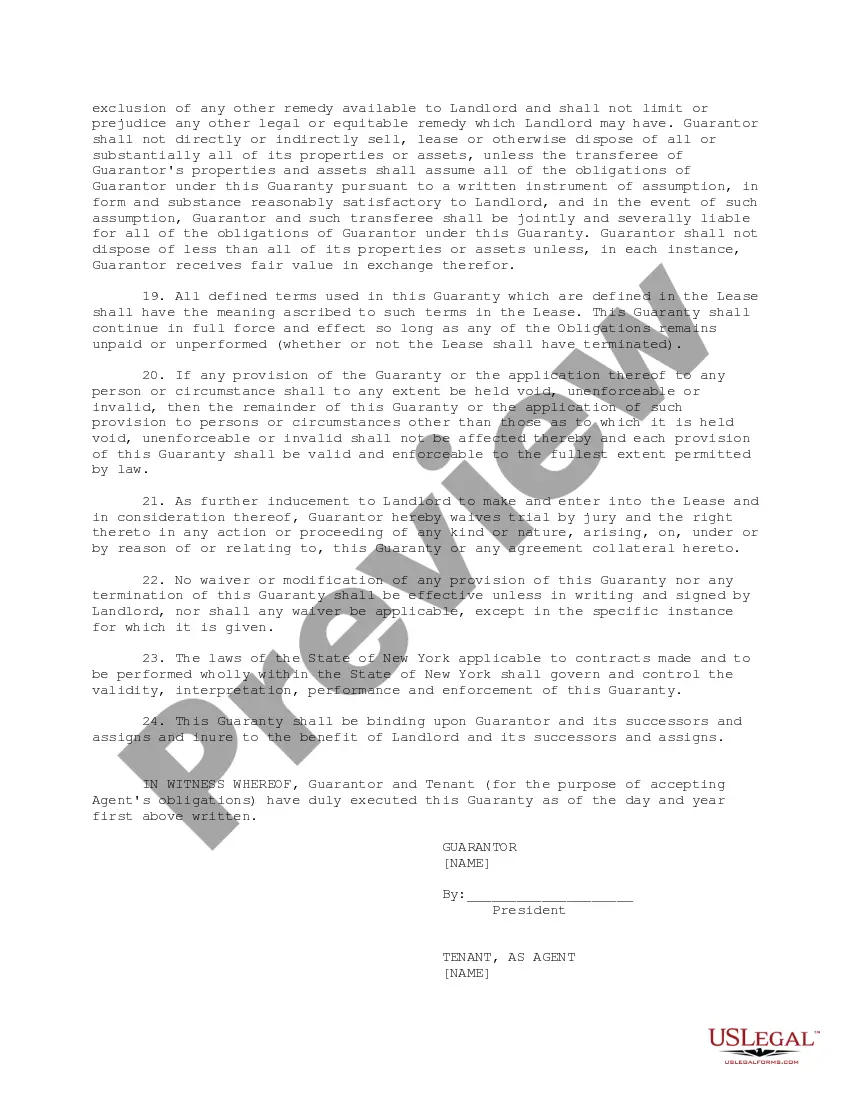

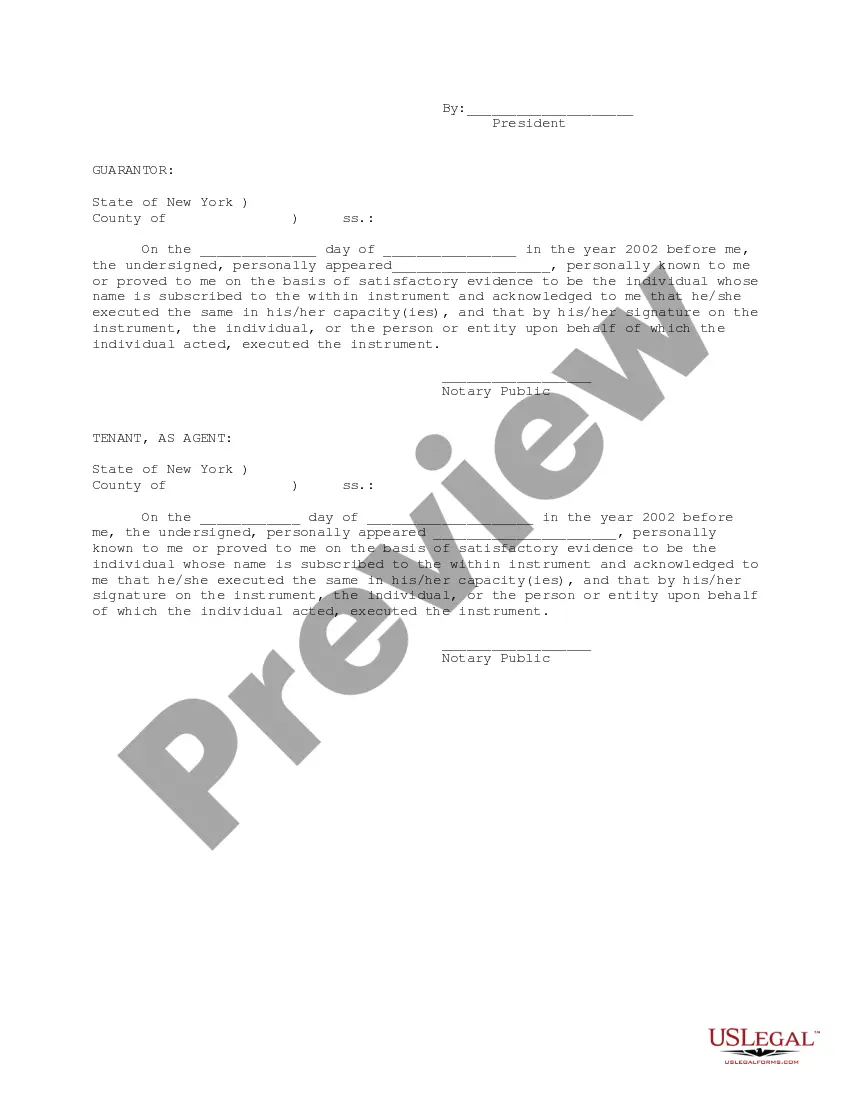

This office lease form is a guranty that absolutely, unconditionally and irrevocably guarantees the landlord the full and prompt performance and observance of all of the tenant's obligations under the lease, including, and without limitation, the full and prompt payment of all rent and additional rent payable by the tenant under the lease and tenant's indemnity obligations benefiting the landlord under the lease.

Harris County, located in Texas, presents the Harris Texas Joint and Several Guaranty of Performance and Obligations, a legal concept pertaining to the guarantee of performance and obligations by multiple parties. This guarantee ensures that all involved parties are jointly and severally liable for fulfilling a contract, lease, or any other legal agreement. Under this guarantee, each party involved assumes equal responsibility for fulfilling the performance and obligations stated in the agreement. If one party fails to meet its obligations, the other parties become liable for fulfilling the defaulted party's share. Essentially, this joint and several guarantee acts as a safety net, protecting the involved parties from potential losses resulting from defaults or breaches. The Harris Texas Joint and Several Guaranty of Performance and Obligations is commonly found in various contexts, including: 1. Commercial Leases: Property owners often require tenants, especially in commercial real estate, to sign a joint and several guaranties. This ensures that even if one tenant fails to meet their rent or maintenance obligations, the other tenants can be held responsible, protecting the landlord's interests. 2. Construction Contracts: In large-scale construction projects, such as infrastructure development, all contractors and subcontractors involved may be required to provide a joint and several guaranties. This guarantees that if any party fails to perform their duties or fulfill contractual obligations, the others will step in to ensure completion without unnecessary delays or financial burdens. 3. Loan Agreements: Lenders may request a joint and several guaranties when extending credit to multiple borrowers or business partners. In the event that one borrower defaults on their loan, the lender can seek repayment from any of the other guarantors, increasing the chances of recovering their funds. It is crucial for parties involved in such agreements to thoroughly understand the implications of the Harris Texas Joint and Several Guaranty of Performance and Obligations. While it offers protection against potential liabilities, it also means assuming responsibility for the actions or inaction of other parties. Therefore, consulting with a knowledgeable attorney is recommended to ensure full comprehension and to determine the best course of action tailored to individual circumstances.Harris Texas Joint and Several Guaranty of Performance and Obligations

Description

How to fill out Harris Texas Joint And Several Guaranty Of Performance And Obligations?

How much time does it typically take you to create a legal document? Since every state has its laws and regulations for every life scenario, locating a Harris Joint and Several Guaranty of Performance and Obligations suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Aside from the Harris Joint and Several Guaranty of Performance and Obligations, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Harris Joint and Several Guaranty of Performance and Obligations:

- Check the content of the page you’re on.

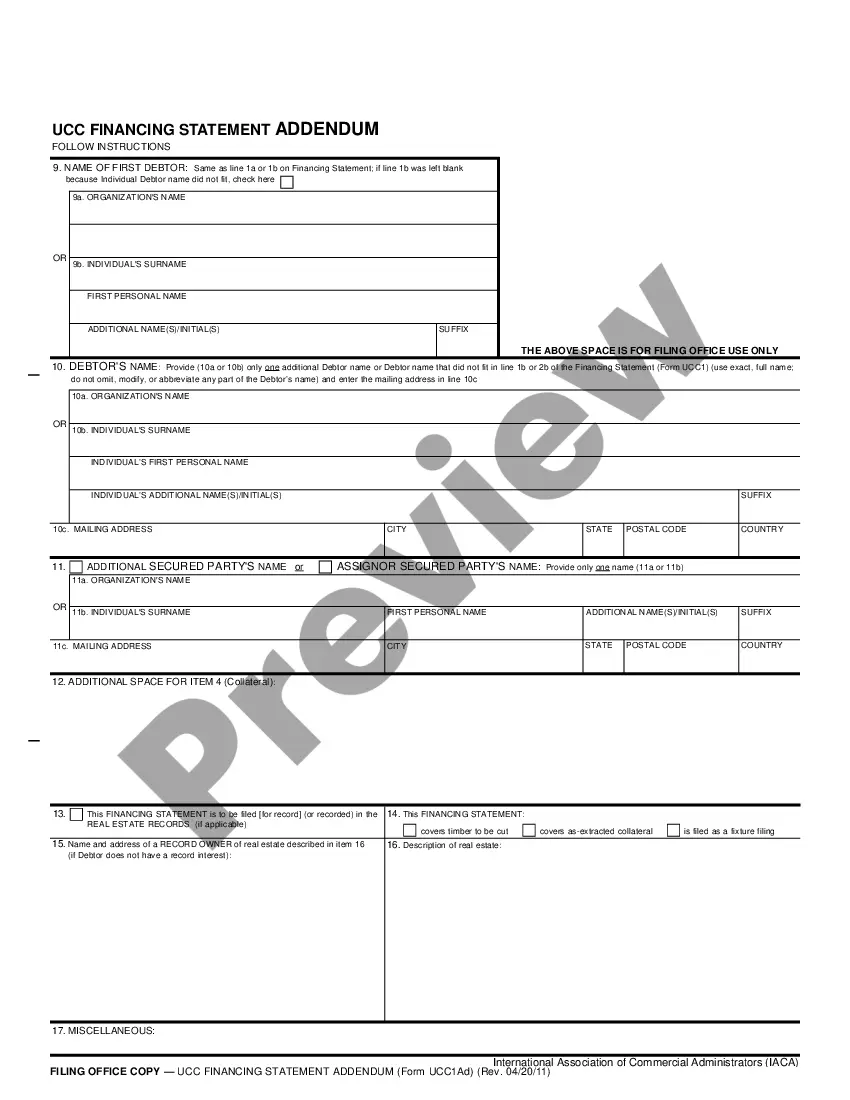

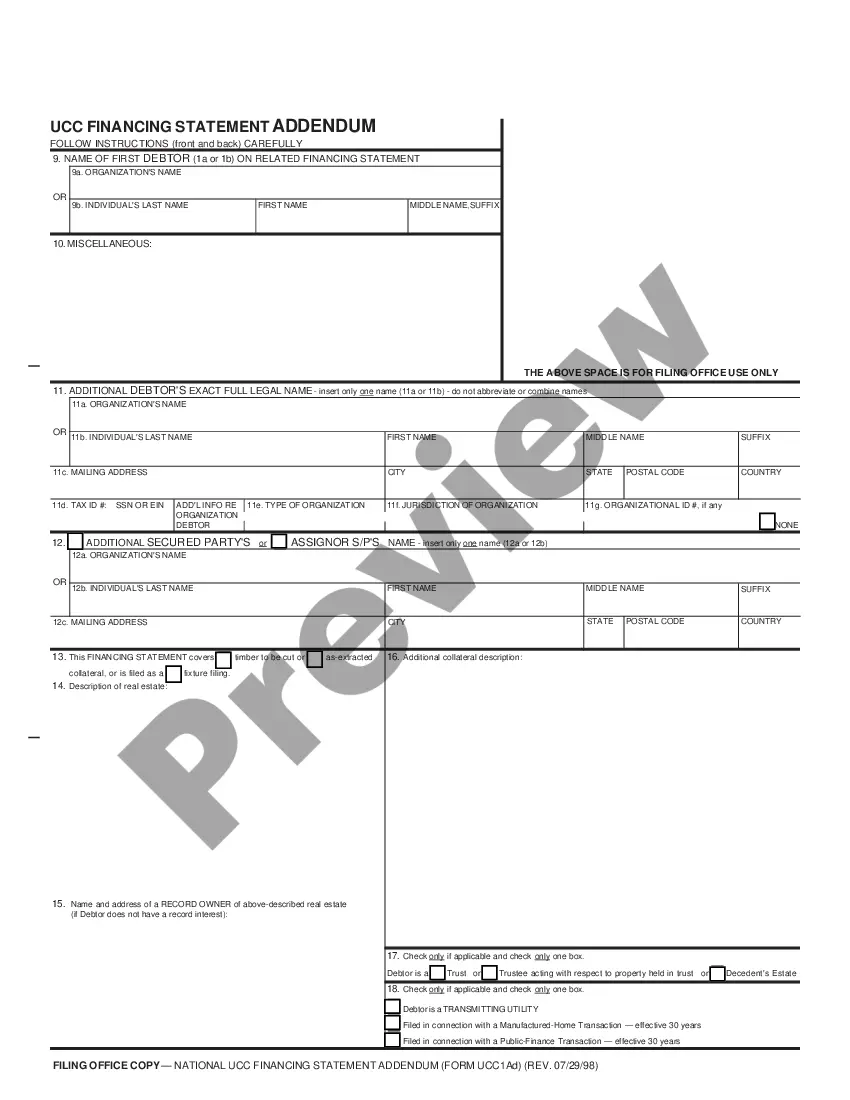

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Harris Joint and Several Guaranty of Performance and Obligations.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!