This office lease guaranty states that the guarantor's obligations under this guaranty shall be unaffected by any discharge or release of the tenant, its successors or assigns, or any of their debts, in connection with any bankruptcy, reorganization, or other insolvency proceeding or assignment for the benefit of creditors.

A Queens New York Guarantor Waiver is a legal document that prevents the release of the guarantor from their responsibilities in the event of a tenant's discharge, release, or bankruptcy. This waiver ensures that the guarantor remains liable for any obligations they have committed to before the tenant's adverse circumstances. There are various types of Queens New York Guarantor Waivers that serve different purposes and protect the interests of both the landlord and the guarantor. Some key types include: 1. Discharge Release Waiver: This type of waiver prevents the guarantor from being released from their obligations if the tenant is discharged from their legal liabilities. It ensures that any remaining debts or unpaid rents still fall under the guarantor's responsibility. 2. Tenant Release Waiver: In situations where the tenant is released from their lease agreement or voluntarily terminates the lease contract, this particular waiver safeguards the guarantor by keeping them accountable for the rents and other lease obligations that were initially agreed upon. 3. Bankruptcy Waiver: When a tenant declares bankruptcy, it often results in the discharge of the debts they have accumulated. However, with a Queens New York Guarantor Bankruptcy Waiver, the guarantor remains bound by their obligations outlined in the lease, providing the landlord with some assurance of financial security. It is crucial to have a detailed and comprehensive Queens New York Guarantor Waiver that covers all potential scenarios to protect both the landlord and the guarantor. By including appropriate language and provisions within the document, all parties involved can avoid any undue financial burdens or legal complications that may arise due to the discharge, release, or bankruptcy of the tenant. Note: It is advised to consult a legal professional or attorney well-versed in real estate laws within Queens New York to ensure the drafting of a thorough and enforceable Guarantor Waiver that adheres to all applicable legal requirements and regulations.Queens New York Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy

Description

How to fill out Queens New York Guarantor Waiver Which Avoids Release Of Guarantor By Reason Of The Tenant Discharge Release Or Bankruptcy?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so picking a copy like Queens Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Queens Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy. Adhere to the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

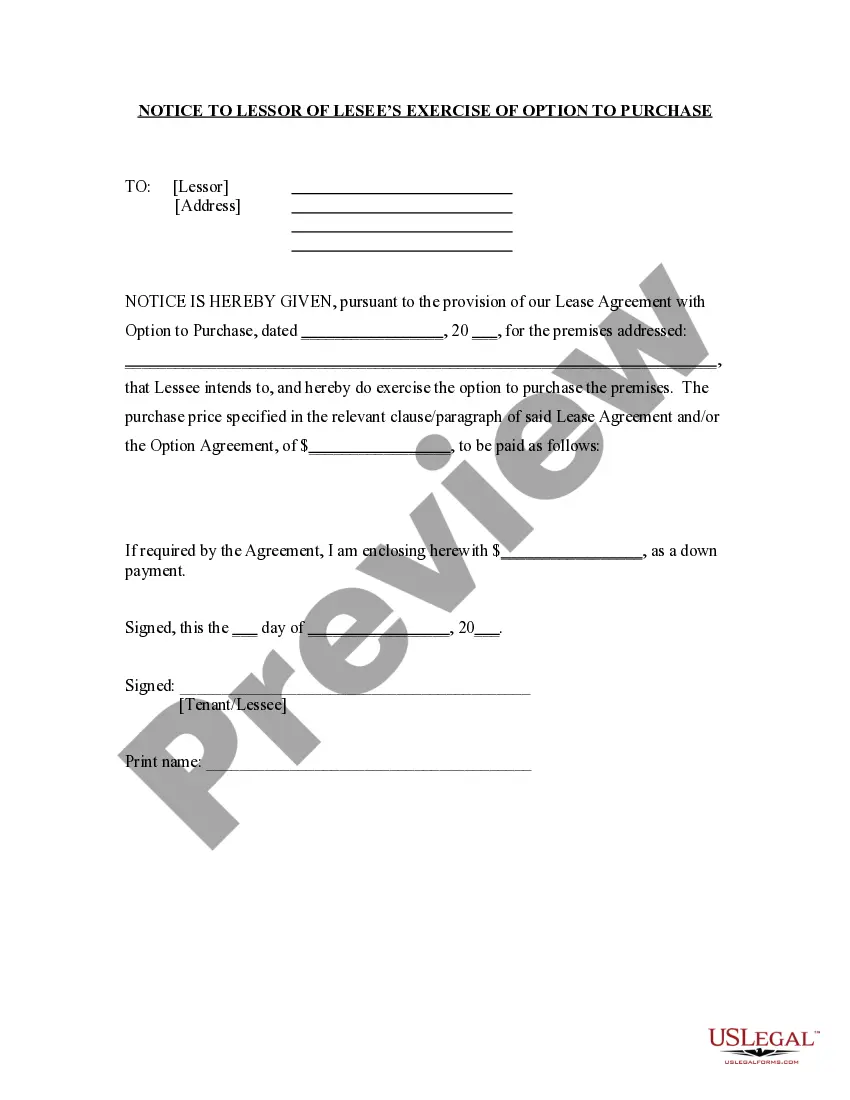

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Queens Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Even when a lender is faced with a bankruptcy proceeding, the guarantor's promise to pay the full amount of a debt is inviolate: a claim against the guarantor need not be reduced to account for recoveries from other sources unless and until the creditor is paid in full.

Guarantors would be required to pay for the loan when the main borrower fails to keep up with repayments. Many guarantors are often used as a last resort and the lender will usually speak to the main borrower first to collect repayment.

4 This is one benefit to being a guarantor not a primary obligor. It FASB Summary of Interpretation No. 45 also clarifies that a guarantor is required to recognize, at the inception of a guarantee, a liability for the fair value of the obligation undertaken in issuing the guarantee.

In these transactions, a lender may include a waiver of suretyship defenses within its loan documentation to allow the lender to modify the underlying loan documents from time to time without the concern that such modification will absolve or discharge the surety from its obligations to the lender.

Also, it's important to understand that filing a Chapter 7 bankruptcy on behalf of the business will not get rid of a personal guarantee. To wipe out the debt, the actual signer of the guarantee must file for bankruptcy.

Guarantors have several rights that extend beyond that of the debtor. These rights include: Right of Subrogation This right allows the guarantor to recover from the debtor if the guarantor has paid the debtor's debts. For example, the guarantor has creditor rights if the debtor claims bankruptcy.

When you guarantee a loan for your business, friend, or family member, you make yourself liable for it. Luckily, you can usually wipe out your personal liability for debt through bankruptcyincluding a personal guarantee entered into for your business.

Being a guarantor for a rental property involves you vouching for the tenant. If the tenant is unable to meet their obligations under the tenancy agreement, you (the guarantor) will be legally bound to pay out either for overdue rent or damage to the property.

To improve the odds of getting a loan, you could ask someone to be a guarantor (an individual or company that pays an obligation if the borrower fails to do so). Or, if you're applying for a business loan, you might agree to guarantee the loan with your personal assets.

Can a guarantor stop being a guarantor? Sadly no. The reason that you cannot be removed from the loan agreement is because the person who guarantees a loan plays a huge role in the application process.