Riverside, California is a vibrant city located in the Inland Empire region of Southern California. Nestled alongside the scenic Santa Ana River, Riverside offers a unique blend of natural beauty, rich history, and modern amenities. With its favorable climate, diverse population, and thriving business community, Riverside has become an attractive destination for residents, tourists, and investors alike. Now, let's explore the concept of "Clauses Relating to Preferred Returns" in the context of Riverside, California. Preferred returns refer to a specific type of financial arrangement that rewards investors with a predetermined rate of return before other investors or parties involved. These clauses are often included in contracts or agreements related to real estate investments or partnership agreements. In the real estate sector of Riverside, California, investors and developers may encounter different types of clauses relating to preferred returns. Here are a few examples: 1. Preferred Return Clause: This clause specifies that certain investors or partners involved in a real estate project will receive their investment returns or profits before any other investors or parties. It ensures that these preferred investors receive a predetermined percentage, typically annualized, as a return on their investment, even if the overall project does not generate significant profits. 2. Tiered Preferred Return Clause: This clause introduces multiple tiers or levels of preferred returns based on specific performance benchmarks or milestones. For instance, if a real estate project achieves certain predetermined financial goals, the preferred investors may receive a higher percentage of return than if the project falls short of those goals. This helps incentivize performance and mitigates risk for the preferred investors. 3. Catch-Up Preferred Return Clause: In some cases, the initial preferred returns defined in a contract may not be fully achieved due to unforeseen circumstances or delays. The catch-up preferred return clauses enable the preferred investors to eventually "catch up" on their missed returns once the project starts generating profits. This clause ensures that the preferred investors receive their intended returns, even if there are temporary setbacks. 4. Waterfall Preferred Return Clause: This clause establishes a predetermined order of distribution of profits or returns from a real estate project. It outlines how profits will be distributed among different investors or parties involved in the project, including the preferred investors. The waterfall structure helps ensure transparency and fair distribution of returns based on the agreed-upon terms. It is essential to note that these clauses relating to preferred returns may vary in wording and specifics depending on the contractual agreements and the parties involved. Consultation with legal and financial professionals is crucial to understanding and incorporating these clauses effectively for any real estate investment project in Riverside, California, or elsewhere. In conclusion, Riverside, California offers a thriving real estate market where clauses relating to preferred returns can be incorporated into investment agreements. An understanding of the various types of preferred return clauses, such as preferred return clause, tiered preferred return clause, catch-up preferred return clause, and waterfall preferred return clause, can assist investors in navigating the Riverside real estate landscape and maximizing their returns.

Riverside California Clauses Relating to Preferred Returns

Description

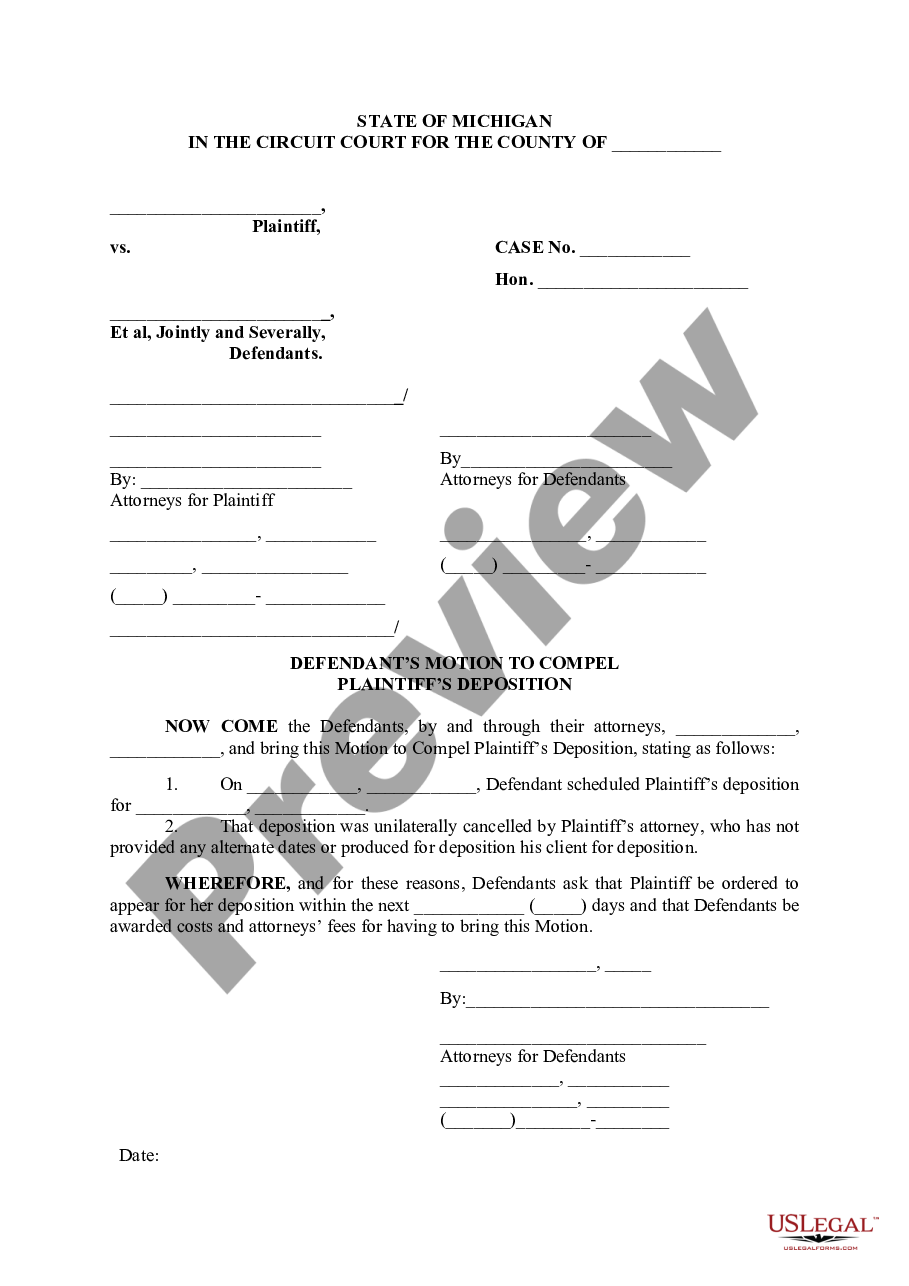

How to fill out Riverside California Clauses Relating To Preferred Returns?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Riverside Clauses Relating to Preferred Returns, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Consequently, if you need the latest version of the Riverside Clauses Relating to Preferred Returns, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Riverside Clauses Relating to Preferred Returns:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Riverside Clauses Relating to Preferred Returns and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!