In Collin, Texas, the Clauses Relating to Initial Capital Contributions act as a critical element for businesses and investors. These clauses outline the terms and conditions related to the initial capital investments made by partners or shareholders of a business entity. By defining the obligations, rights, and responsibilities of each party involved, these clauses minimize misunderstandings and conflicts, ensuring a smooth functioning of the enterprise. Now, let's explore two types of Collin Texas Clauses Relating to Initial Capital Contributions: 1. Initial Capital Contribution Amount: This type of clause specifies the agreed-upon initial capital amount that partners or shareholders are required to contribute when forming or joining a business entity in Collin, Texas. It defines the financial commitment of each stakeholder and often includes provisions for payment deadlines, acceptable forms of contribution (cash, assets, etc.), and consequences for failure to meet the obligations. Keywords: Collin Texas, initial capital contribution, partners, shareholders, business entity, financial commitment, payment deadlines, acceptable forms of contribution, consequences, failure. 2. Capital Contribution Schedule: This clause provides a structure for the timing and installment of the initial capital contributions. It outlines the predetermined schedule or milestones for partners or shareholders to meet their capital funding obligations over a specified period. Such schedules can be equally distributed installments, staggered payments, or customized plans agreed upon by the involved parties. Additionally, this clause may address whether interest or penalties are applicable for delayed or missed contributions. Keywords: Collin Texas, capital contribution schedule, timing, installments, capital funding obligations, schedule, milestones, equally distributed installments, staggered payments, customized plans, interest, penalties. Overall, the Collin Texas Clauses Relating to Initial Capital Contributions play a vital role in defining the financial commitments and expectations of partners or shareholders. These clauses ensure transparency and fairness, safeguarding the interests of all parties involved in a business undertaking.

Collin Texas Clauses Relating to Initial Capital contributions

Description

How to fill out Collin Texas Clauses Relating To Initial Capital Contributions?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, finding a Collin Clauses Relating to Initial Capital contributions meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the Collin Clauses Relating to Initial Capital contributions, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more steps to complete before you obtain your Collin Clauses Relating to Initial Capital contributions:

- Examine the content of the page you’re on.

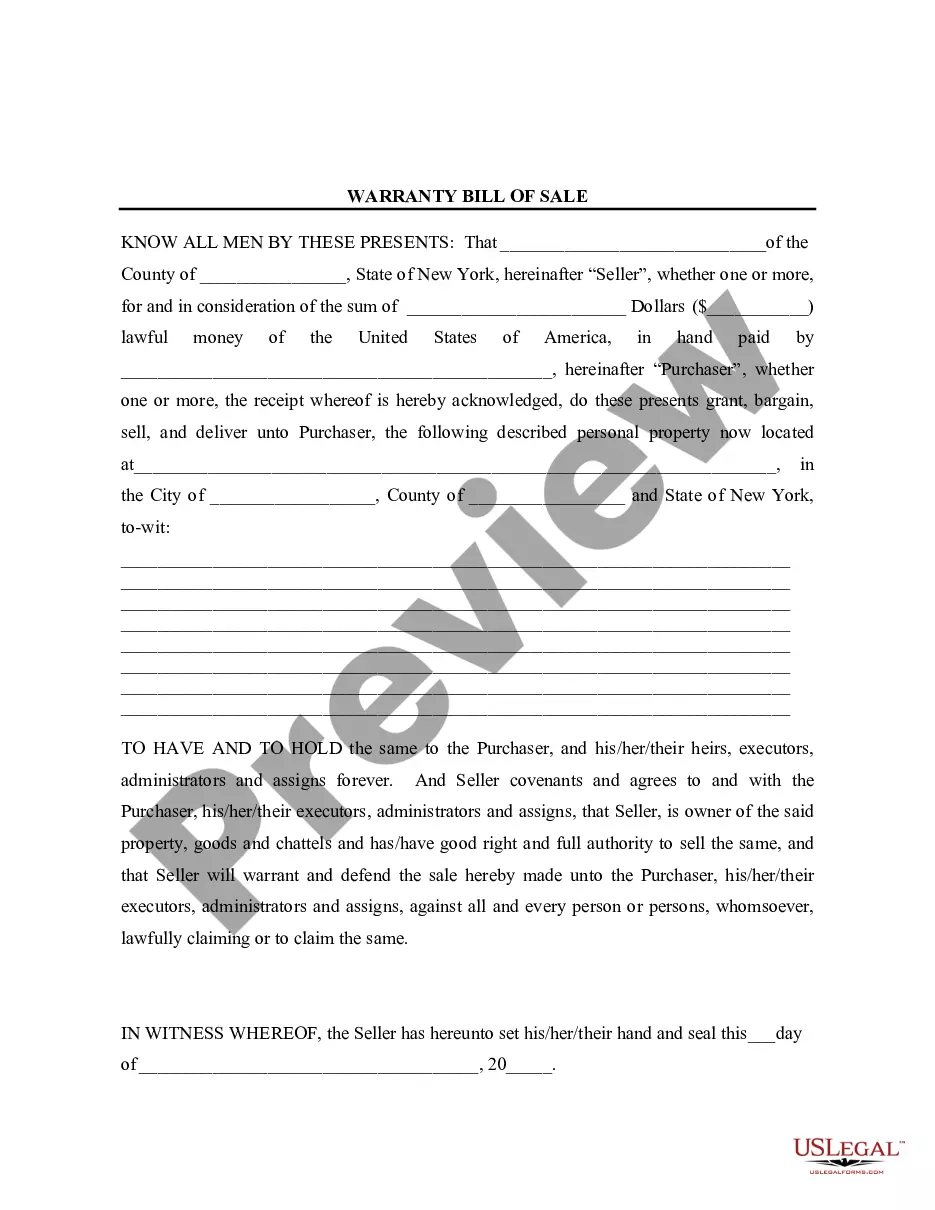

- Read the description of the sample or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Collin Clauses Relating to Initial Capital contributions.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!