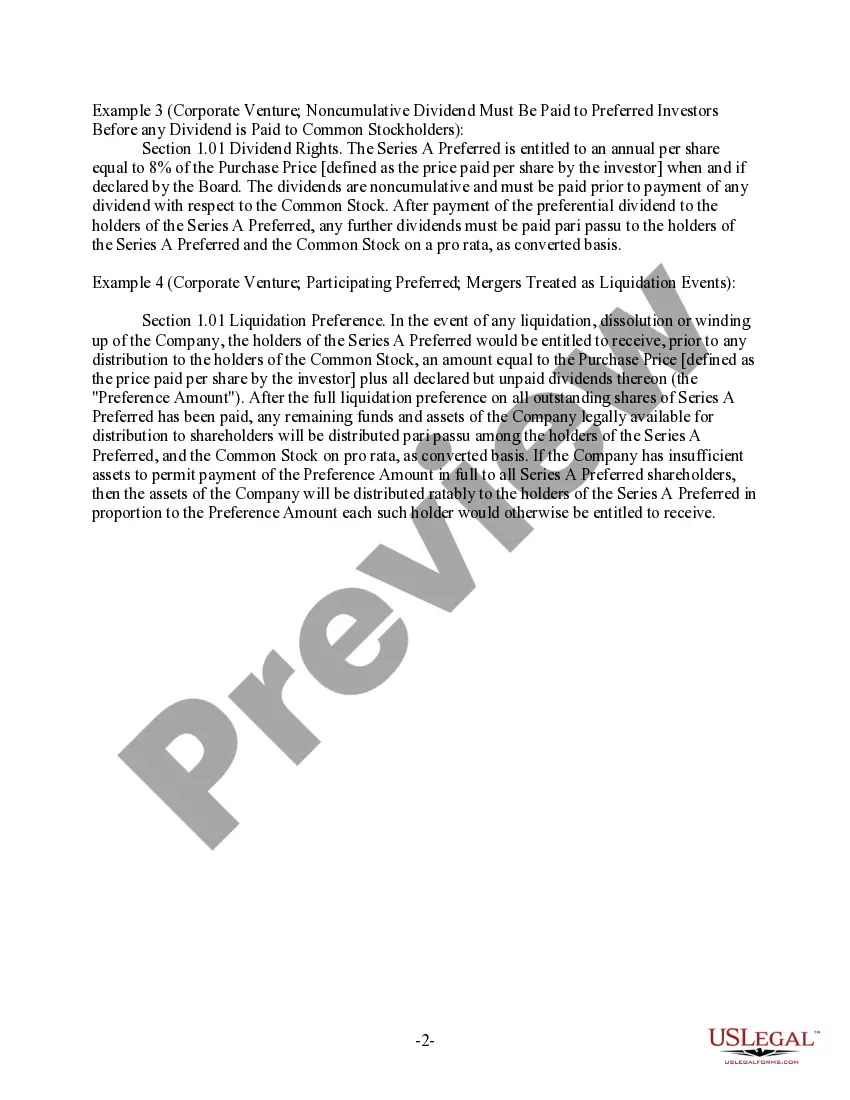

Allegheny Pennsylvania is a county located in the southwestern part of the state. It is home to the city of Pittsburgh, known for its vibrant arts scene, extensive park system, and rich industrial history. Allegheny County encompasses various municipalities, each contributing to the diverse tapestry of the region. When it comes to clauses relating to preferred returns, Allegheny Pennsylvania offers several options for investors and businesses looking to maximize their financial gains. These clauses are commonly found in partnership or operating agreements and dictate the way profits and losses are allocated among different parties involved in a venture. Preferred returns clauses provide investors or certain parties with priority access to profits before others receive a payout. Here are a few types of Allegheny Pennsylvania clauses relating to preferred returns: 1. Simple Preferred Return Clause: This type of clause ensures that preferred investors receive a specific percentage of the profits before other equity owners are entitled to a distribution. For instance, the clause could guarantee a 10% annual preferred return to investors before any other distributions are made. 2. Cumulative Preferred Return Clause: In this scenario, if the preferred return is not fully met in a particular year, the unpaid amount accumulates and becomes a priority payment in subsequent profitable years. This guarantees that investors will eventually receive their preferred return, even if the business faces temporary losses. 3. Non-Cumulative Preferred Return Clause: Unlike the cumulative clause, this type does not allow any unpaid preferred returns to accumulate. If the preferred return is not met in a given year, the opportunity to receive that portion of the return is forfeited. This clause may be advantageous for businesses that need flexibility in distributing profits. 4. Preferred Return Hurdle Clause: This type of clause sets a certain profit threshold that needs to be achieved before the preferred return is triggered. For example, a preferred return might only be applicable if the business achieves a specific minimum annual profit margin. This clause protects the business from guaranteeing a preferred return during less profitable years. 5. Negotiated Preferred Return Clause: This clause allows parties involved in the agreement to negotiate the terms of the preferred return according to their specific requirements and risk tolerance. It provides flexibility to adapt the preferred return structure to the unique needs of the investment opportunity. In conclusion, Allegheny Pennsylvania offers various types of clauses relating to preferred returns for investors and businesses. These clauses, such as simple preferred return, cumulative preferred return, non-cumulative preferred return, preferred return hurdle, and negotiated preferred return, enable parties to establish favorable profit allocation strategies while accounting for potential risks and expectations.

Allegheny Pennsylvania Clauses Relating to Preferred Returns

Description

How to fill out Allegheny Pennsylvania Clauses Relating To Preferred Returns?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life scenario, finding a Allegheny Clauses Relating to Preferred Returns meeting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the Allegheny Clauses Relating to Preferred Returns, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Allegheny Clauses Relating to Preferred Returns:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Allegheny Clauses Relating to Preferred Returns.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

To calculate the preferred return amount, multiply the total equity investment from limited partners by the preferred return percentage. If the preferred return is 8% and limited partners invested $1 million, the annual preferred return is $80,000 (0.08 $1,000,000).

The preferred return, or hurdle rate, is basically a minimum annual return that the limited partners are entitled to before the general partners may begin receiving carried interest. If there is a hurdle, the rate is typically around 8%.

To calculate the preferred return amount, multiply the total equity investment from limited partners by the preferred return percentage. If the preferred return is 8% and limited partners invested $1 million, the annual preferred return is $80,000 (0.08 $1,000,000).

A preferred return of 8% means the first 8% of distributions must first be paid to the investor, and any distributions above the 8% follows a split or waterfall as dictated by the operating agreement (be sure to always read this agreement very closely).

Preferred Return - Excel Waterfall Model - Up to 10 Years - YouTube YouTube Start of suggested clip End of suggested clip This is just simply saying okay the investor is gonna get X percent of of return on their equityMoreThis is just simply saying okay the investor is gonna get X percent of of return on their equity each year and that's not an internal rate of return preferred.

A preferred returnsimply called prefdescribes the claim on profits given to preferred investors in a project. The preferred investors will be the first to receive returns up to a certain percentage, generally 8 to 10 percent.

A preferred return in private real estate investing is the minimum return an investor must receive before an investment manager can earn a performance fee. The preferred return is typically between 6% to 9% in real estate investing, depending on the risk of the investment.

A preferred return is a profit distribution preference whereby profits, either from operations, sale, or refinance, are distributed to one class of equity before another until a certain rate of return on the initial investment is reached.

A preferred return is a profit distribution preference whereby profits, either from operations, sale, or refinance, are distributed to one class of equity before another until a certain rate of return on the initial investment is reached.