Chicago, Illinois is a vibrant city located in the heart of the Midwest region of the United States. Known for its rich history, stunning architecture, diverse culture, and thriving economy, Chicago is a popular destination for both tourists and investors. In the realm of investment, one concept that is often discussed is the Chicago Illinois Clauses Relating to Preferred Returns. Preferred returns, in general, refer to a contractual arrangement between investors and investment managers, determining the order in which profits are distributed. In the context of Chicago, Illinois, there are various types of clauses relating to preferred returns that play a significant role in investment agreements. Let's explore a few of them. 1. Basic Preferred Return Clause: This clause ensures that investors receive a specified rate of return on their investment before any profits are distributed to other parties. The basic preferred return clause establishes a minimum threshold, often expressed as a percentage or a certain amount of money, that must be achieved before additional profits are shared. 2. Accelerated Preferred Return Clause: The accelerated preferred return clause allows investors to receive a higher rate of return until a predetermined hurdle rate is met. Once this hurdle rate is reached, the profits may be distributed differently, often resulting in a reduced preferred return or a sharing of profits between investors and managers at a different ratio. 3. Catch-Up Preferred Return Clause: A catch-up preferred return clause is used when investment managers are entitled to a portion of the profits after the investors have received their preferred return. This clause allows the managers to "catch up" and receive a more substantial share until a predetermined percentage of the total profits is reached. Afterward, the distribution of profits may revert to a predetermined ratio. 4. Tiered Preferred Return Clause: A tiered preferred return clause establishes different levels or tiers of preferred returns based on the level of profitability achieved. In this structure, the rate of preferred return may vary depending on the performance of the investment. For example, if the investment reaches a certain profitability threshold, the preferred return rate might increase. 5. Preferred Return "Waterfall" Clause: A preferred return waterfall clause outlines the order in which profits are distributed among various parties. It details how the returns are divided, starting with preferred returns and then moving towards the distribution of profits to other stakeholders, such as managers or sponsors. These Chicago Illinois Clauses Relating to Preferred Returns are crucial elements of investment agreements, providing a framework for how profits are shared among investors and managers in the dynamic financial landscape of Chicago. They ensure transparency, equity, and appropriate compensation for the parties involved. Understanding these clauses is essential for both seasoned investors and those looking to explore investment opportunities in the vibrant city of Chicago, Illinois.

Chicago Illinois Clauses Relating to Preferred Returns

Description

How to fill out Chicago Illinois Clauses Relating To Preferred Returns?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any personal or business objective utilized in your region, including the Chicago Clauses Relating to Preferred Returns.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Chicago Clauses Relating to Preferred Returns will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Chicago Clauses Relating to Preferred Returns:

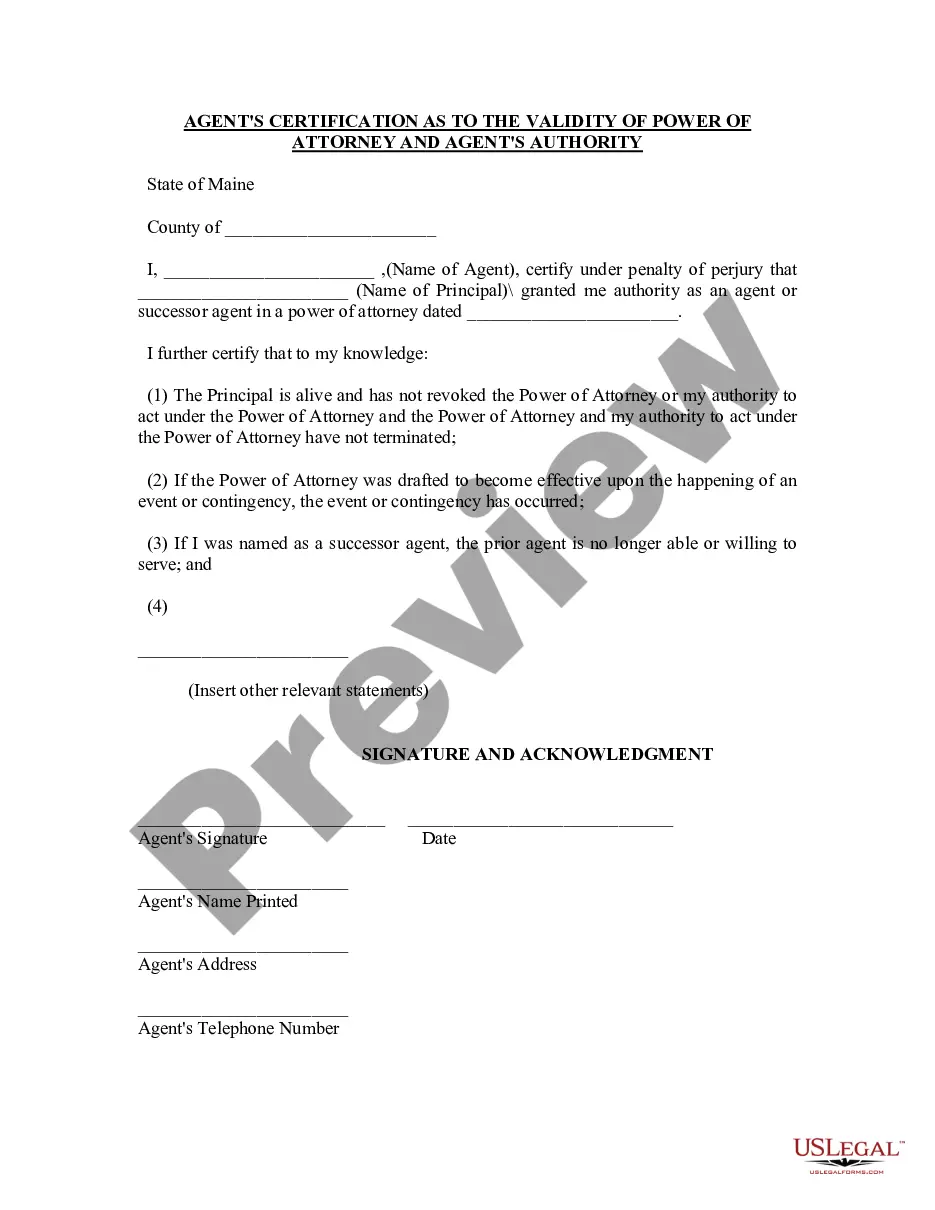

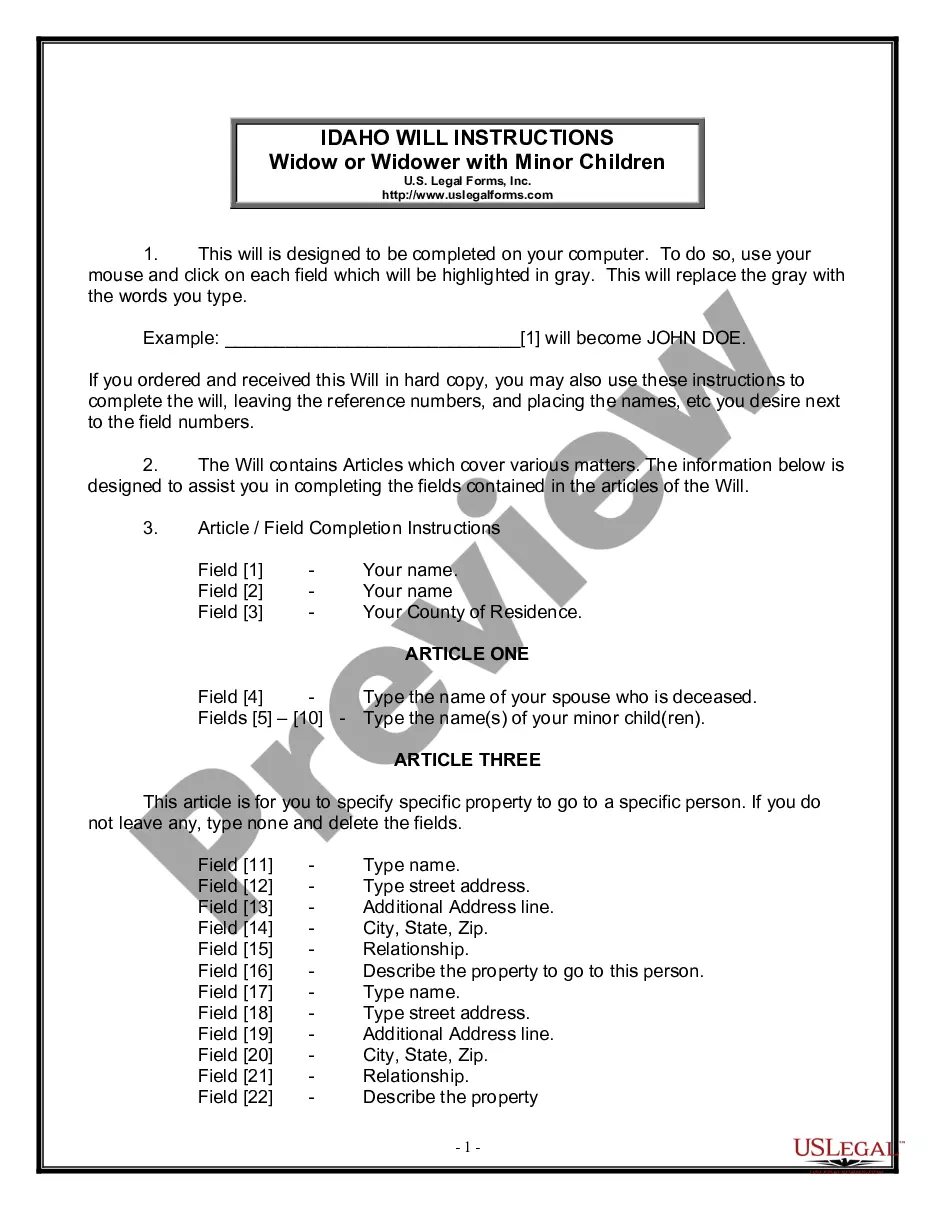

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Chicago Clauses Relating to Preferred Returns on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!