Travis Texas Clauses Relating to Venture Ownership Interests play a crucial role in structuring and governing the relationship between the venture partners or investors within business ventures established or operating in Travis County, Texas. These clauses provide legal provisions and guidelines that define the rights, obligations, and protections associated with ownership interests in a venture, ensuring a smooth and transparent partnership. There are several types of Travis Texas Clauses Relating to Venture Ownership Interests, each serving a unique purpose. Some of the most common ones include: 1. Share Transfer Provisions: These clauses outline the conditions and restrictions associated with transferring ownership interests or shares between partners or to third parties. They may include pre-emption rights, which grant existing partners the first right to purchase any offered shares to maintain ownership control. 2. Vesting and Earn-Out Clauses: These clauses govern the timing and conditions for the full ownership acquisition of a partner or investor's interest in the venture. Vesting typically involves a specific timeframe and milestones that must be met for an individual to fully claim their ownership portion. Earn-out clauses can be added to ensure fair compensation based on the venture's future performance. 3. Drag-Along and Tag-Along Rights: These clauses protect the interests of majority or minority owners in the event of a sale or transfer of the venture. Drag-along rights allow majority owners to compel minority owners to sell their shares if they receive an attractive offer from an external buyer. Conversely, tag-along rights enable minority owners to join in the sale and sell their shares on the same terms and conditions as the majority owners. 4. Anti-Dilution Provisions: These clauses protect investor ownership interests from dilution in the event of additional capital raises at lower valuations. They ensure that existing investors maintain their proportional ownership in the venture by providing mechanisms for adjusting their ownership percentage or receiving further shares. 5. Anti-Competition Clauses: These clauses prohibit venture partners or investors from engaging in competing businesses during the partnership or after its dissolution. They safeguard the venture's interests by preventing conflicts of interest and unfair competition. 6. Decision-Making and Voting Rights: These clauses determine the decision-making process within the venture, including voting rights of partners or investors. They outline the requirements for majority or super majority approvals for significant matters, ensuring important decisions are made with the consensus of the ownership base. It is crucial for businesses operating or considering investments in Travis County, Texas, to have a thorough understanding of these Travis Texas Clauses Relating to Venture Ownership Interests. Engaging legal professionals specializing in venture law can help ensure that these clauses are properly drafted and customized to the specific needs and goals of the venture, protecting the interests of all stakeholders involved.

Travis Texas Clauses Relating to Venture Ownership Interests

Description

How to fill out Travis Texas Clauses Relating To Venture Ownership Interests?

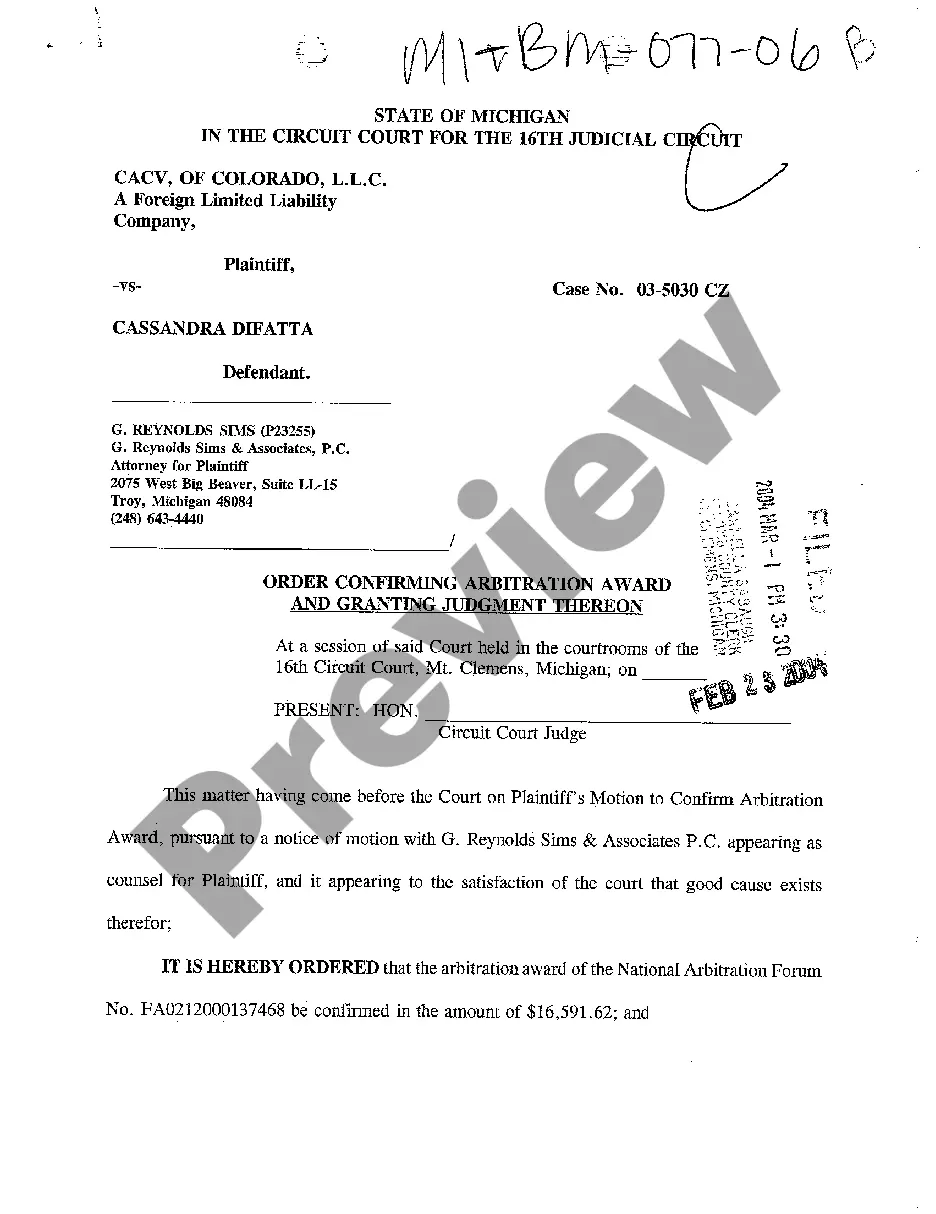

Draftwing paperwork, like Travis Clauses Relating to Venture Ownership Interests, to take care of your legal affairs is a difficult and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can take your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms intended for various scenarios and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Travis Clauses Relating to Venture Ownership Interests form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Travis Clauses Relating to Venture Ownership Interests:

- Ensure that your document is specific to your state/county since the regulations for writing legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Travis Clauses Relating to Venture Ownership Interests isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and get the document.

- Everything looks great on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

Generally, a joint venture consists of each of the following characteristics: The parties undertaking the joint venture are legally independent, with the exception of the work they do together during this collaboration. The parties set out to accomplish a specific, mutually beneficial goal.

Since the joint venture is not a legal entity, it does not enter into contracts, hire employees, or have its own tax liabilities. These activities and obligations are handled through the co-venturers directly and are governed by contract law.

Sections of a Joint Venture Contract The formation of the venture. The business name of the venture. The purpose of the joint venture. All parties contributions. The profit distribution. The management set up. Parties responsibilities. No-exclusivity clause.

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance.

A joint venture is not a partnership or a corporation, although some legal aspects of a joint venture (such as income tax treatment) may be ruled by partnership laws. Joint ventures are widely used to gain entrance into foreign markets.

A joint venture can be incorporated as a limited liability company under the Companies Act or a limited liability partnership (LLP) under the Limited Liability Partnership Act 2008.

Spouses electing qualified joint venture status are treated as sole proprietors for Federal tax purposes. The spouses must share the businesses' items of income, gain, loss, deduction, and credit. Therefore, the spouses must take into account the items in accordance with each spouse's interest in the business.

A joint venture (JV) is a business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task. This task can be a new project or any other business activity. In a JV, each of the participants is responsible for profits, losses, and costs associated with it.

The following is included in a Joint Venture Agreement: Business location. The type of joint venture. Venture details, such as its name, address, purpose, etc. Start and end date of the joint venture. Venture members and their capital contributions. Member duties and obligations. Meeting and voting details.

A joint venture (JV) is a business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task. They are a partnership in the colloquial sense of the word but can take on any legal structure.