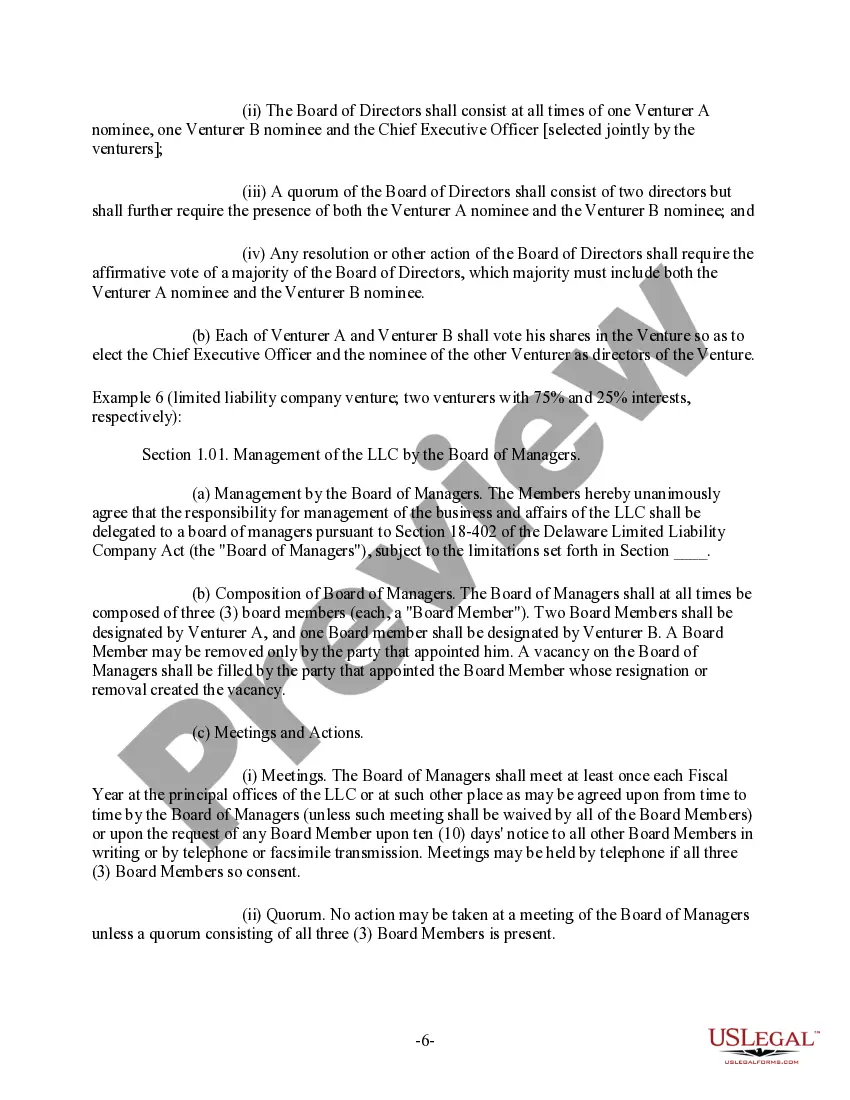

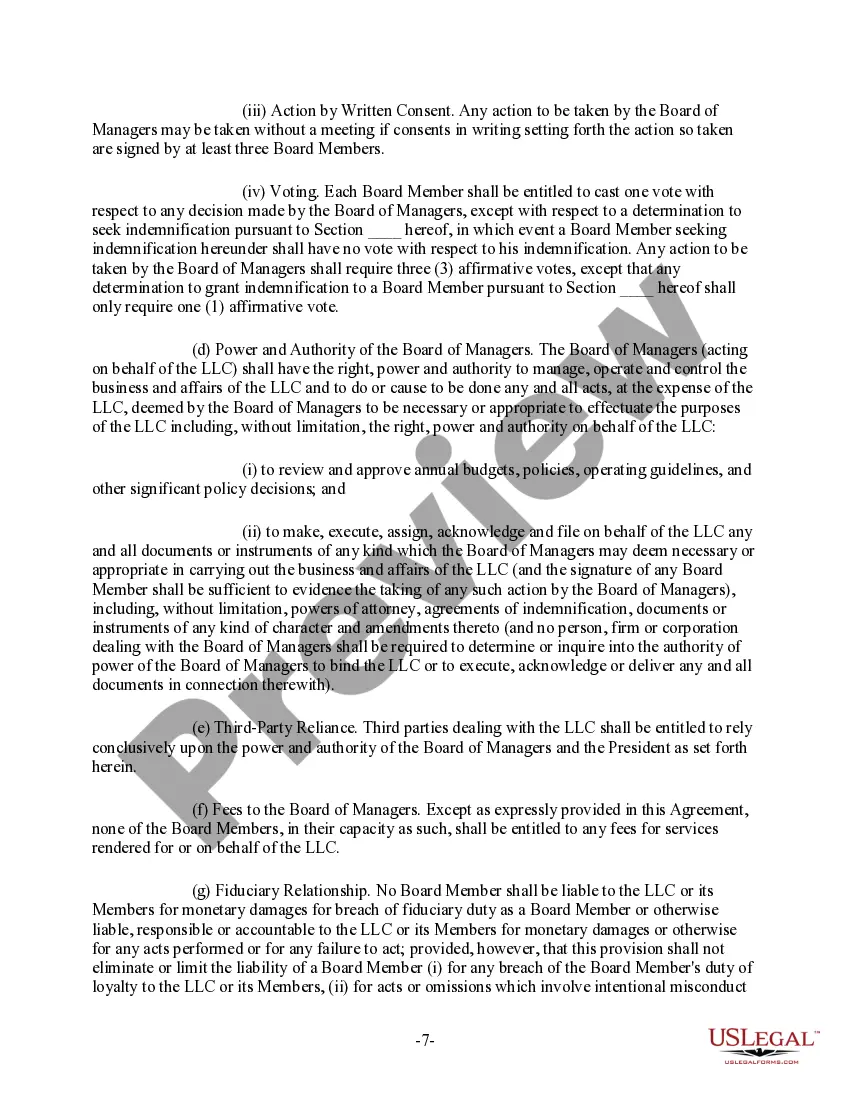

Chicago, Illinois is a vibrant city known for its thriving business landscape and entrepreneurial spirit. When it comes to the city's venture capital ecosystem, several clauses relating to the Chicago Illinois Venture Board are worth mentioning. These clauses outline the structure, functions, and responsibilities of various venture boards operating in the city. 1. Formation Clause: The formation clause establishes the legal framework for the Chicago Illinois Venture Board. It defines the board's purpose, membership criteria, and procedures for electing its members. 2. Composition Clause: The composition clause outlines the ideal representation on the board, highlighting the desired mix of industry experts, experienced entrepreneurs, venture capitalists, and other relevant stakeholders. It may also specify the number of seats reserved for different categories of members. 3. Governance Clause: The governance clause governs the decision-making process within the board. It outlines the frequency of meetings, quorum requirements, and voting procedures. It also sets rules for the appointment of chairpersons, committee formations, and the tenure of board members. 4. Investment Mandate Clause: The investment mandate clause defines the board's primary objective, including its investment focus and target sectors. It may outline the investment strategy, risk appetite, and desired returns, providing a blueprint for the board's investment decisions. 5. Deal Flow Clause: The deal flow clause sets expectations for the quantity and quality of investment opportunities that the board should consider. It may mention the sources of deal flow, such as partnerships with local accelerators, incubators, or other venture capital firms. 6. Due Diligence Clause: The due diligence clause defines the process and requirements for conducting thorough due diligence on potential investments. It may specify the key factors to consider, such as market analysis, management team evaluation, financial assessment, and legal review. 7. Reporting Clause: The reporting clause details the board's reporting obligations to its stakeholders, including the frequency and format of reporting. It may specify the provision of periodic financial statements, investment performance updates, and other relevant information to keep stakeholders informed. 8. Exit Strategy Clause: The exit strategy clause outlines the board's approach to realizing returns on investments. It may mention options such as initial public offerings (IPOs), mergers and acquisitions (M&A), or strategic partnerships and establish guidelines for timing and valuation expectations. 9. Conflict of Interest Clause: The conflict of interest clause addresses potential conflicts that may arise among board members or between the board and other entities. It establishes guidelines for disclosure, refusal, and ethical conduct to ensure transparency and integrity within the board. These clauses, among others, form the foundation of Chicago Illinois Venture Board's operations and provide a clear framework for decision-making, accountability, and success in driving the city's venture capital ecosystem.

Chicago Illinois Clauses Relating to Venture Board

Description

How to fill out Chicago Illinois Clauses Relating To Venture Board?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Chicago Clauses Relating to Venture Board, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various types varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how you can locate and download Chicago Clauses Relating to Venture Board.

- Go over the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Chicago Clauses Relating to Venture Board.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Chicago Clauses Relating to Venture Board, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional entirely. If you need to deal with an extremely difficult case, we recommend getting a lawyer to review your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork effortlessly!

Form popularity

FAQ

Contractor should have experience in providing services for a minimum of 3 years in respective field. Details of company information with organization structure, list of manpower with the CVs of key personnel, plant and machinery list mentioning year of manufacturing, support agencies, other facilities and resources.

The 3 Types of Contractors General Contractors. The term ?general contractor? is used in two ways, in my experience.Turn-Key (Specialty) Services. If you don't like the idea of paying someone to manage your schedules and hire sub-contractors, you can do this work yourself.Freelance Workers.

In general terms, a contractor is responsible for planning, leading, executing, supervising and inspecting a building construction project. The responsibility extends from the beginning to the end of the project, regardless of its scope.

Applicable Federal Acquisition Regulation (FAR) coverage is found in Subpart 9.1, which prescribes the policies, standards, and procedures for determining whether prospective contractors and subcontractors are responsible.

The requirements of a contract are consideration, offer and acceptance, legal purpose, capable parties, and mutual assent.

A federal government contractor is a person who enters into a contract, or is bidding on such a contract, with any agency or department of the United States government and is paid, or is to be paid, for services, material, equipment, supplies, land or buildings with funds appropriated by Congress.

The most important piece of legislation regulating federal contractors and grantees is the Drug-free Workplace Act of 1988 (PDF 204 KB).

Here's our list of the most essential construction traits that workers and contractors need to acquire to succeed in the industry. Physical Strength and Endurance.Dexterity and Hand-Eye Coordination.Building and Engineering Knowledge.Strong Reading and Math Skills.Memory.Communication.Experience with Technology.

Business regulations for federal contracting As a government contractor, you also must comply with labor standards statutes (Service Contract Act, Contract Work Hours, Safety Standards Act, and more), as well as other statutes, unless the contract states that a particular statute isn't applicable.

To be determined responsible, a contractor must: Have adequate financial resources to perform the contract, or the ability to obtain them. Be able to comply with the required or proposed delivery or performance schedule, taking into consideration all existing commercial and government business commitments.