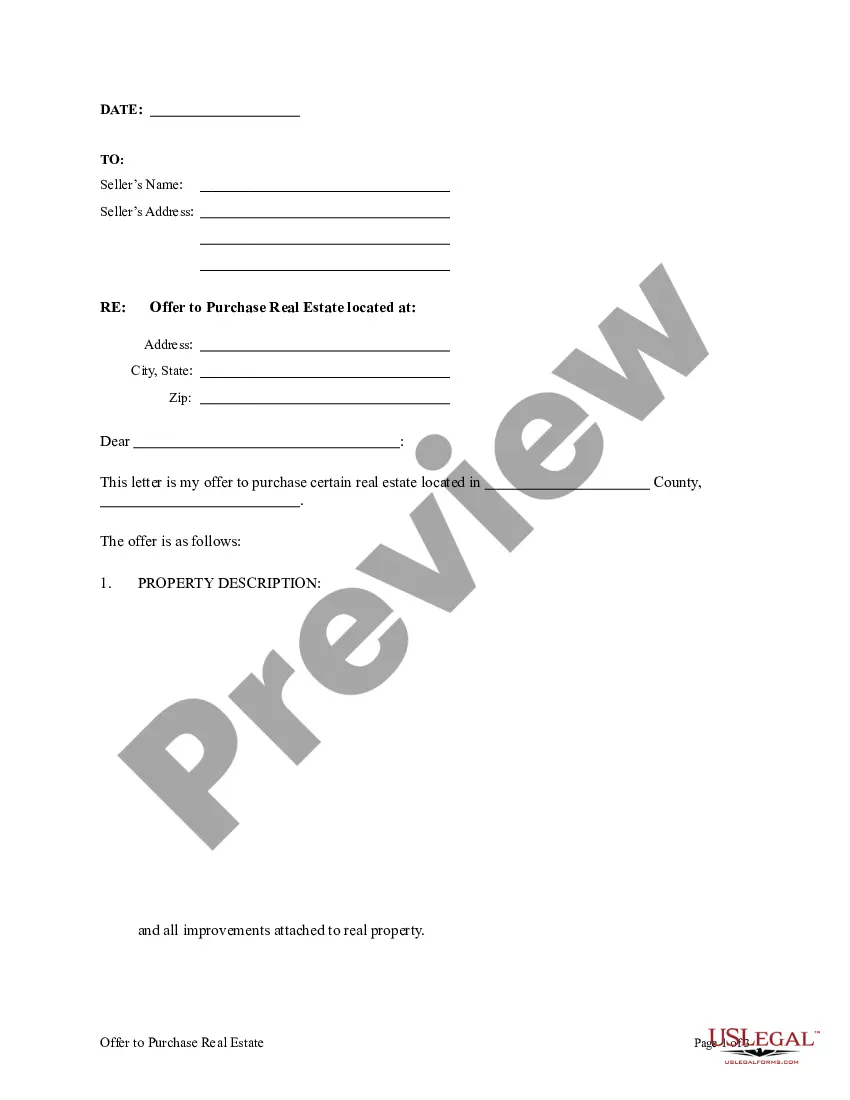

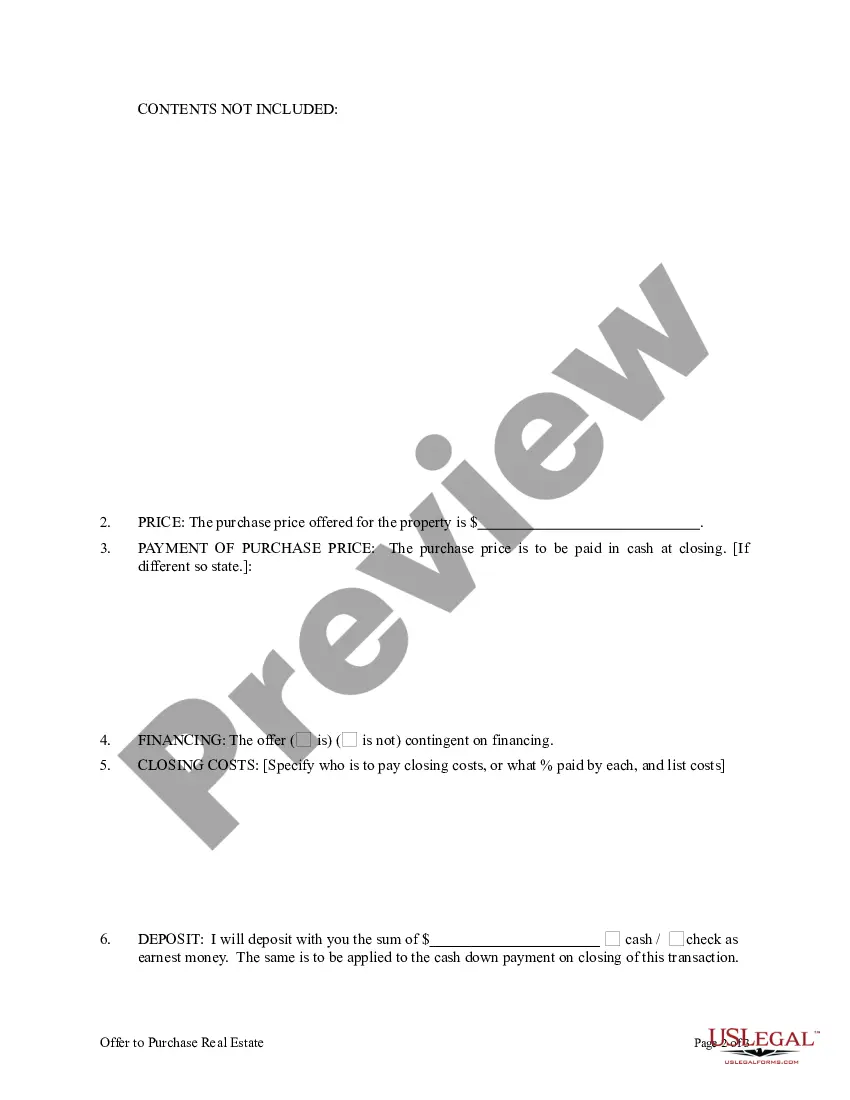

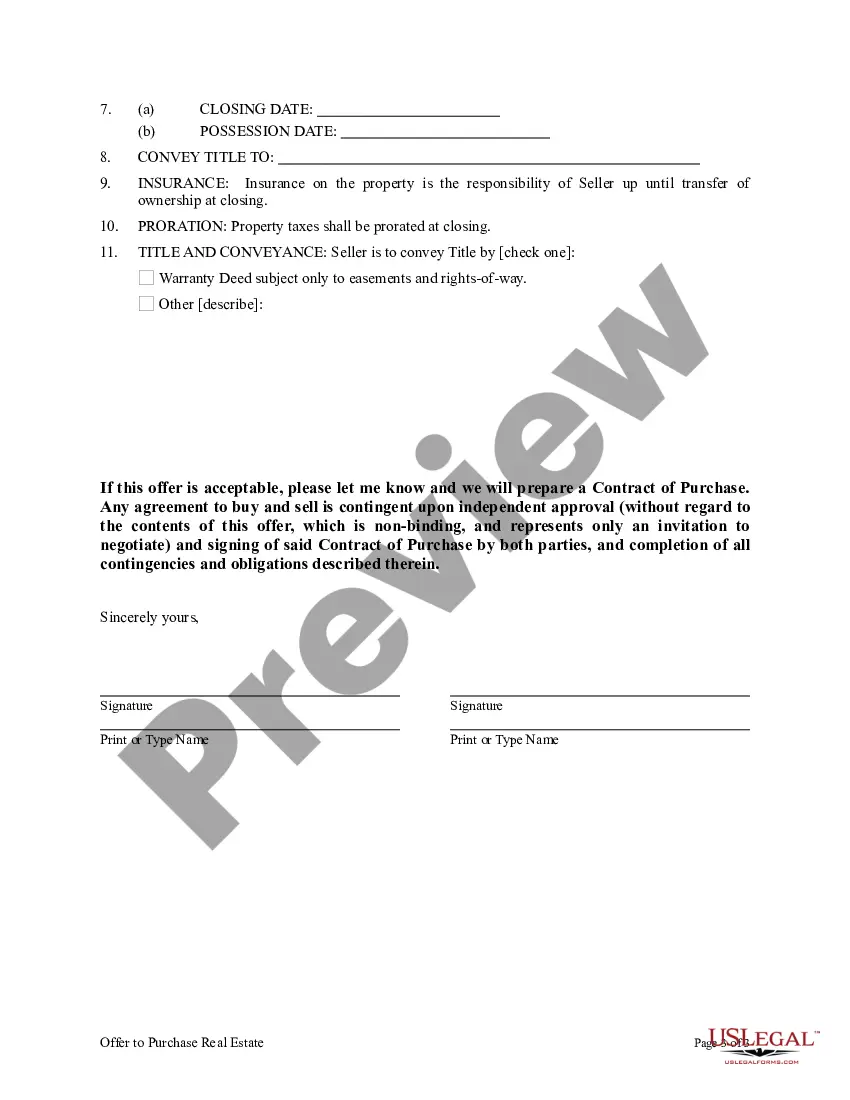

Philadelphia, Pennsylvania, Offer to Purchase Real Estate is a legal document that outlines the terms and conditions of buying a property in Philadelphia. It serves as a contract between the buyer and the seller, detailing the important information and obligations of both parties. This document is essential in ensuring a smooth and transparent transaction for the purchase of real estate in Philadelphia. The Offer to Purchase Real Estate includes various relevant keywords, such as: 1. Property Description: This section provides detailed information about the property being purchased, including its address, lot size, zoning, and the type of property (residential, commercial, or industrial). 2. Purchase Price: The Offer to Purchase includes the agreed-upon purchase price for the property. This amount is negotiated between the buyer and the seller and often includes provisions for a down payment and financing terms. 3. Deposit: The document specifies the deposit amount the buyer will provide as a sign of good faith. This amount is typically a percentage of the purchase price and is held in escrow until the closing of the transaction. 4. Contingencies: These are conditions that must be satisfied for the sale to proceed. The Offer to Purchase may include contingencies such as mortgage approval, home inspection, and a satisfactory title search. 5. Closing Date: The document clearly establishes the agreed-upon date when the transaction will be completed and the property will officially transfer to the buyer. 6. Financing Terms: If the buyer intends to obtain financing to purchase the property, this section includes necessary details, such as the type of loan, interest rate, and any financial contingencies. 7. Earnest Money: This refers to the funds provided by the buyer in good faith to demonstrate their serious intent to purchase the property. It serves as additional financial security for the seller, compensating them if the buyer defaults on the agreement. Different types of Philadelphia Pennsylvania Offer to Purchase Real Estate may vary based on the nature of the transaction or the specific requirements of the buyer and seller. Some common variations include residential purchase agreements, commercial property purchase agreements, lease-option agreements, and land contract agreements. Each type serves a different purpose and has unique terms and conditions tailored to the specific real estate transaction. To properly execute an Offer to Purchase Real Estate in Philadelphia, it is advisable to consult with a real estate attorney or a knowledgeable real estate professional who can provide guidance and ensure compliance with local regulations and specific requirements.

Philadelphia Pennsylvania Offer to Purchase Real Estate

Description

How to fill out Philadelphia Pennsylvania Offer To Purchase Real Estate?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Philadelphia Offer to Purchase Real Estate, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Philadelphia Offer to Purchase Real Estate from the My Forms tab.

For new users, it's necessary to make several more steps to get the Philadelphia Offer to Purchase Real Estate:

- Analyze the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!