Kings New York Clauses Relating to Preferred Returns: Explained In real estate investment, Kings New York Clauses Relating to Preferred Returns play a crucial role, providing clarity and protection for both investors and developers. These clauses are designed to ensure that preferred returns are honored, creating a favorable investment environment. Let's dive deeper into the details of what Kings New York Clauses Relating to Preferred Returns entail, discussing their types and significance. What are Preferred Returns? Preferred returns, commonly referred to as "pref" returns, refer to a predetermined minimum rate of return that investors receive before the developers or sponsors can share in the profits generated by a real estate project. These returns are usually expressed as a percentage of the initial investment or as a predetermined annual return. Types of Kings New York Clauses Relating to Preferred Returns: 1. Fixed Preferred Return Clause: The fixed preferred return clause guarantees investors a predetermined fixed percentage of return on their investment. For example, if the fixed preferred return is set at 8%, the investors receive the first 8% of the profits generated by the project before the developers can claim their share. 2. Cumulative Preferred Return Clause: Under a cumulative preferred return clause, any unpaid preferred returns carry forward to subsequent periods until investors receive their full preferred return amount. This clause ensures that investors are not excluded from their preferred returns for extended periods, enhancing their confidence in the investment. 3. Non-Cumulative Preferred Return Clause: Unlike the cumulative clause, the non-cumulative preferred return clause does not carry forward any unpaid preferred returns. If the project fails to generate sufficient profits to meet the preferred return in a particular period, the investors forego that portion, and the developers are not obligated to make up for the shortfall in subsequent periods. Significance of Kings New York Clauses Relating to Preferred Returns: — Investor Protection: These clauses provide assurance to investors that they will receive a specified return on their investment, enhancing their trust and confidence in the project and developers. — Clarity and Transparency: By clearly defining the preferred return structure, these clauses promote transparency and eliminate any ambiguity related to profit distribution between developers and investors. — Risk Mitigation: Preferred returns act as a risk-mitigating measure for investors, offering them a level of security even during challenging market conditions or if the project underperforms. — Attracting Capital: Developers incorporating Kings New York Clauses Relating to Preferred Returns in their investment offerings can attract a larger pool of investors, as the clearly outlined returns make the investment opportunity more enticing. In summary, Kings New York Clauses Relating to Preferred Returns are essential components of real estate investment agreements. They safeguard the interests of investors while promoting transparency and trust between investors and developers. Fixed, cumulative, and non-cumulative clauses are some key types of preferred return clauses used in Kings New York agreements. Ultimately, these clauses provide clarity, protection, and enhanced confidence to ensure successful and rewarding real estate investments.

Kings New York Clauses Relating to Preferred Returns

Description

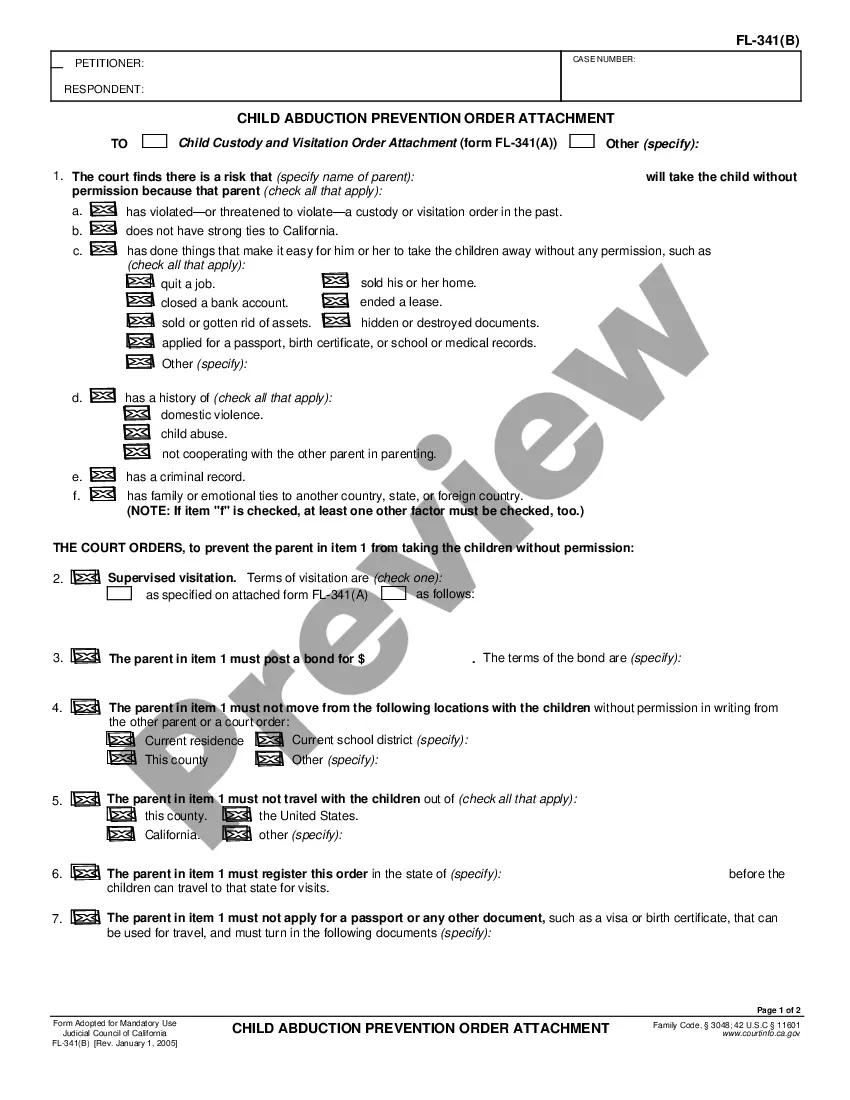

How to fill out Kings New York Clauses Relating To Preferred Returns?

If you need to get a trustworthy legal form supplier to get the Kings Clauses Relating to Preferred Returns, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support make it easy to find and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to look for or browse Kings Clauses Relating to Preferred Returns, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Kings Clauses Relating to Preferred Returns template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less pricey and more affordable. Set up your first company, organize your advance care planning, draft a real estate agreement, or complete the Kings Clauses Relating to Preferred Returns - all from the convenience of your home.

Join US Legal Forms now!