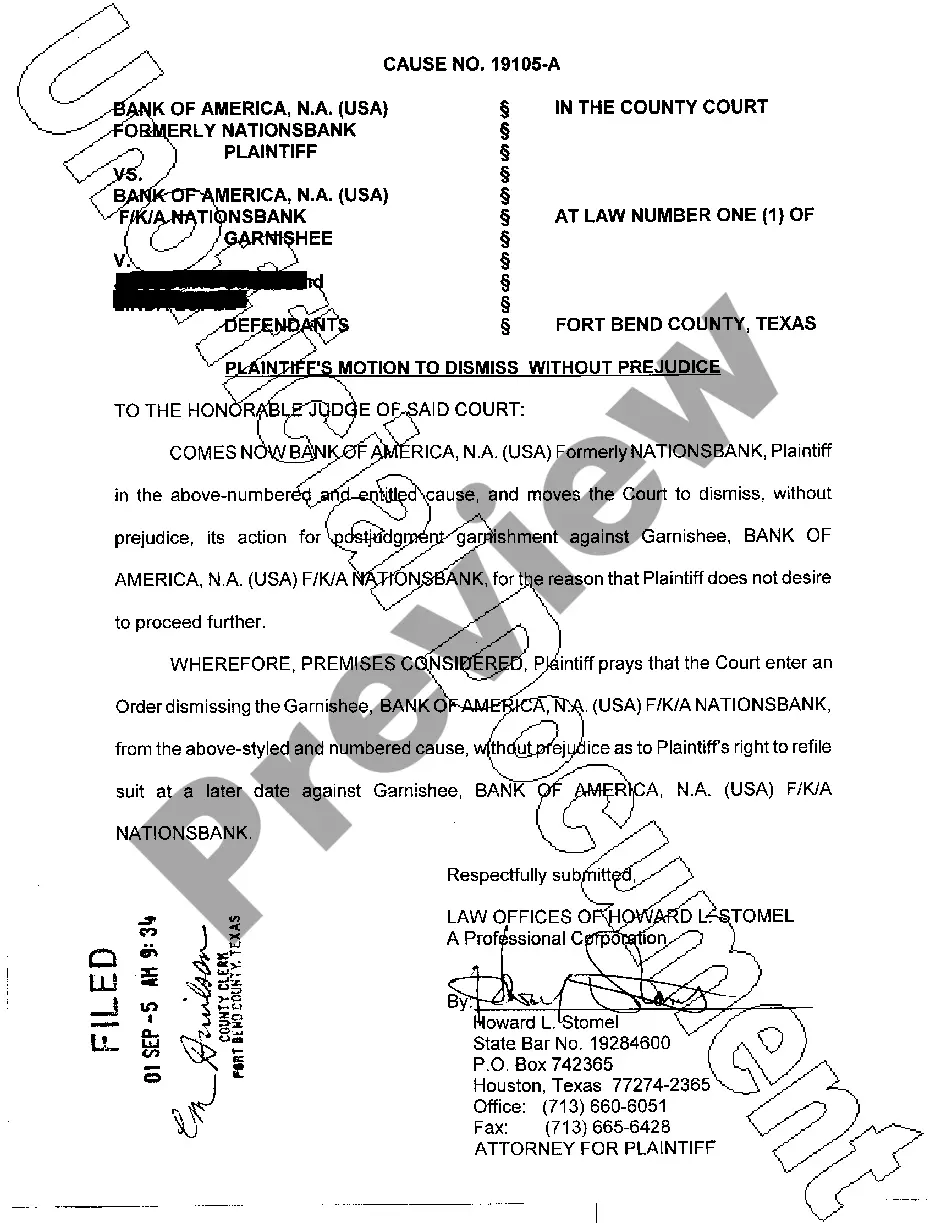

This office lease clause provides the standard for which the actual measurements are to be determined. This form also lists the importance of using a standard measurement method.

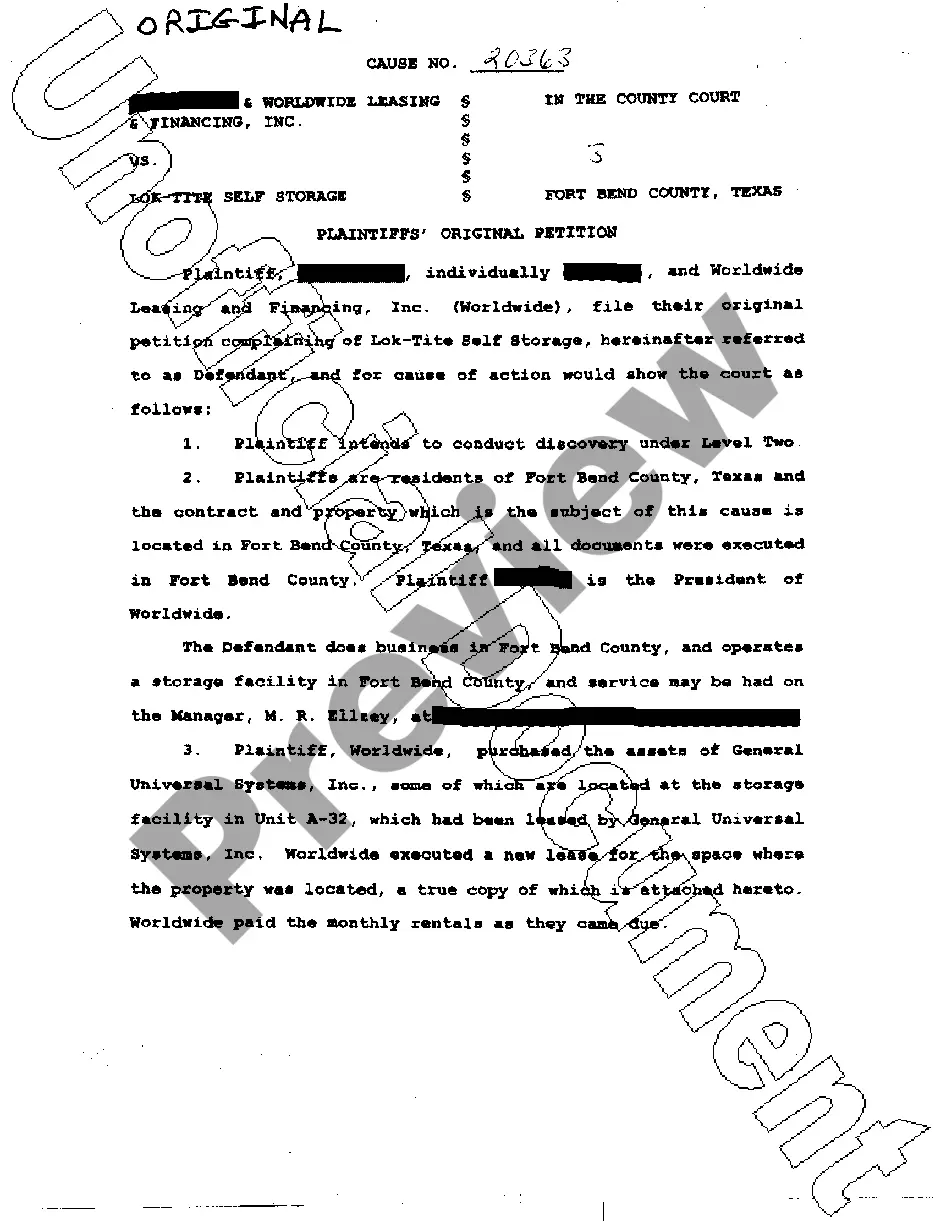

Maricopa, Arizona is a vibrant city located in the southwestern part of the United States. The city is known for its beautiful landscapes, rich history, and diverse culture. When it comes to real estate and construction, Maricopa has specific clauses that outline the standard measuring methods for remeasurement purposes. These clauses not only ensure accuracy but also set a standardized approach for measurement across different properties and structures. One of the notable Maricopa Arizona clauses setting forth the standard measuring method for remeasurement is the "Total Area Measurement Clause." This clause provides guidelines for calculating the total area of a property, including both the interior and exterior space. It requires the inclusion of all habitable rooms, common areas, and any attached structures such as garages or patios. The clause may specify the use of certain tools or software for accurate measurements. Another type of Maricopa Arizona clause related to measuring methods is the "Floor-to-Ceiling Height Clause." This clause establishes the standard for measuring the vertical clearance between the floor and ceiling in a building or room. It ensures consistency in determining the overall height and volumetric capacity of a space by considering the usable vertical space for various purposes like occupancy, furniture placement, or storage. Furthermore, the "Unit Partitioning Clause" is applicable in situations where larger properties are divided into multiple units or sections. This clause defines the standard method for measuring the partitioned areas, walls, and floors within each unit, ensuring uniformity in measurements across different sections. It may outline specific requirements for wall thickness, floor elevation, or ceiling height. In Maricopa, Arizona, these clauses not only set the standard measuring methods for remeasurement, but they also help establish fair and accurate property valuations, facilitate building code compliance, and provide guidelines for construction planning and design considerations. Keywords: Maricopa Arizona, clause, standard measuring method, remeasurement, Total Area Measurement Clause, Floor-to-Ceiling Height Clause, Unit Partitioning Clause, real estate, construction, accuracy, property valuation, building code compliance, construction planning, design considerations.