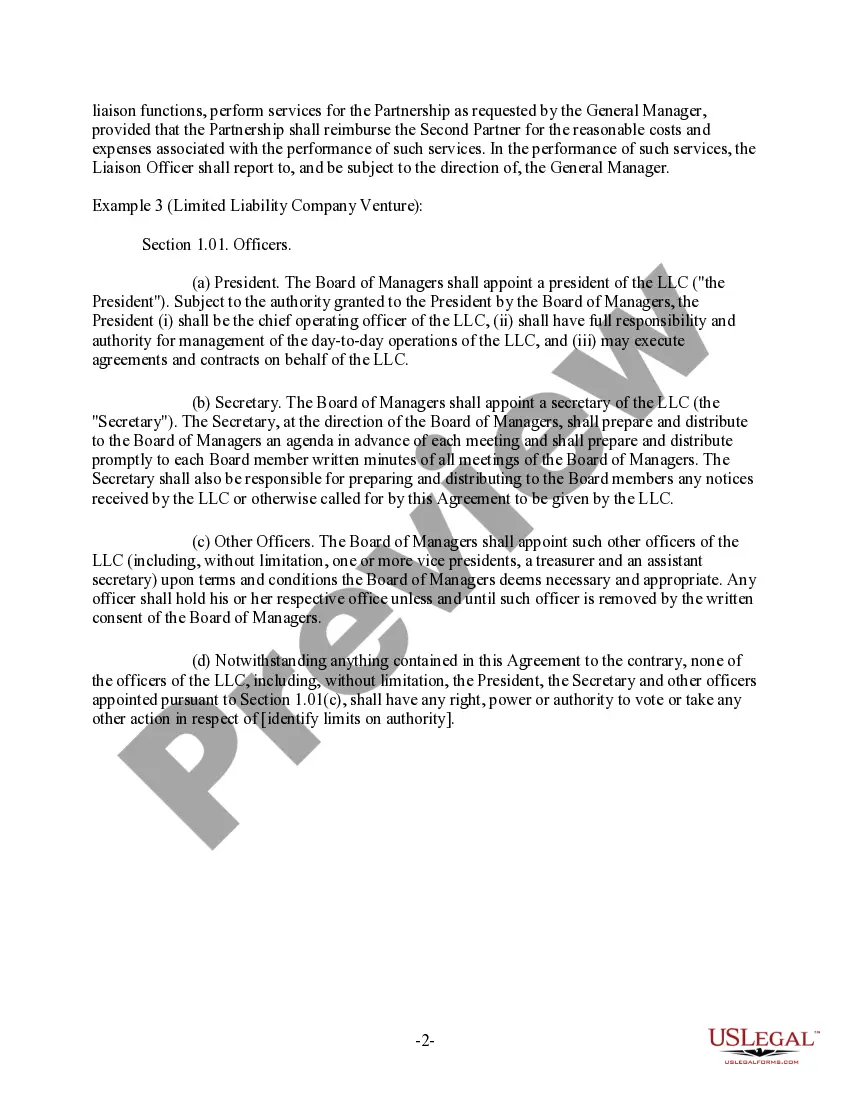

Cook Illinois Clauses Relating to Venture Officers: A Comprehensive Guide Introduction: Cook Illinois, a prestigious law firm specializing in corporate law, has developed specific clauses pertaining to Venture Officers. These clauses aim to govern the powers, duties, and responsibilities of officers within a venture capital-backed company. This article will provide an in-depth description of Cook Illinois Clauses Relating to Venture Officers, covering their types and importance in the corporate world. Relevant keywords include Cook Illinois, Venture Officers, clauses, corporate law, types. 1. Types of Cook Illinois Clauses Relating to Venture Officers: a) Duties and Powers Clause: This clause outlines the core responsibilities and authority vested in the Venture Officers. It defines their duties in accordance with the company's bylaws, ensuring they act in the best interest of the venture capital firm and its investors. b) Reporting and Disclosures Clause: This clause lays out the reporting obligations of the Venture Officers to the venture capital firm and other stakeholders. It mandates timely and accurate information disclosure regarding financials, strategic decisions, and any potential conflicts of interest. c) Term and Termination Clause: This clause stipulates the length of the Venture Officers' terms, including details on renewals or early termination. It may also address the termination process, specifying scenarios such as resignation, removal, or death. d) Non-Compete and Non-Disclosure Clause: To protect the venture capital firm's interests, this clause prevents Venture Officers from divulging sensitive information, engaging in direct competition, or soliciting investors or employees for their own gain during or after their tenure. e) Compensation and Equity Clause: This clause defines the compensation structure, including base salaries, bonuses, stock options, and equity grants, for Venture Officers. It ensures fair remuneration and aligns their interests with the success of the venture capital-funded company. 2. Importance of Cook Illinois Clauses Relating to Venture Officers: a) Legal Certainty: Cook Illinois Clauses provide legal certainty by setting clear expectations, rights, and obligations for Venture Officers. They ensure all parties involved understand their roles and boundaries, minimizing potential disagreements and legal disputes. b) Investor Protection: Venture capital firms rely on Cook Illinois Clauses to safeguard their investments by imposing certain restrictions on Venture Officers. These clauses prevent misuse of investor funds, unauthorized disclosure of sensitive company information, or conflicts of interest that could jeopardize the firm's interests. c) Governance Framework: Cook Illinois Clauses establish a robust governance framework for venture-backed companies. They create a transparent environment where Venture Officers are accountable for their actions, enhancing the overall corporate governance structure. d) Attracting and Retaining Top Talent: Clear clauses related to compensation, equity, and term agreements help attract high-caliber Venture Officers to join and lead venture capital-backed companies. These clauses ensure competitive compensation packages are in place while safeguarding the venture capital firm's interests in the long run. Conclusion: Cook Illinois Clauses Relating to Venture Officers play a critical role in establishing the framework, responsibilities, and protection for both venture capital firms and Venture Officers. They foster a cooperative and fruitful environment, enabling venture-backed companies to thrive while safeguarding the interests of all stakeholders. These clauses provide legal certainty, protect investments, establish governance, and attract top talent — all essential requirements for success in the dynamic world of venture capital funding.

Cook Illinois Clauses Relating to Venture Officers

Description

How to fill out Cook Illinois Clauses Relating To Venture Officers?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Cook Clauses Relating to Venture Officers, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you pick a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Cook Clauses Relating to Venture Officers from the My Forms tab.

For new users, it's necessary to make some more steps to get the Cook Clauses Relating to Venture Officers:

- Take a look at the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!