Title: Understanding Harris Texas Clauses Relating to Preferred Returns Introduction: In Harris County, Texas, investors and businesses often come across clauses relating to preferred returns within various legal agreements. These clauses have a direct impact on the distribution of profits or returns to preferred investors. This article aims to provide a detailed description of what Harris Texas Clauses Relating to Preferred Returns entail, including different types that may be encountered. Key Points: 1. Definition of Preferred Returns: Preferred returns refer to the minimum rate of return agreed upon by investors and sponsors in a business venture or investment project. These returns are typically provided to preferred investors before other shareholders or investors receive their share of profits. 2. Role of Harris Texas Clauses Relating to Preferred Returns: To protect the rights and interests of preferred investors, clauses related to preferred returns are included in legal agreements or contracts. These clauses outline the specific terms and conditions governing the preferred returns and address various scenarios that may arise during the investment period. Types of Harris Texas Clauses Relating to Preferred Returns: 1. Simple Preferred Return Clause: This type of clause ensures that preferred investors receive a fixed percentage of return on their investment before other participants. For example, a simple preferred return clause might state that preferred investors receive an 8% annual return on their investment before any distribution is made to other stakeholders. 2. Cumulative Preferred Return Clause: With a cumulative preferred return clause, any unpaid preferred returns from previous periods accumulate and must be paid before other participants receive distributions or profits. This type of clause benefits preferred investors by ensuring they receive all unpaid returns before others are entitled to profits. 3. Catch-Up Preferred Return Clause: In some cases, the sponsor or general partner agrees to allow the preferred investors to catch up on any previously unpaid preferred returns. This catch-up provision ensures that preferred investors receive their full preferred returns early in the investment period, so they can "catch up" to the other participants and share subsequent profits equally. 4. Carried Interest Preferred Return Clause: Carried interest refers to the share of profits received by the sponsor or general partner above a certain threshold. With this clause, preferred investors may benefit from receiving their preferred return before the sponsor or general partner is entitled to any carried interest. Conclusion: Understanding Harris Texas Clauses Relating to Preferred Returns is essential for investors and stakeholders involved in business ventures or investment projects. These clauses define the terms and conditions for distributing returns to preferred investors, ensuring their rights and interests are protected. The types of preferred return clauses, such as simple, cumulative, catch-up, and carried interest, vary in their specific provisions and should be carefully reviewed in legal agreements to ensure all parties are aware of their entitlements.

Harris Texas Clauses Relating to Preferred Returns

Description

How to fill out Harris Texas Clauses Relating To Preferred Returns?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to draft Harris Clauses Relating to Preferred Returns without expert help.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Harris Clauses Relating to Preferred Returns by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Harris Clauses Relating to Preferred Returns:

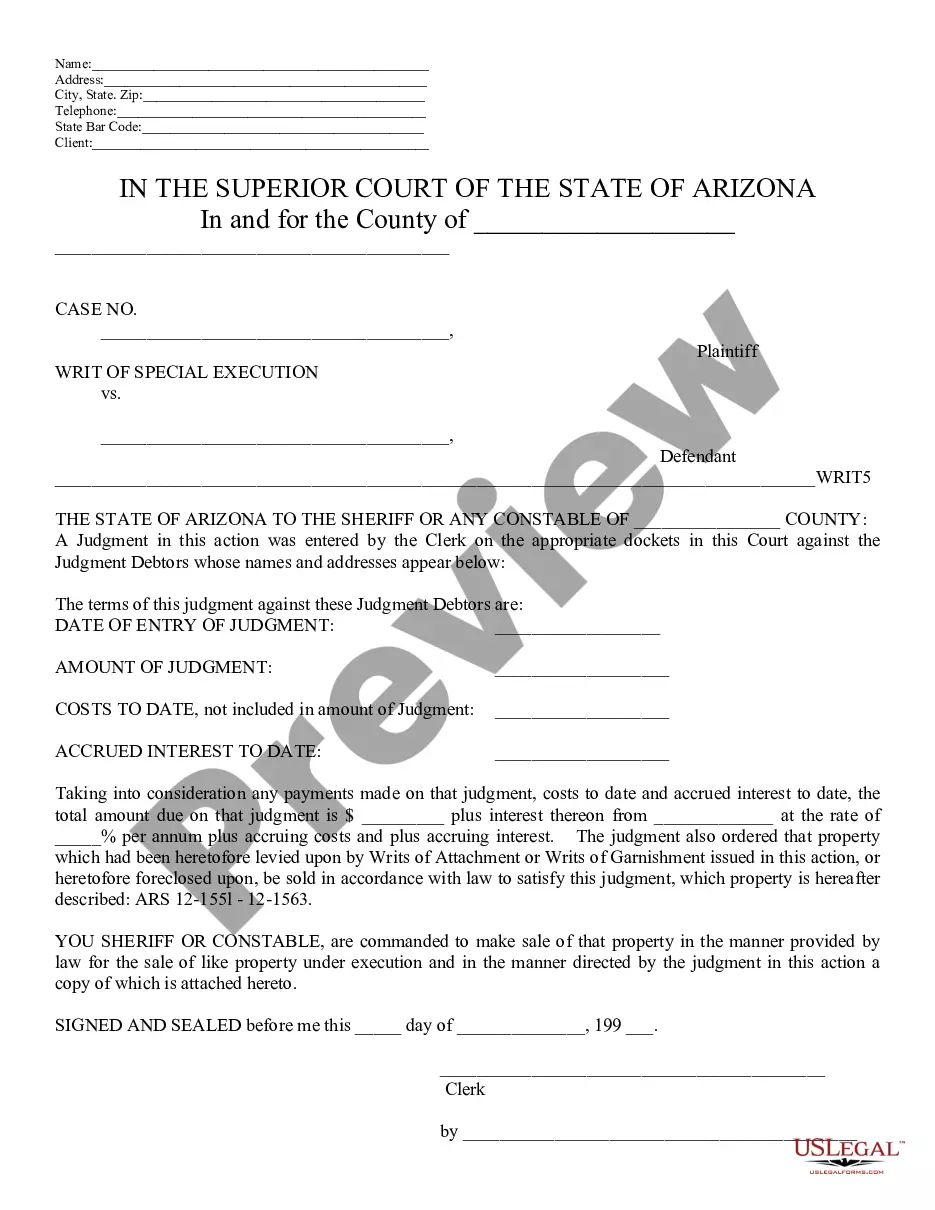

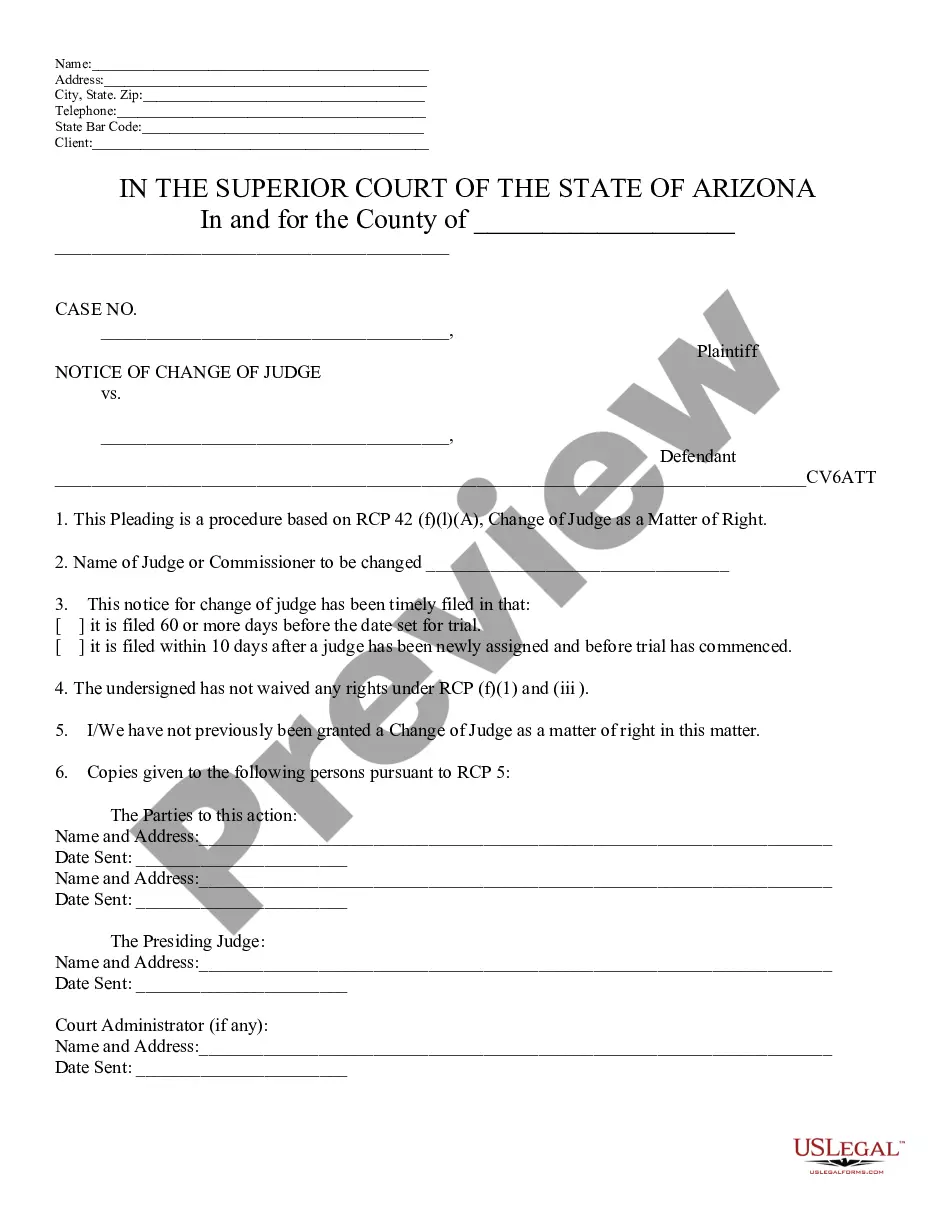

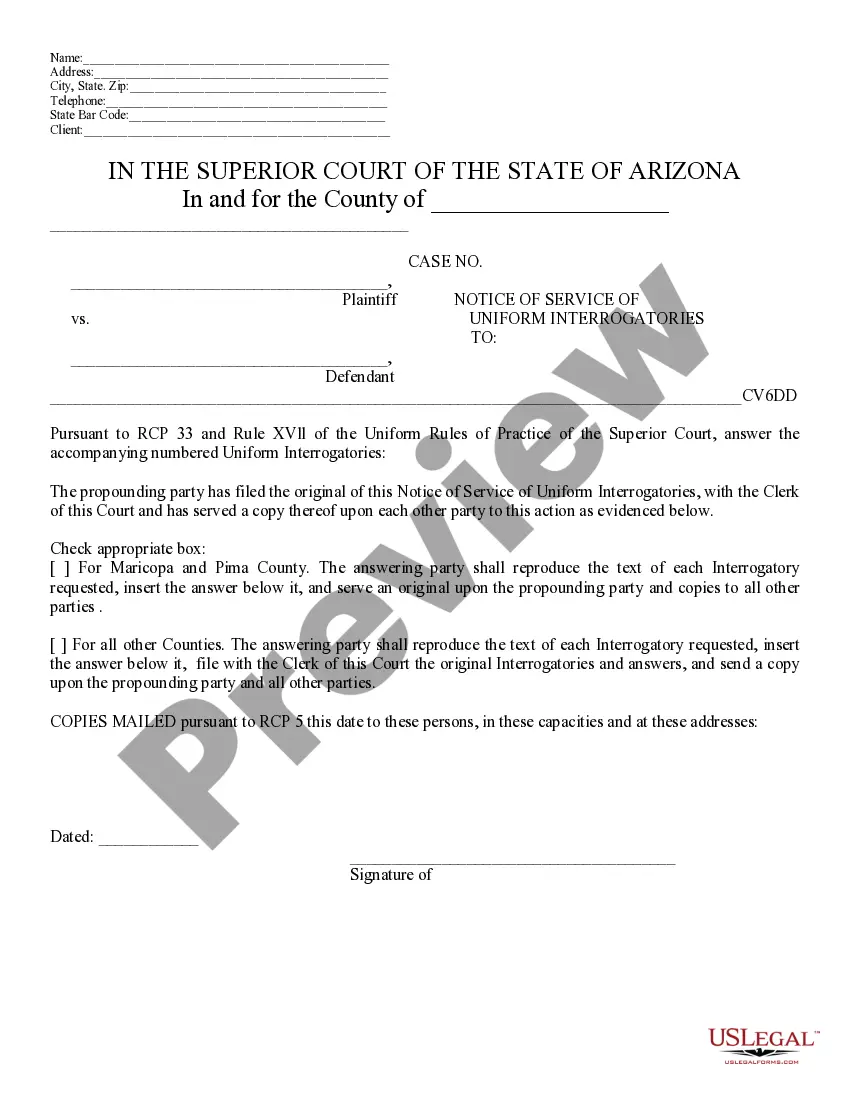

- Examine the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a couple of clicks!