing mortgage or lien is already in place. In such cases, the lender of the new loan may require the subordination of the existing mortgage or lien to ensure their priority position in case of default. This provision protects the interests of lenders and provides clarity in the event of foreclosure proceedings. Another type of Miami-Dade Florida Detailed Subordination Provision involves subordination of leases. For instance, when a property owner decides to lease their property and subsequently takes out a loan secured by the property, the lender may require subordination of the lease. This provision allows the lender to step into the landlord's position if foreclosure occurs, ensuring that the leasehold interest remains subordinate to the lender's mortgage, thus maintaining the lender's priority and protecting their security. The Miami-Dade Florida Detailed Subordination Provision also addresses the subordination of mechanics' liens. Mechanics' liens are claims filed by contractors or construction professionals for unpaid services or materials provided for property improvements. If a property owner obtains financing secured by the property, lenders will often require subordination of the mechanics' liens to ensure their priority status. This provision safeguards lenders' interests by ensuring that their mortgages or liens have priority over any potential mechanics' liens. Having a clear and detailed subordination provision in Miami-Dade Florida is crucial for the smooth functioning of real estate transactions and financing agreements. It provides a framework for ensuring order and priority in the face of multiple claims on a property. By understanding and adhering to this provision, lenders, property owners, and tenants can protect their interests and navigate these complex processes with clarity and confidence.Miami-Dade County, located in the southern part of Florida, governs a vast area with numerous municipalities and unincorporated areas. As part of its zoning regulations, Miami-Dade Florida includes a detailed subordination provision, also known as a subordination clause or provision, which plays a crucial role in property transactions and financing agreements. The Miami-Dade Florida Detailed Subordination Provision outlines the order of priority for various liens, mortgages, or encumbrances that may be placed on a property. In simple terms, it determines which party's claim takes precedence in case of default or foreclosure. This provision is essential for establishing the rights and interests of different stakeholders involved in real estate transactions. One type of Miami-Dade Florida Detailed Subordination Provision is related to mortgage subordination. Mortgage subordination occurs when a property owner seeks to take out a new loan, while an existing mortgage or lien is already in place. In such cases, the lender of the new loan may require the subordination of the existing mortgage or lien to ensure their priority position in case of default. This provision protects the interests of lenders and provides clarity in the event of foreclosure proceedings. Another type of Miami-Dade Florida Detailed Subordination Provision involves subordination of leases. For instance, when a property owner decides to lease their property and subsequently takes out a loan secured by the property, the lender may require subordination of the lease. This provision allows the lender to step into the landlord's position if foreclosure occurs, ensuring that the leasehold interest remains subordinate to the lender's mortgage, thus maintaining the lender's priority and protecting their security. The Miami-Dade Florida Detailed Subordination Provision also addresses the subordination of mechanics' liens. Mechanics' liens are claims filed by contractors or construction professionals for unpaid services or materials provided for property improvements. If a property owner obtains financing secured by the property, lenders will often require subordination of the mechanics' liens to ensure their priority status. This provision safeguards lenders' interests by ensuring that their mortgages or liens have priority over any potential mechanics' liens. Having a clear and detailed subordination provision in Miami-Dade Florida is crucial for the smooth functioning of real estate transactions and financing agreements. It provides a framework for ensuring order and priority in the face of multiple claims on a property. By understanding and adhering to this provision, lenders, property owners, and tenants can protect their interests and navigate these complex processes with clarity and confidence.