Nassau, New York: A Deep Dive into Clauses Relating to Powers of Venture Nassau, New York is a county located in the state of New York, USA. When it comes to business ventures and partnerships within the county, there are various clauses relating to the powers of venture that every business owner or investor should be aware of. 1. Joint Venture Clause: This clause pertains to a partnership agreement between two or more parties who decide to undertake a specific business project or venture together. It outlines the powers, rights, and responsibilities of each party involved, including decision-making authority, profit-sharing arrangements, and liability distribution. 2. Voting Rights Clause: This clause defines the powers and procedures associated with voting on significant matters within a business venture. It covers topics such as majority requirements for decision-making, the allocation of voting rights among partners, and protocols for exercising such rights. 3. Management Authority Clause: This clause outlines the powers and limitations of each party involved in the business venture in regard to management and decision-making. It clarifies the authority of partners to make decisions independently, collectively, or through appointed officers, and sets the boundaries within which such decisions are to be made. 4. Capital Contribution Clause: This clause describes the financial obligations and responsibilities of each party involved in the venture. It specifies the amounts or proportions of capital contributions required from each partner, the timing and method of payment, and any requirements for future investments or additional capital injections. 5. Withdrawal and Dissolution Clause: As the name suggests, this clause regulates the procedures and consequences of a partner's withdrawal from the venture or the dissolution of the partnership. It typically outlines the steps involved in exiting the business, the distribution of assets and liabilities, and provisions for the continuity of the venture should a partner decide to withdraw. 6. Non-Compete Clause: This clause aims to protect the interests of the venture by restricting partners from engaging in similar business activities that may directly compete with or undermine the venture. It sets the scope, duration, and geographic limitations of such non-compete agreements to safeguard the business's competitive edge. Understanding these clauses relating to venture powers is crucial for any business owner or investor in Nassau, New York. These clauses help establish a clear framework for decision-making, accountability, and dispute resolution within the partnership, ensuring a harmonious and productive business environment. Note: It is always recommended consulting legal professionals specializing in business law and contracts to ensure the drafting and execution of appropriate clauses tailored to the specific needs and circumstances of each business venture.

Nassau New York Clauses Relating to Powers of Venture

Description

How to fill out Nassau New York Clauses Relating To Powers Of Venture?

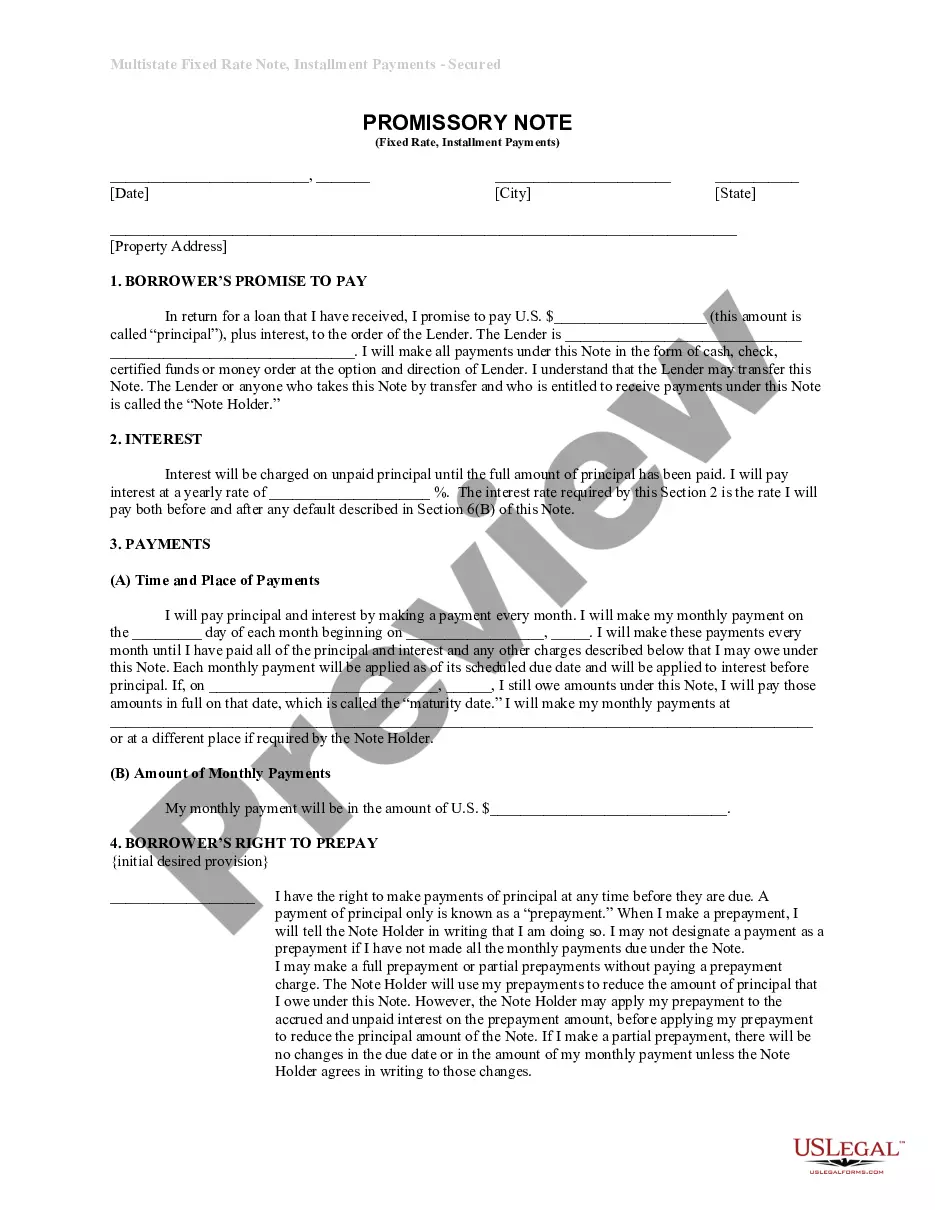

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Nassau Clauses Relating to Powers of Venture is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Nassau Clauses Relating to Powers of Venture. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Nassau Clauses Relating to Powers of Venture in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

How to Read a Term Sheet Investors: Those who are investing money into the business. Amount Raised: Total amount raised to date. Price Per Share: Price of each share. Pre-Money Valuation: Value of the company before investment. Capitalization: Company's shares multiplied by share price.

Venture Capital Legal Documents: Everything You Need to Know Different Documents in Venture Capital. Agreements. Stock purchase agreement. Voting agreement. Right of first refusal/co-sale agreement. Investors' rights agreement. Subscription agreement. Other Documents.

Investor Rights Agreement (IRA) Right of First Refusal / Co-Sale Agreement. Certificate of Incorporation. Venture Capital Financing Documents on AngelList.

The Stages of Venture Capital Financing The Seed Stage.The Startup Stage.The First Stage.The Expansion Stage.The Bridge Stage.

The key clauses of a term sheet can be grouped into four categories; deal economics, investor rights and protection, governance management and control, and exits and liquidity.

The answer varies from firm to firm, but most venture capital firms want to see most of the following: proprietary intellectual property. a large market size. management team members with expertise and experience. a scalable business model. the ability to exit for $50 million or more within 5 years.

Key elements of a VC term sheet Money raised. Your investor will likely require that you raise a minimum amount of money before they disburse their funds.Pre-money valuation.Non-participating liquidation preference. conversion to common.Anti-dilution provisions.The pay-to-play provision.Boardroom makeup.Dividends.

How To Raise Venture Capital Funding in 7 Steps 1 Determine Business Valuation. 2 Determine Funding Need. 3 Put Your Pitch Together. 4 Target Venture Capital Investors. 5 Negotiate. 6 Proceed Through Due Diligence. 7 Close The Deal. 8 Alternatives to Venture Capital.

5 Key Components To Help Your Business Attract Venture Capital Investors Unique Idea.Show Experience.Build a Strong, Dependable Team.Growth Potential.Defensible Business Model.

Protective provisions are terms that allow preferred shareholders to veto or block specific corporate actions. Protective provisions can help protect the interests of minority shareholders in the event that various shareholders disagree regarding the best course of action for the company.