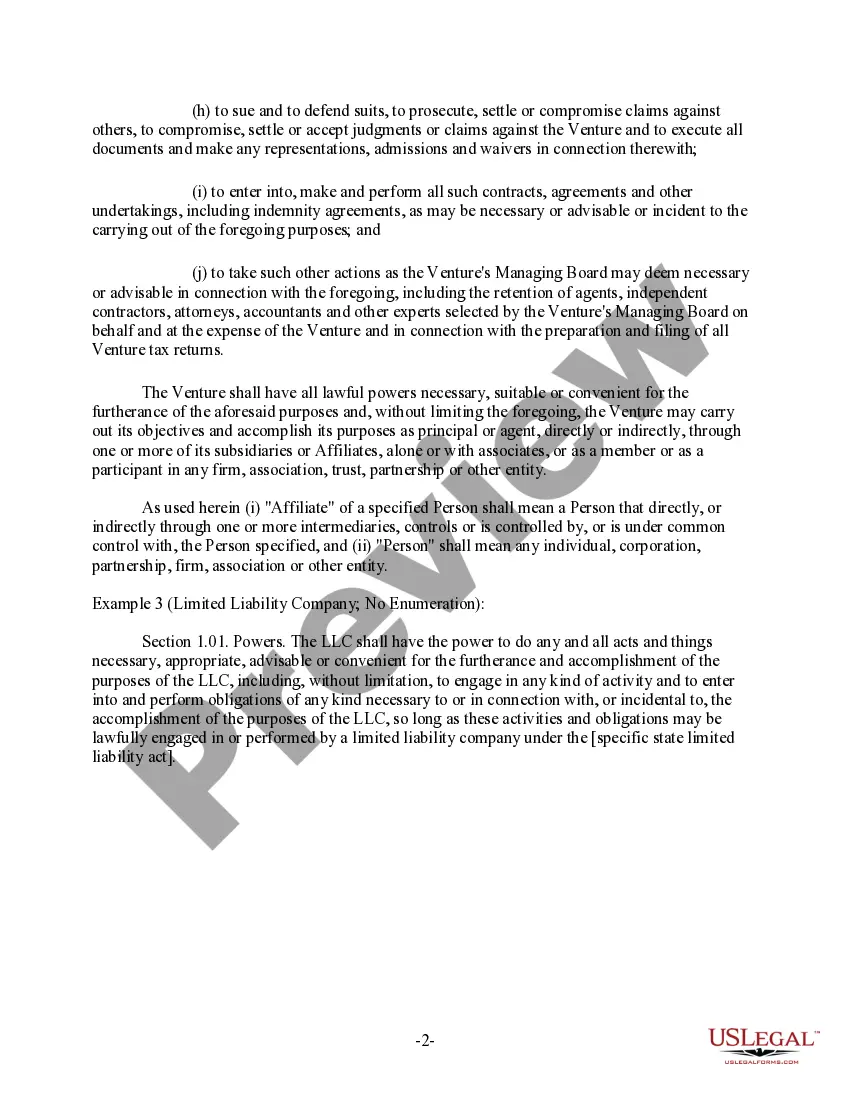

Wake North Carolina is a county located in the state of North Carolina, United States. It is known for its diverse economy, rich culture, and diverse natural landscapes. Within Wake County, there are specific legal clauses known as "Clauses Relating to Powers of Venture" which are important for businesses operating in the area. These clauses outline the powers and limitations of ventures or partnerships in Wake County, providing a legal framework for business operations. One of the key types of Wake North Carolina Clauses Relating to Powers of Venture is the "Limited Liability Clause." This clause outlines the limited liability protection afforded to business ventures in Wake County. It states that each individual partner or member of a venture is not personally liable for the debts and obligations of the venture beyond their initial investment. This protection helps ensure that individuals are shielded from financial risks beyond what they have agreed to contribute. Another important type of Wake North Carolina Clause Relating to Powers of Venture is the "Authority Clause." This clause lays out the decision-making power and authority within a venture. It defines who has the ability to make binding decisions on behalf of the venture, such as entering into contracts, acquiring assets, or negotiating partnerships. The clause may designate specific individuals or provide a hierarchical structure for decision-making. Additionally, Wake North Carolina also recognizes the "Dissolution Clause" in relation to powers of venture. This clause covers the process and circumstances under which a venture may be dissolved or terminated. It outlines the steps required for dissolution, such as a majority vote of the members or partners, and the distribution of assets and liabilities upon dissolution. The Dissolution Clause ensures that ventures can be terminated in an organized manner, protecting the interests of all involved parties. Furthermore, Wake North Carolina may have specific clauses related to the taxation and financial reporting requirements within a venture. These clauses aim to ensure compliance with state and federal tax regulations, as well as provide transparency in financial reporting. Overall, Wake North Carolina's Clauses Relating to Powers of Venture play a crucial role in providing a legal structure for business ventures within the county. These clauses protect the rights and interests of individuals involved in ventures, define decision-making authority, and outline the process for dissolution. By understanding and adhering to these clauses, businesses can navigate the legal landscape of Wake County, contributing to its thriving economy and vibrant community.

Wake North Carolina Clauses Relating to Powers of Venture

Description

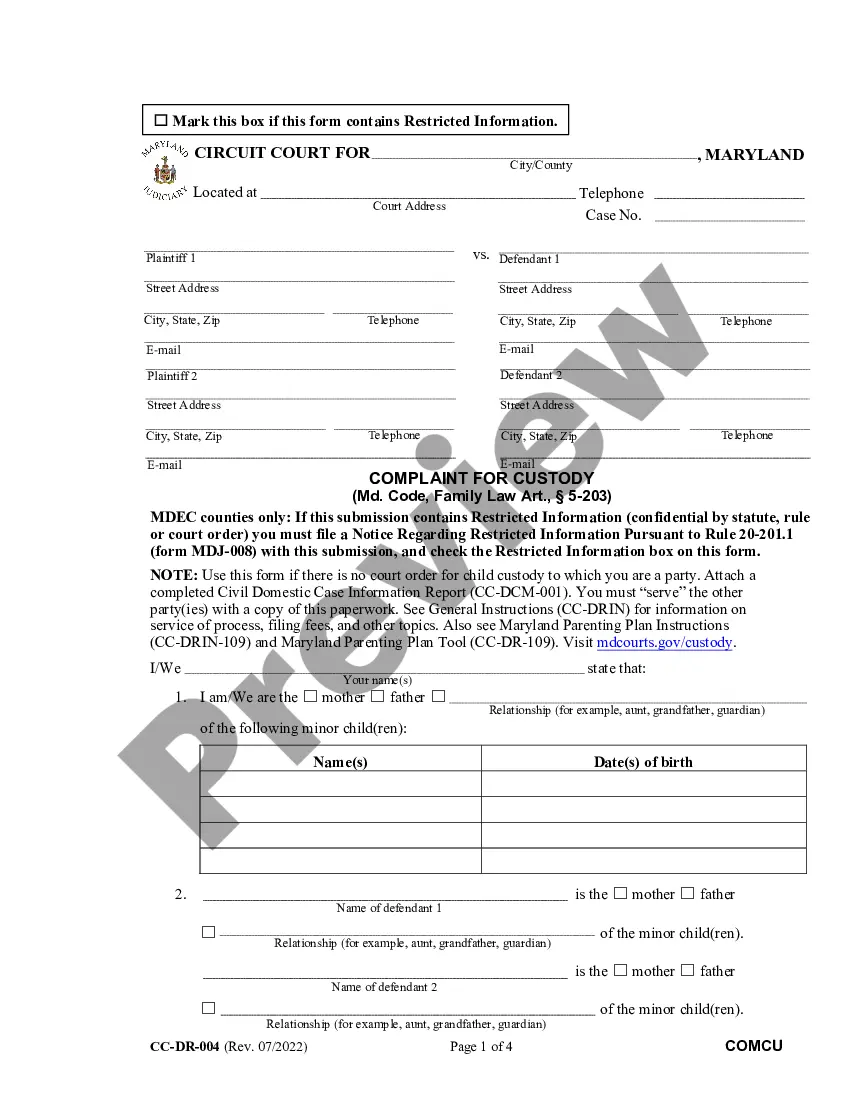

How to fill out Wake North Carolina Clauses Relating To Powers Of Venture?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business purpose utilized in your county, including the Wake Clauses Relating to Powers of Venture.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Wake Clauses Relating to Powers of Venture will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Wake Clauses Relating to Powers of Venture:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Wake Clauses Relating to Powers of Venture on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

What to look for in a term sheet Valuation: pre-money valuation vs. post-money valuation.Type of stock: common vs. preferred.Option pool. Option pool - an amount of equity reserved for future hires.Liquidation Preference.Participation rights.Pro-rata rights.Tag-along & drag-along rights.Anti-dilution provision.

Key elements of a VC term sheet Money raised. Your investor will likely require that you raise a minimum amount of money before they disburse their funds.Pre-money valuation.Non-participating liquidation preference. conversion to common.Anti-dilution provisions.The pay-to-play provision.Boardroom makeup.Dividends.

How to Read a Term Sheet Investors: Those who are investing money into the business. Amount Raised: Total amount raised to date. Price Per Share: Price of each share. Pre-Money Valuation: Value of the company before investment. Capitalization: Company's shares multiplied by share price.

A term sheet is an important document that is part of a tentative business deal. It is a summary of the terms and conditions of the tentative agreement. It is generally formatted as bullet points. It should be as detailed as possible so that the parties involved understand the information and are on the same page.

The key clauses of a term sheet can be grouped into four categories; deal economics, investor rights and protection, governance management and control, and exits and liquidity.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity.Securities being issued.Board rights.Investor protections.Dealing with shares.Miscellaneous provisions.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity.Securities being issued.Board rights.Investor protections.Dealing with shares.Miscellaneous provisions.

A venture capitalist (VC) is a private equity investor that provides capital to companies with high growth potential in exchange for an equity stake. This could be funding startup ventures or supporting small companies that wish to expand but do not have access to equities markets.

Few VCs use standard financial-analysis techniques to assess deals. The most commonly used metric is simply the cash returned from the deal as a multiple of the cash invested. Though VCs reject far more deals than they accept, they can be very aggressive when they spot a company they like.

With so many investment opportunities and start-up pitches, VCs often have a set of criteria that they look for and evaluate before making an investment. The management team, business concept and plan, market opportunity, and risk judgement all play a role in making this decision for a VC.