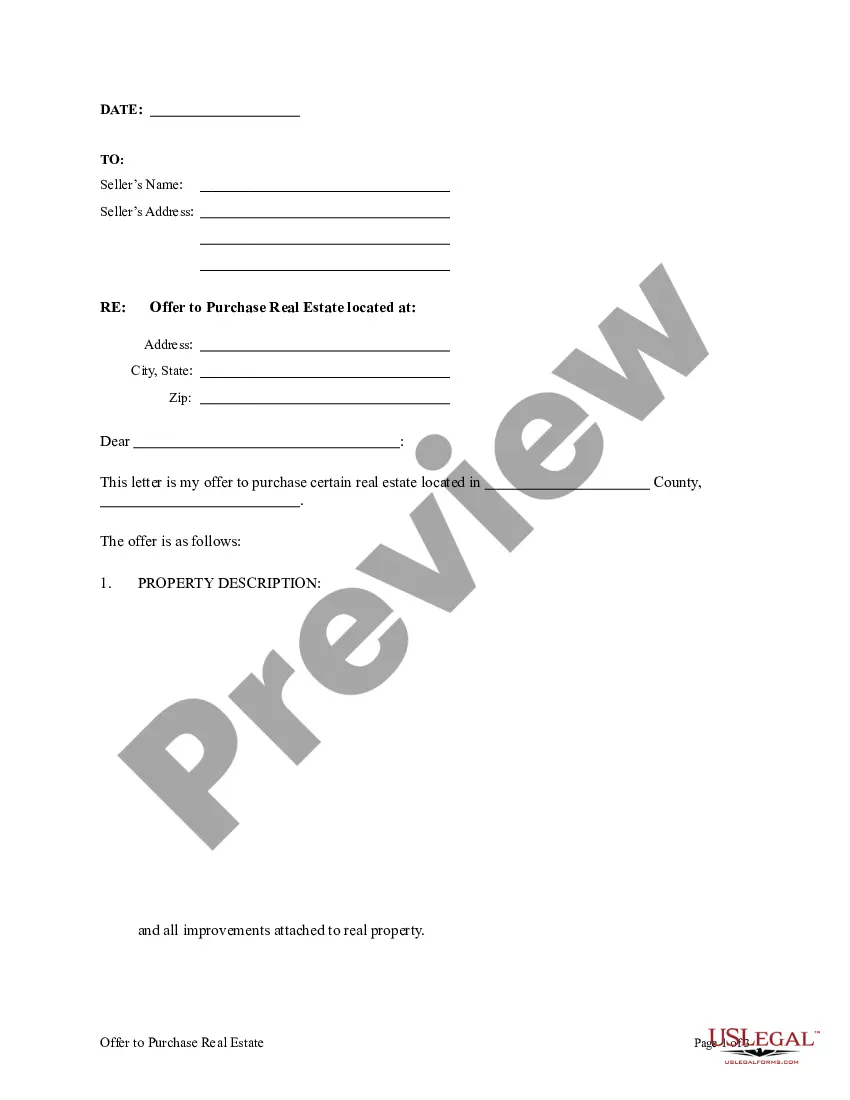

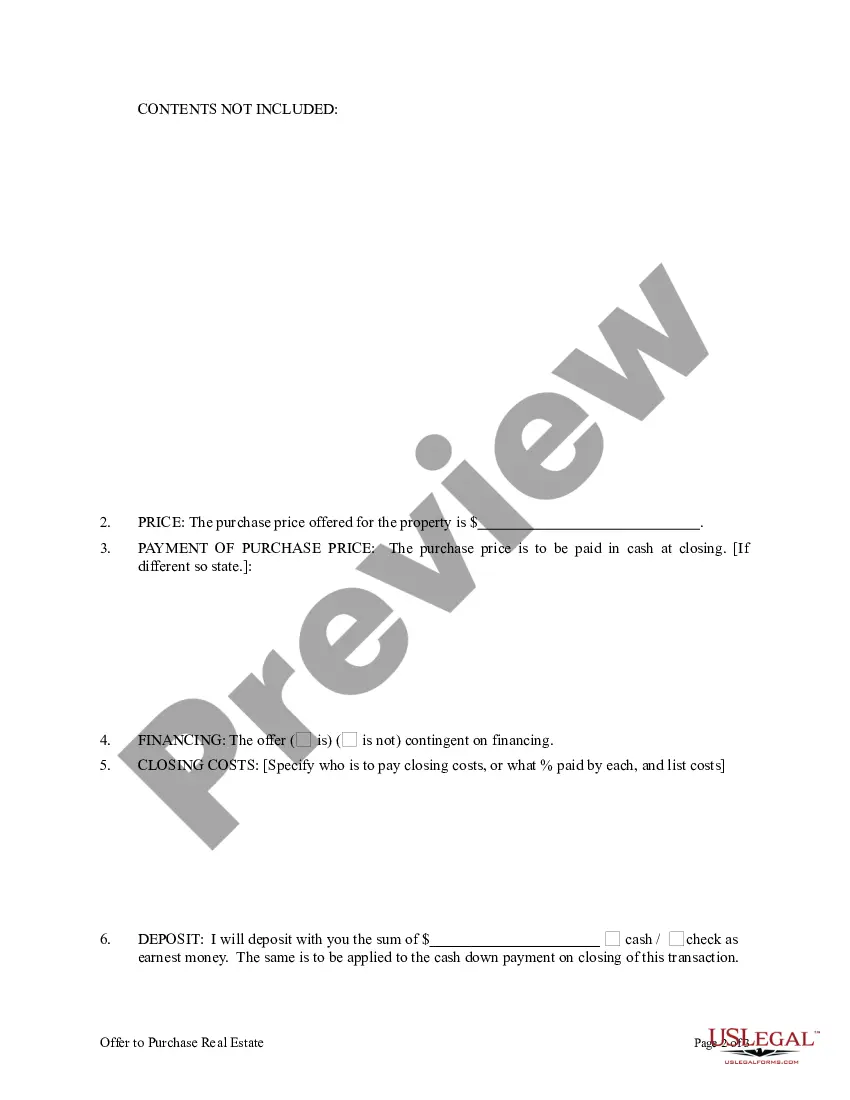

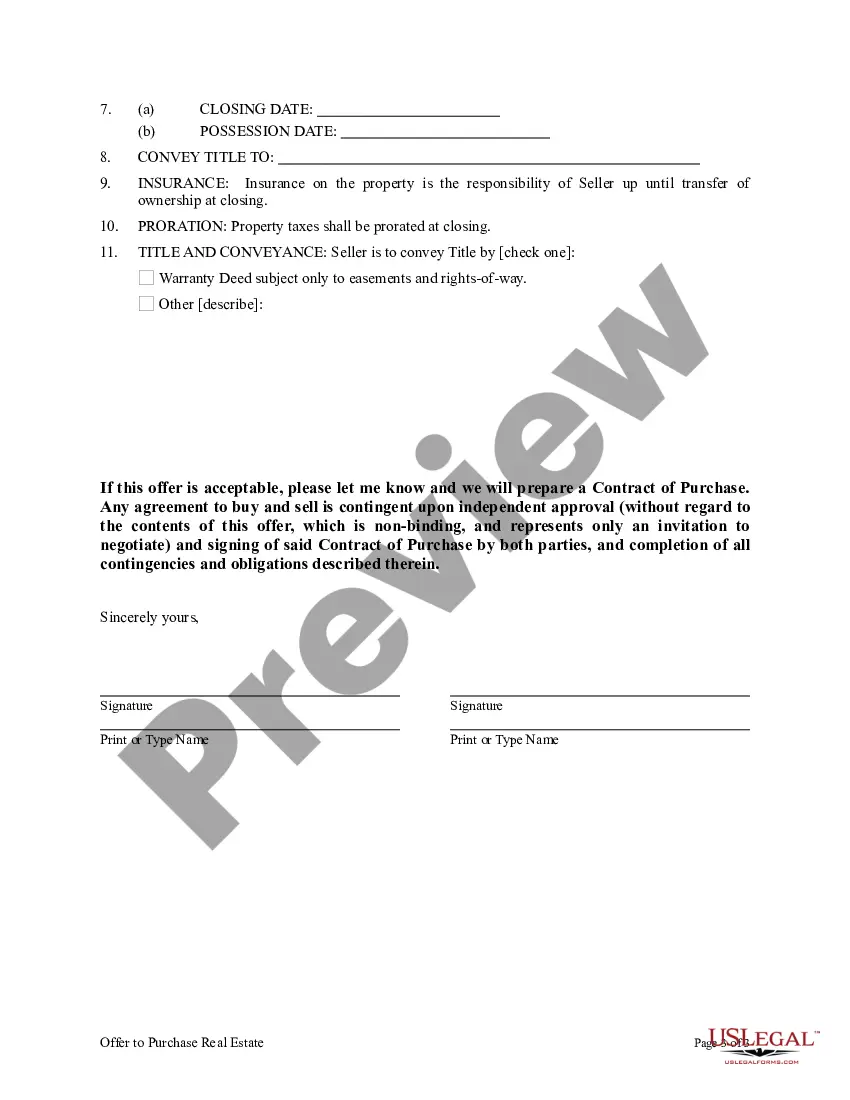

Harris Texas Offer to Purchase Real Estate is a legal document that outlines the terms and conditions of a property sale transaction in Harris County, Texas. It serves as a formal agreement between a buyer and seller, establishing their rights and obligations during the real estate transaction process. The Harris Texas Offer to Purchase Real Estate documents the purchase price, closing date, and contingencies that must be met for the sale to proceed. It also includes relevant details such as property address, legal description, and any included fixtures or personal property. This contract ensures that both parties are aware of their rights and responsibilities throughout the transaction. Different types of Harris Texas Offer to Purchase Real Estate may include specific clauses or contingencies tailored to different circumstances. For instance, a cash offer may have different terms than a financed offer, or a commercial property sale may have additional provisions compared to a residential property sale. Depending on the situation, there could also be variations in the way earnest money, inspections, or title commitment are handled. When creating a Harris Texas Offer to Purchase Real Estate, it is crucial to include important keywords that address the specific details and requirements of the transaction. These may include: 1. Purchase price: Clearly mention the agreed-upon amount for the property being sold. 2. Closing date: Specify the date by which the transaction is expected to be completed. 3. Contingencies: Detail any specific conditions that must be satisfied for the sale to proceed, such as satisfactory home inspection or appraisal results. 4. Property address and legal description: Provide accurate information identifying the property being sold. 5. Earnest money: Address the amount of earnest money to be deposited and how it will be handled. 6. Financing: Outline the terms of financing, if applicable, including loan amount, interest rate, and any contingencies related to obtaining a loan. 7. Representations and warranties: Specify any warranties made by the seller regarding the property's condition or other relevant aspects. 8. Closing costs: Determine which party is responsible for paying certain closing costs, such as title insurance or transfer taxes. 9. Default and remedies: Include provisions that outline actions that can be taken in case of default by either party. 10. Signatures: Ensure that both the buyer and seller sign the document, indicating their agreement to the terms and conditions. Remember, each Harris Texas Offer to Purchase Real Estate can vary depending on the circumstances of the transaction. It is crucial for both the buyer and seller to thoroughly review and understand the terms before signing, or seek legal advice if needed.

Harris Texas Offer to Purchase Real Estate

Description

How to fill out Harris Texas Offer To Purchase Real Estate?

Whether you intend to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so picking a copy like Harris Offer to Purchase Real Estate is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Harris Offer to Purchase Real Estate. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Harris Offer to Purchase Real Estate in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!