Maricopa, Arizona: Understanding Clauses Relating to Preferred Returns When it comes to real estate investment in Maricopa, Arizona, it is crucial to familiarize yourself with various clauses associated with preferred returns. Preferred returns refer to the specific rate of return that limited partners or investors receive before general partners or sponsors can participate in the profits from an investment project. These clauses are employed to ensure fairness and incentivize investors to participate in some riskier aspects of a venture. Let's explore the different types of Maricopa, Arizona clauses relating to preferred returns: 1. Cumulative Preferred Return Clause: In Maricopa, the cumulative preferred return clause guarantees that limited partners receive their preferred return before any profit distribution takes place. This type of clause accumulates any unpaid preferred returns to be eventually paid out to investors when the investment project starts generating profits. Cumulative clauses offer security to investors by ensuring they receive their entitled returns, regardless of the project's current profitability. 2. Non-Cumulative Preferred Return Clause: Unlike cumulative clauses, non-cumulative preferred return clauses do not accumulate unpaid returns. Instead, they specify that limited partners must receive their preferred return distributions before profit distributions are made, but only for the current period. If the project fails to generate sufficient profits to fulfill the preferred returns for a specific period, the shortfall is not carried forward to future periods. 3. Compounding Preferred Return Clause: Under this clause, any unpaid preferred returns accumulate over time and compound in subsequent periods. This ensures that limited partners receive their preferred return entitlements along with the compounded unpaid amounts before general partners receive their share. Compounding clauses provide a higher overall return to investors, especially if the project encounters delays or temporary non-profitability. 4. Preferred Return Carried Interest Clause: In some cases, Maricopa, Arizona clauses relating to preferred returns may include a carried interest structure. This clause specifies that general partners or sponsors can receive compensation in the form of additional profits from future profits after limited partners have received their preferred returns. The structure incentivizes general partners to strive for higher profits to maximize their own share, aligning their interests with limited partners. Understanding these different types of contractual clauses relating to preferred returns is essential for real estate investors in Maricopa, Arizona. By considering such clauses, investors can effectively evaluate investment opportunities, assess risk profiles, and determine the potential returns on their investments. It is advisable to consult legal professionals or experienced real estate advisors to ensure proper interpretation and implementation of these clauses in investment agreements.

Maricopa Arizona Clauses Relating to Preferred Returns

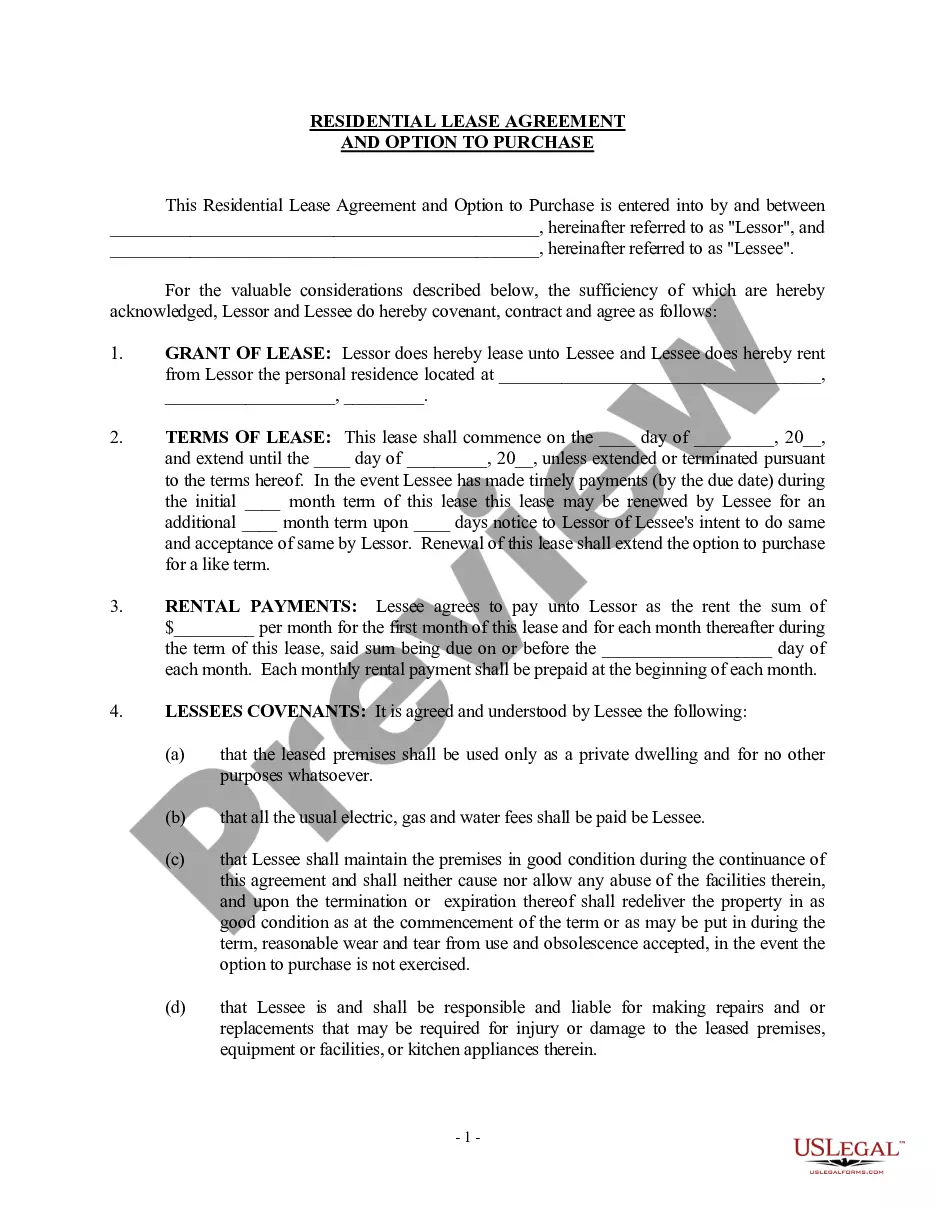

Description

How to fill out Maricopa Arizona Clauses Relating To Preferred Returns?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Maricopa Clauses Relating to Preferred Returns is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Maricopa Clauses Relating to Preferred Returns. Adhere to the guide below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Clauses Relating to Preferred Returns in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!