This office lease form states that a guaranty in which a corporate guarantor has the authority of the signatory to bind a corporation. This guaranty gives the guarantor full power, authority and legal right to execute and deliver this guaranty and that this guaranty constitutes the valid and binding obligation of the guarantor.

Palm Beach Florida Authority of Signatory to Bind the Guarantor

Description

How to fill out Authority Of Signatory To Bind The Guarantor?

Creating documents for business or personal requirements is always a significant obligation.

When formulating a contract, a public service application, or a durable power of attorney, it's vital to consider all federal and state regulations of the specific jurisdiction.

However, smaller counties and even municipalities also have legal statutes that must be taken into account.

The remarkable aspect of the US Legal Forms library is that all paperwork you have ever obtained is securely stored, enabling you to access it through your profile in the My documents section at any time. Register on the platform and swiftly obtain verified legal templates for any situation with just a few clicks!

- All these factors make it stressful and time-consuming to formulate Palm Beach Authority of Signatory to Bind the Guarantor without expert assistance.

- You can potentially save on legal fees by preparing your documentation and create a legally acceptable Palm Beach Authority of Signatory to Bind the Guarantor independently, utilizing the US Legal Forms online library.

- It is the largest digital repository of state-specific legal forms that are professionally vetted, ensuring you can trust their authenticity when selecting a template for your region.

- Previous subscribers need only to Log In to their accounts to retrieve the necessary form.

- If you do not have a subscription yet, follow the step-by-step instructions below to acquire the Palm Beach Authority of Signatory to Bind the Guarantor.

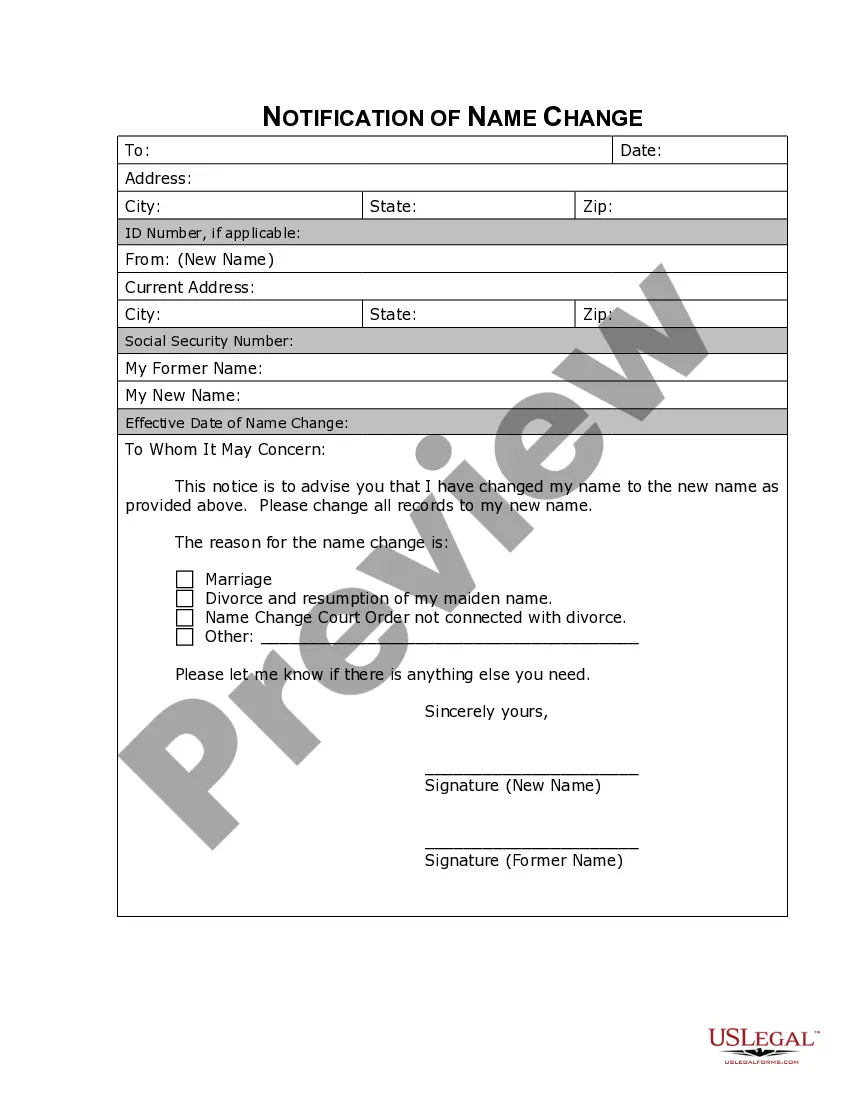

- Review the page you have opened and confirm whether it contains the document you need.

- To do so, check the form description and preview if those options are available.

Form popularity

FAQ

A personal guarantee is a promise to pay a loan, contract, lease, or other financial agreement if the primary borrower, be it a business or individual, cannot. If the primary borrower does not pay the debt, you may be sued because you signed a personal guarantee.

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.

At law, the giver of a guarantee is called the surety or the "guarantor". The person to whom the guarantee is given is the creditor or the "obligee"; while the person whose payment or performance is secured thereby is termed "the obligor", "the principal debtor", or simply "the principal".

Differences between guarantees and indemnities a guarantee imposes a secondary liability, which means that there will be another person who is primarily liable for the same obligation, whereas an indemnity imposes a primary liability.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

A letter of guarantee is a document issued by your bank that ensures your supplier gets paid for the goods or services it provides to your company, in the event that your company itself can't pay. In that case, your bank will pay your supplier up to a specified amount.

What is a guarantor and guarantee? A guarantor is a person, third party or organisation that agrees to guarantee your loan. The guarantee is a legal assurance given by the guarantor to pay the loan if the borrower defaults and is unable to pay.

In financial terms, a guarantee is a promise made by the guarantor that a debt or other obligation will be paid if the original borrower is unable or unwilling to make good on the loan. The guarantor is the person or organization who accepts the responsibility to see that the debt is satisfied.