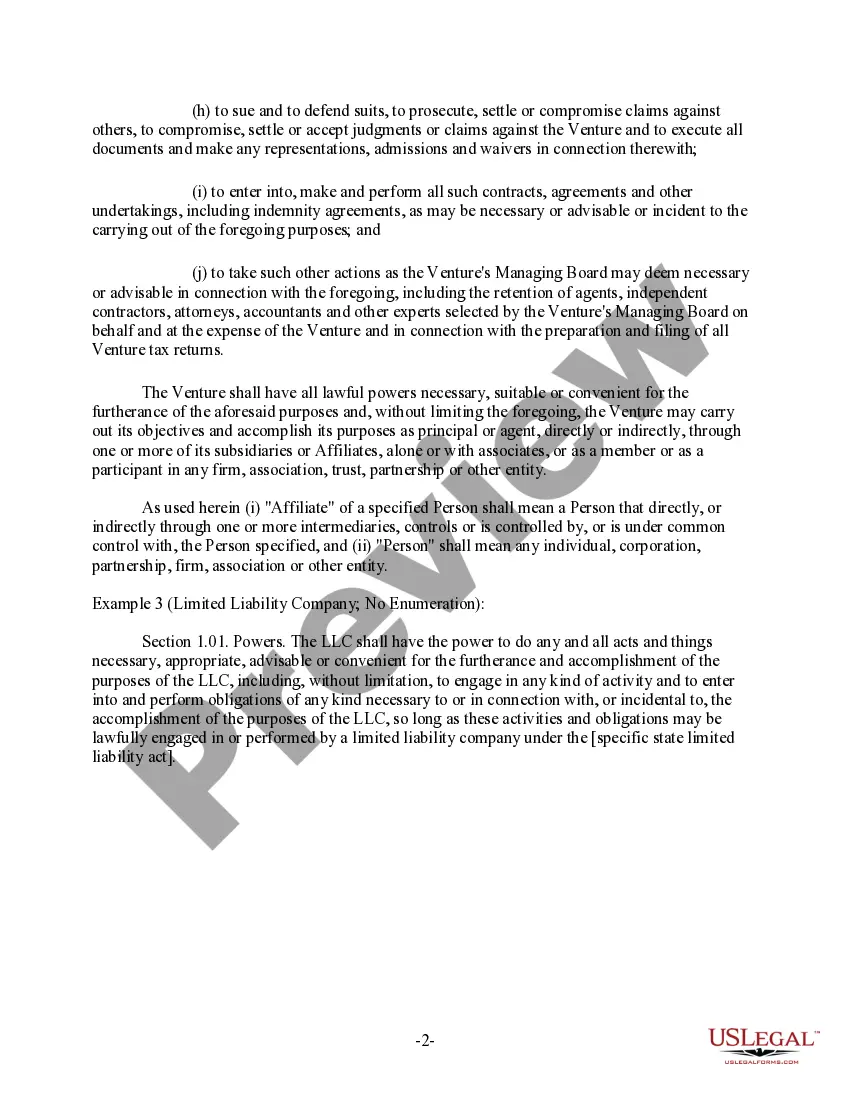

Suffolk New York Clauses Relating to Powers of Venture serve as crucial legal provisions in business agreements and contracts involving venture capital or investment partnerships. These clauses outline the powers and authorities granted to the venture capitalist or investment firm, as well as the rights and limitations imposed on the entrepreneur or startup seeking funding. Leveraging relevant keywords, here is a detailed description of Suffolk New York Clauses Relating to Powers of Venture: 1. Introduction: In Suffolk New York, clauses pertaining to the powers of venture are essential components of business agreements governing venture capital or investment partnerships. These clauses specify the rights and responsibilities of both the venture capitalist entity and the entrepreneur or startup in need of financing. 2. Scope and Purpose: The Suffolk New York Clauses Relating to Powers of Venture are designed to establish a clear framework for the exercise of powers within the venture capital relationship. These clauses allow the venture capitalist to influence strategic decisions and operational matters while also protecting the entrepreneur's interests. 3. Types of Clauses: a. Management-Related Clauses: — Board Representation: Determines the number of venture capital-appointed members on the startup's board of directors, ensuring an influential voice in crucial decisions. — Board Observer Rights: Allows the venture capitalist to attend board meetings without voting privileges, gaining insight into the company's operations and performance. — Key Decision Approval: Grants the venture capitalist the power to veto significant business actions or decisions, safeguarding their investment. b. Governance and Control Clauses: — Consents: Obliges the entrepreneur to seek prior written consent from the venture capitalist regarding any activities outlined in the agreement, ensuring alignment of interests. — Reserved Matters: Specifies a list of critical decisions that require the explicit approval or consultation of the venture capitalist, maintaining control over vital aspects of the business. — Deadlock Resolution Mechanisms: Defines procedures to resolve decision-making deadlocks between the venture capitalist and the entrepreneur, minimizing potential conflicts. c. Capital Control Clauses: — Capital Calls: Establishes the venture capitalist's authority to request additional capital from the entrepreneur to meet the business's financial needs. — Exit Rights: Outlines the conditions under which the venture capitalist can demand the entrepreneur to initiate an exit, such as through IPO, merger, or acquisition. — Liquidation Preferences: Determines the order of distribution of proceeds upon liquidation or sale, ensuring the venture capitalist achieves a favorable return on investment. 4. Legal Compliance: Suffolk New York Clauses Relating to Powers of Venture must comply with local laws and regulations governing partnership agreements and investments. Legal professionals specialized in New York venture capital law should be consulted when drafting or interpreting these clauses. In conclusion, Suffolk New York Clauses Relating to Powers of Venture are crucial contractual provisions that grant powers to the venture capitalist while also protecting the interests of the entrepreneur or startup seeking financing. These clauses cover various aspects such as management, governance, control, and capital, facilitating a balanced and mutually beneficial venture capital relationship.

Suffolk New York Clauses Relating to Powers of Venture serve as crucial legal provisions in business agreements and contracts involving venture capital or investment partnerships. These clauses outline the powers and authorities granted to the venture capitalist or investment firm, as well as the rights and limitations imposed on the entrepreneur or startup seeking funding. Leveraging relevant keywords, here is a detailed description of Suffolk New York Clauses Relating to Powers of Venture: 1. Introduction: In Suffolk New York, clauses pertaining to the powers of venture are essential components of business agreements governing venture capital or investment partnerships. These clauses specify the rights and responsibilities of both the venture capitalist entity and the entrepreneur or startup in need of financing. 2. Scope and Purpose: The Suffolk New York Clauses Relating to Powers of Venture are designed to establish a clear framework for the exercise of powers within the venture capital relationship. These clauses allow the venture capitalist to influence strategic decisions and operational matters while also protecting the entrepreneur's interests. 3. Types of Clauses: a. Management-Related Clauses: — Board Representation: Determines the number of venture capital-appointed members on the startup's board of directors, ensuring an influential voice in crucial decisions. — Board Observer Rights: Allows the venture capitalist to attend board meetings without voting privileges, gaining insight into the company's operations and performance. — Key Decision Approval: Grants the venture capitalist the power to veto significant business actions or decisions, safeguarding their investment. b. Governance and Control Clauses: — Consents: Obliges the entrepreneur to seek prior written consent from the venture capitalist regarding any activities outlined in the agreement, ensuring alignment of interests. — Reserved Matters: Specifies a list of critical decisions that require the explicit approval or consultation of the venture capitalist, maintaining control over vital aspects of the business. — Deadlock Resolution Mechanisms: Defines procedures to resolve decision-making deadlocks between the venture capitalist and the entrepreneur, minimizing potential conflicts. c. Capital Control Clauses: — Capital Calls: Establishes the venture capitalist's authority to request additional capital from the entrepreneur to meet the business's financial needs. — Exit Rights: Outlines the conditions under which the venture capitalist can demand the entrepreneur to initiate an exit, such as through IPO, merger, or acquisition. — Liquidation Preferences: Determines the order of distribution of proceeds upon liquidation or sale, ensuring the venture capitalist achieves a favorable return on investment. 4. Legal Compliance: Suffolk New York Clauses Relating to Powers of Venture must comply with local laws and regulations governing partnership agreements and investments. Legal professionals specialized in New York venture capital law should be consulted when drafting or interpreting these clauses. In conclusion, Suffolk New York Clauses Relating to Powers of Venture are crucial contractual provisions that grant powers to the venture capitalist while also protecting the interests of the entrepreneur or startup seeking financing. These clauses cover various aspects such as management, governance, control, and capital, facilitating a balanced and mutually beneficial venture capital relationship.