Houston, Texas is a prominent city in the southern United States known for its diverse economy and thriving business scene. Within this bustling metropolis, there are several clauses relating to venture interests that play a crucial role in the city's entrepreneurial landscape. These clauses provide legal guidelines and protection for various types of venture interests in Houston, Texas. One such type that stands out is the "Right of First Refusal" clause. This clause dictates that if a venture or business owner decides to sell their interest or transfer their shares, they must first offer the opportunity to existing venture partners or shareholders. This clause helps maintain stability within the venture, preventing sudden changes in ownership and allowing current stakeholders the chance to maintain their investments. Another important clause is the "Drag-Along Rights" clause. This provision empowers majority stakeholders to compel minority stakeholders into selling their interests if an acceptable offer is made to acquire a substantial portion or all of the venture. This clause helps streamline the decision-making process, enabling ventures to more effectively respond to acquisition offers and potentially maximize value for all involved parties. Additionally, the "Tag-Along Rights" clause is an essential component in venture agreements. This clause grants minority stakeholders the right to join in the sale of a venture interest when a majority stakeholder receives an acceptable offer. It ensures that minority stakeholders are not left behind in significant transactions while safeguarding their investments and allowing them to fully participate in potential venture exits. Furthermore, Houston, Texas clauses relating to venture interests often incorporate "Anti-Dilution" provisions. These provisions protect the value of existing investments by adjusting the price per share or ownership percentage during subsequent financing rounds or the issuance of new shares. By safeguarding against dilution, these clauses shield investors' financial interests and encourage their continued support for the venture. Overall, these Houston, Texas clauses relating to venture interests constitute a crucial framework for entrepreneurs, venture capitalists, and shareholders. They outline provisions that promote stability, fair transactions, and appropriate protections for all parties involved in the dynamic and rapidly evolving business landscape of Houston, Texas. These legal safeguards play a significant role in attracting investments and fostering the growth of innovative ventures in the city.

Houston Texas Clauses Relating to Venture Interests

Description

How to fill out Houston Texas Clauses Relating To Venture Interests?

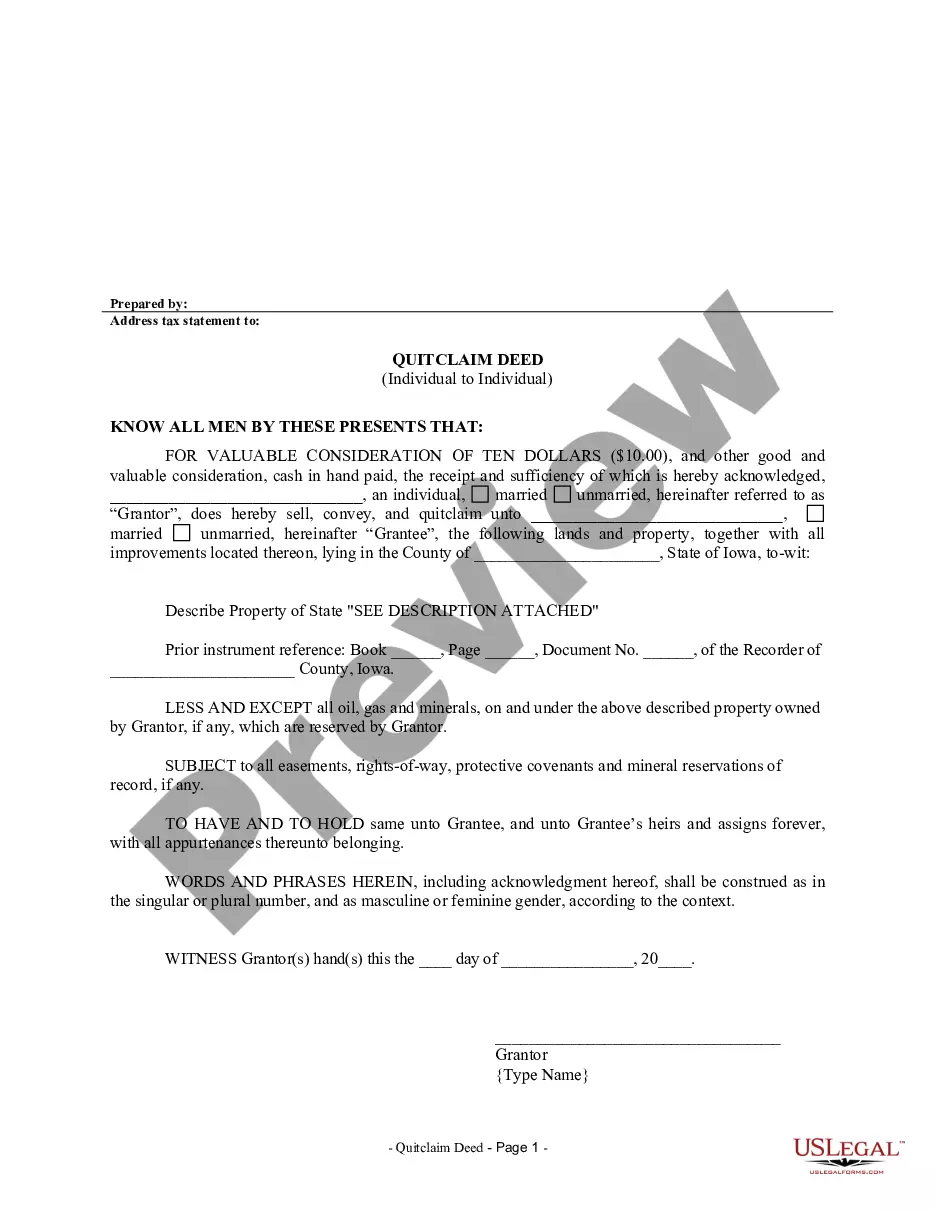

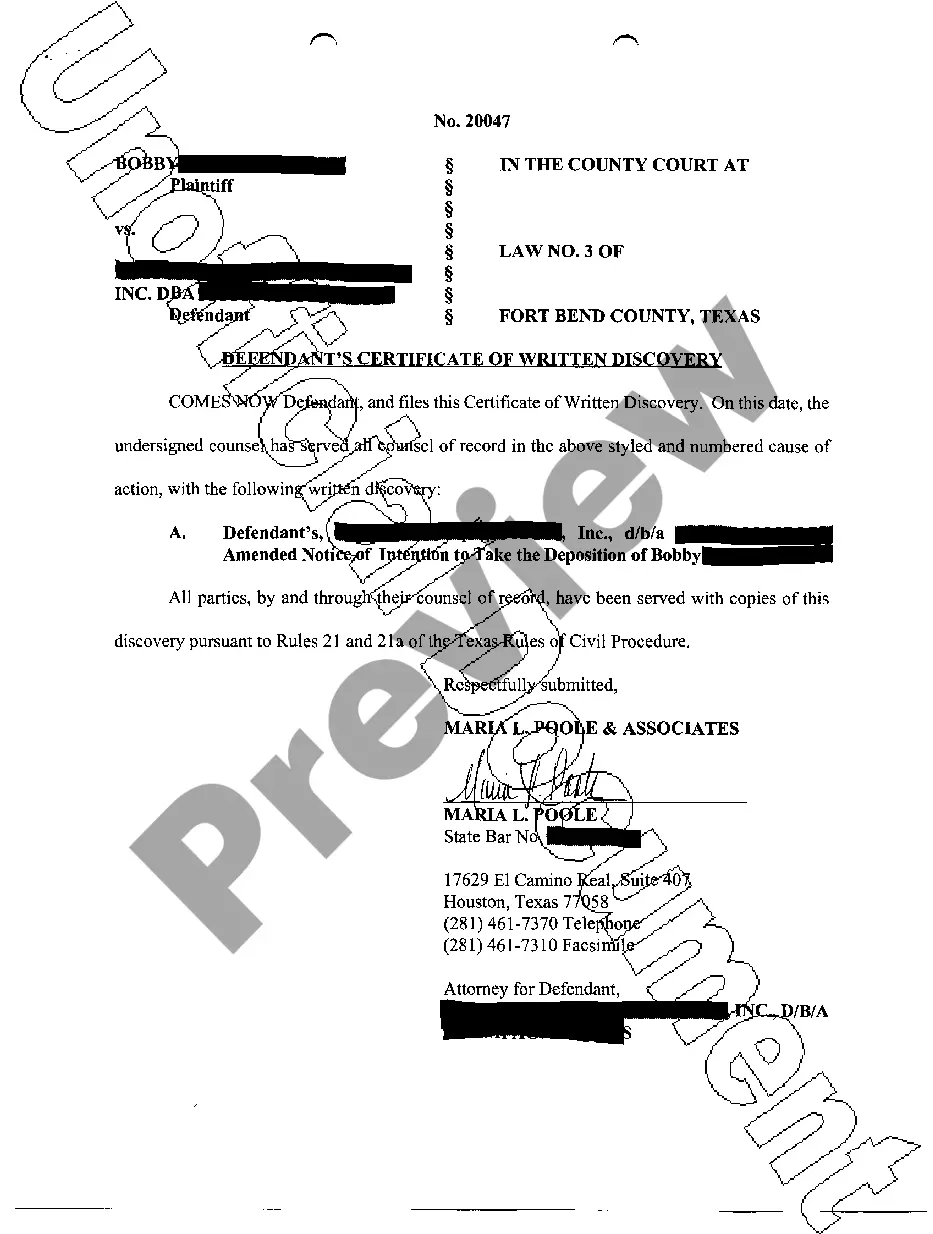

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Houston Clauses Relating to Venture Interests, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how to find and download Houston Clauses Relating to Venture Interests.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Check the related document templates or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Houston Clauses Relating to Venture Interests.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Houston Clauses Relating to Venture Interests, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you need to cope with an extremely difficult case, we advise getting an attorney to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

A joint venture is when two or more businesses pool their resources and expertise to achieve a particular goal....6 tips for a successful joint venture Plan carefully.Communication.Build trust.Monitor performance.Be flexible.Find a way to deal with problems.

How to form a joint venture in 5 steps Find a partner. First, finding a joint venture partner (or more than one partner for larger joint ventures) starts with clearly defining your objective.Choose a type of joint venture.Draft a joint venture agreement.Pay taxes.Follow other applicable regulations.

The joint venture agreement is one of the most important documents in a Joint venture. It lays down the structure, the rights and obligations of parties, the functioning of the joint venture, confidentiality clauses, and most importantly the distribution of profits, etc.

Structuring a real estate JV The 'investor' will typically be structured as a limited partnership managed by a general partner or other tax efficient vehicle. The investor vehicle will contract with the asset manager?owned by the operator investment vehicle?to form the JV entity.

A joint venture is a commercial arrangement between two or more participants who agree to co-operate to achieve a particular objective. Joint ventures cover a wide range of collaborative business arrangements which involve differing degrees of integration and which may be for a fixed or indefinite duration.

Structure of a Real Estate Joint Venture In most cases, the operating member and the capital member of the real estate joint venture set up the Real Estate project as an independent limited liability company (LLC). The parties sign the joint venture agreement, which details the conditions of the joint venture.

The common elements necessary to establish the existence of a joint venture are an express or implied contract, which includes the following elements: (1) a community of interest in the performance of the common purpose; (2) joint control or right of control; (3) a joint proprietary interest in the subject matter; (4)

Following are the types are as follows: Project Joint Venture. This is the most common form of joint venture.Functional Joint Venture.Vertical Joint Venture.Horizontal Joint Venture.

The parties to the joint venture must be at least a combination of two natural persons or entities. The parties may contribute capital, labor, assets, skill, experience, knowledge, or other resources useful for the single enterprise or project. The creation of a joint venture is a matter of facts specific to each case.

Your joint venture agreement must be in writing and follow SBA requirements. The joint venture must be separately identified with its own name and have both a Unique Entity Identifier (UEI) and a Commercial And Government Entity (CAGE) code in the federal government's System for Award Management at SAM.gov.

More info

Contractual Provisions: §5.1 — The JV shall protect and respect the rights and interests of the Lenders. This includes, inter alia, the right of the JV to refuse or terminate the JV if the Lender violates the terms of this JV. §5.4 — The JV shall not be liable on the Lenders' failure to receive full payment. §8 — The Lenders may set an advance rate of interest (see para. 9) on the amount owed without having to give notice or the right to contest the value of the funds owed. §10.1 — Customer may terminate at any time with 2 weeks' notice and the JV has no obligation to honor or pay the termination option. §10.2 — The JV shall not owe any of the assets of the Lender to the Customer unless Customer has paid the amount owed as detailed in the contract. §10.3 — The Lenders may demand the JV to execute the transaction on behalf of the Customer. Chapter C Seller-Proprietor-Consumer Agreements: §1. Definition of a seller-proprietor-consumer.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.